108

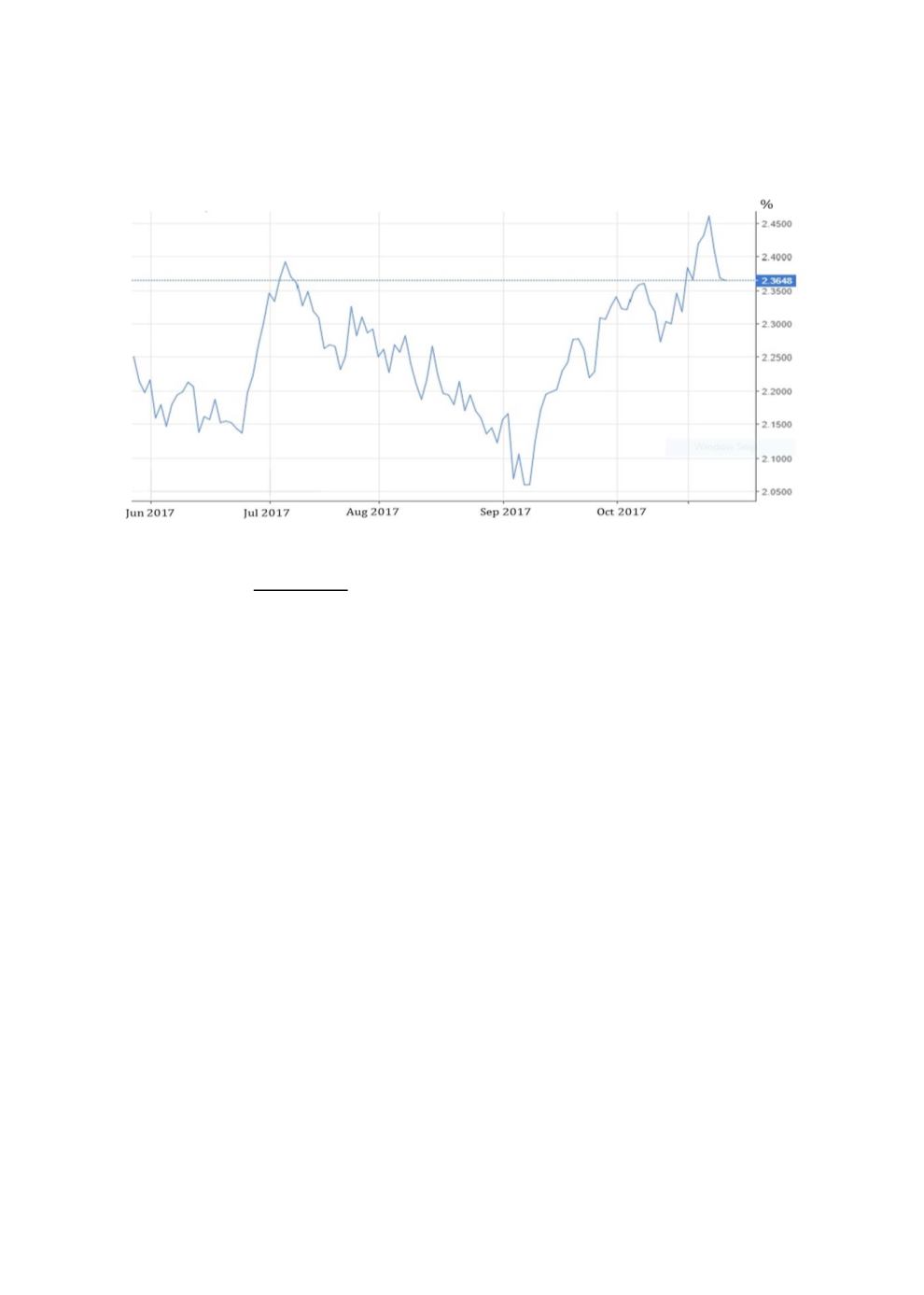

Chart 4.28: USD 10-Year Sovereign Bond Yield

Source: Trading Economics

Analysis of Sukuk Investments – Demand (Buy Side)

According to the DIEFC Report (2017a), Dubai is the world’s leading location for USD-

denominated sukuk listings, which are offered by DFM and Nasdaq Dubai through a single

trading platform. As at end-October 2017, both exchanges hosted about 75 listed sukuk. The

DIEDC (2017a) stated that Nasdaq Dubai plans to set up a global sukuk centre, which is

expected to further develop Dubai’s sukuk industry. With the institution of this centre, more

new offerings will be introduced, including retail sukuk, while secondary sukuk market trading

will be made available to SMEs.

Due to the prevalence of USD-denominated debt securities in the UAE, demand for fixed-

income instruments is mostly driven by financial institutions and fund-management

companies. Sukuk investment by other key institutional investors such as pension funds or

insurance/

takaful

companies is very limited, possibly due to the absence of long-term sukuk,

the UAE’s tax-free regime which creates a level playing field between debt and equity products,

and the dearth of LCY bonds. The UAE’s biggest sovereign wealth fund, i.e. the Abi Dhabi

Investment Authority (ADIA), which could possibly be a catalyst for the growth of the

ICM―like what Malaysia’s Khazanah Nasional does―has not tapped the domestic market.

Rather, the ADIA manages a diversified global investment portfolio consisting of various asset

classes.

4.3.4

KEY FACTORS UNDERPINNING THE UAE’S SUKUK MARKET

Leveraging the DIFC infrastructure as the leading Middle Eastern financial centre, the

UAE―particularly the Dubai government―has been able to attract many foreign investors

worldwide. Article 121 of the UAE Constitution enables the federation to establish financial

free zones in the Emirates and to exclude the application of certain federal laws that are based

on the civil law in the centre. A number of laws had created the DIFC, its own financial

regulator (the DFSA) and other necessary bodies. The laws set out the objectives, powers and