122

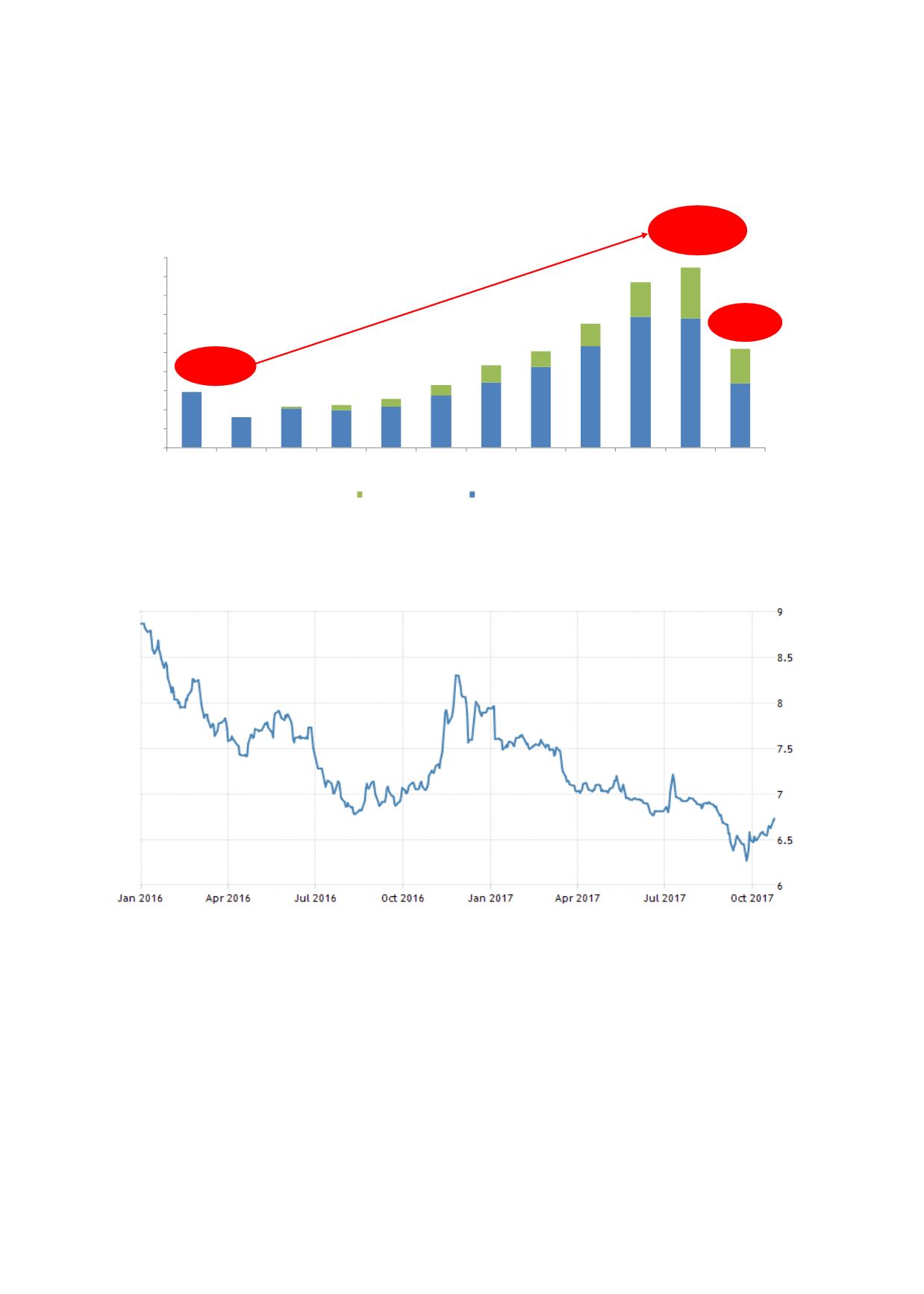

Chart 4.33: Indonesia’s Sovereign Sukuk vs Conventional Issuance (2006-June 2017)

0.00

5.00

10.00

15.00

20.00

25.00

30.00

35.00

40.00

45.00

50.00

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016 June 2017

USD billion

Sukuk issuance

Conventional issuance

USD47.4

billion

USD26.0

billion

USD14.7

billion

3.3

%

35.1

%

Sources: MOF, RAM

Chart 4.34: Indonesian 10-Year Sovereign Bond Yield

Sources: Indonesia Bond Pricing Agency, Trading Economics

In view of the government’s efforts to use sukuk in its national debt-management strategies, its

huge appetite vis-a-vis funding budget gaps and having to meet the development requirements

of infrastructure projects, the issuance of sovereign sukuk will increase rapidly in the

immediate term. Table 4.13 presents Indonesia’s budget deficits from 2014 to 2017.