104

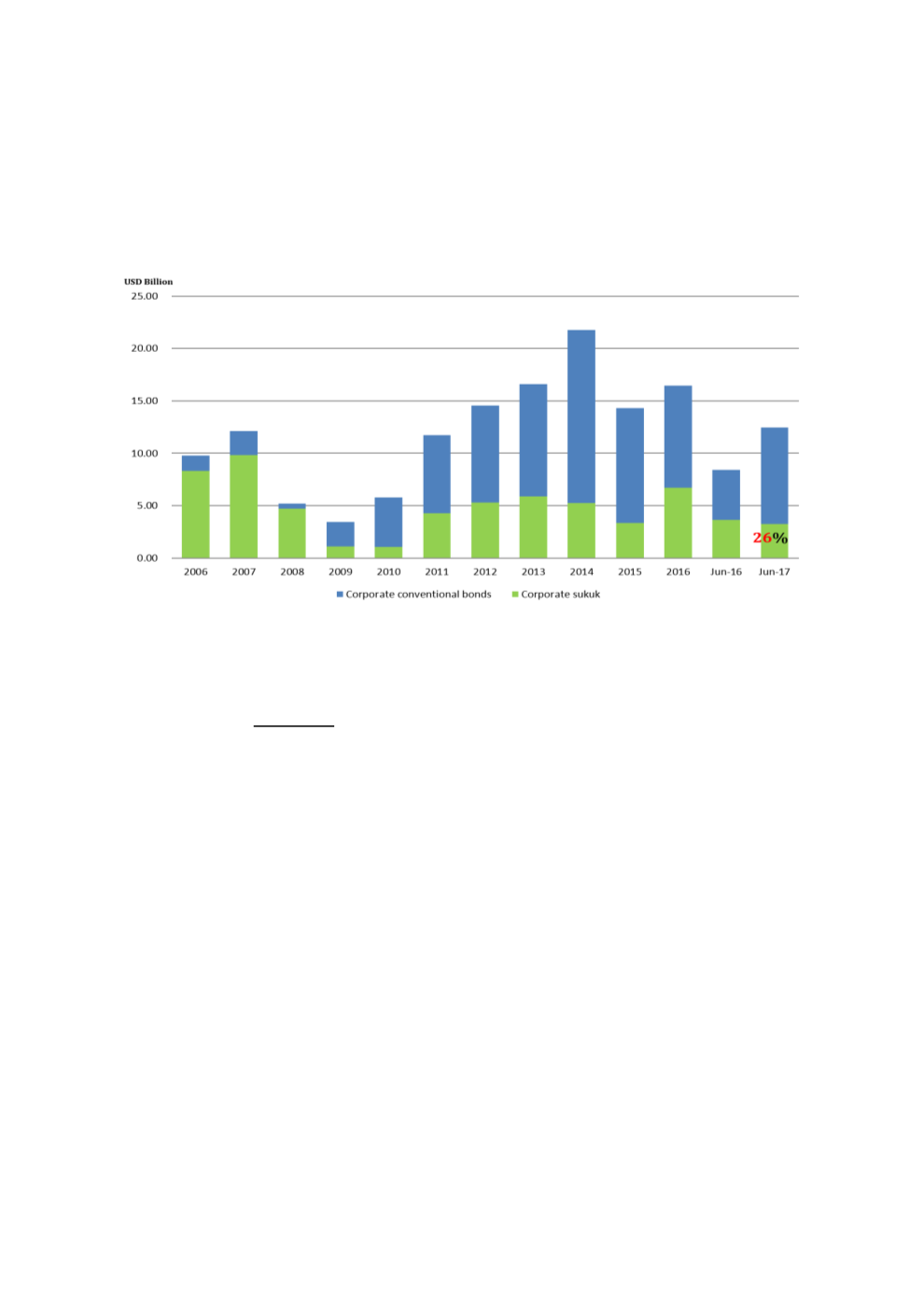

GREs during and after the GFC in 2007-2009, as highlighted earlier. As at end-June 2017,

private sector sukuk issuance only came up to USD3.23 billion (26% of total corporate bonds)

compared to USD9.21 billion of conventional issuances, as shown in Chart 4.24.

Chart 4.24: UAE Corporate Sukuk vs Conventional Issuance (2006-June 2017)

Source: Bloomberg

4.3.3

ANALYSIS OF SUKUK STRUCTURES, ISSUANCE AND INVESTMENT

Analysis of Sukuk Structures

Since the UAE does not have any centralized Shariah authority (as at Dec-2017), sovereign and

corporate issuers have the liberty to choose from an array of approved Shariah contracts

outlined by the AAOIFI in its Shariah Standards No. 17 on Investment Sukuk to develop their

sukuk structures. While governments have issued a combination of

ijarah

and

wakalah bil

istithmar

sukuk, corporates have undertaken more diversified structures, as depicted in Chart

4.25.