102

sized sukuk worth USD600 million (in 2012) and another valued at USD750 million (in 2013),

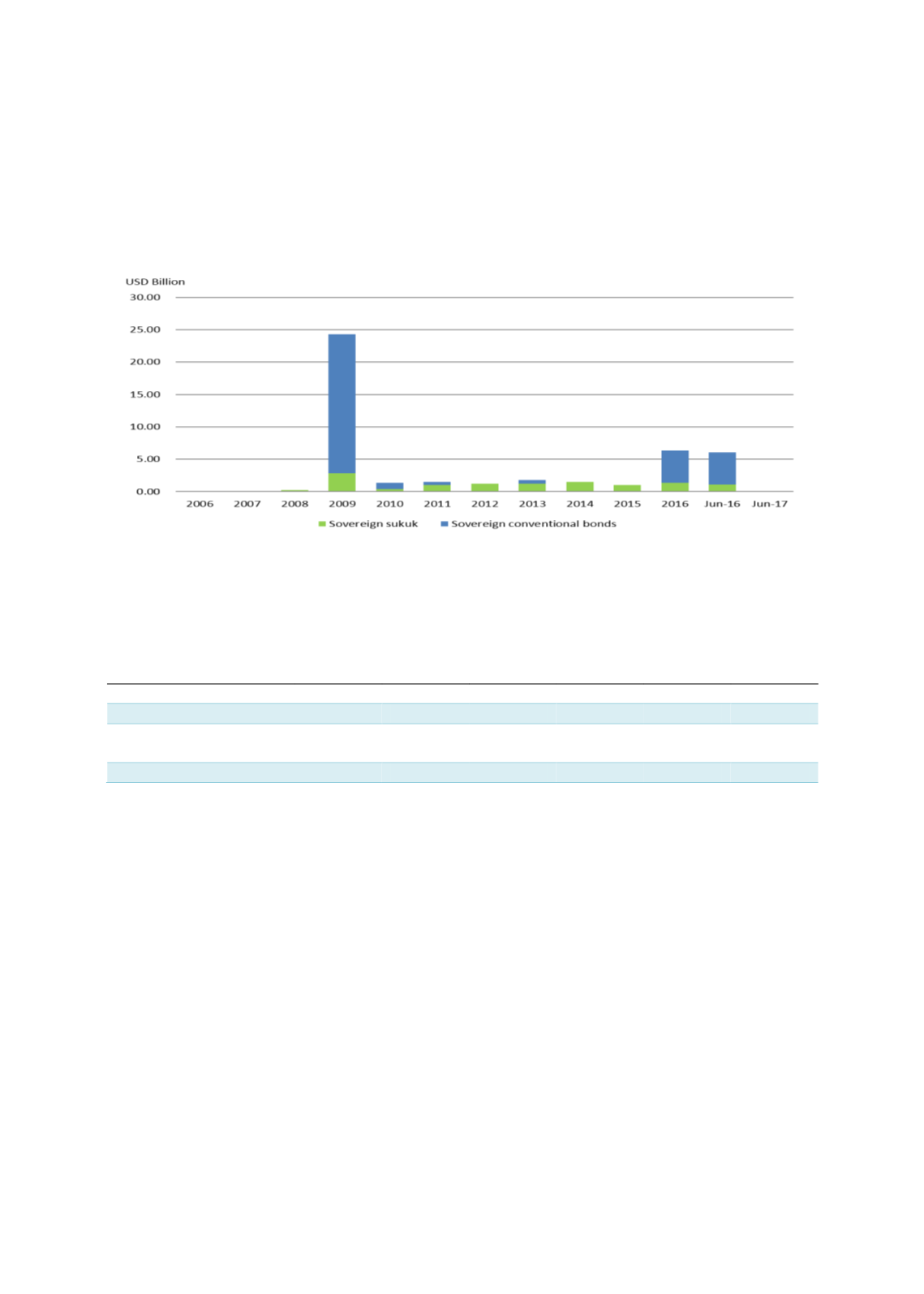

yielding a respective 6.45% and 3.875%. Chart 4.22 indicates total UAE sovereign sukuk

issuance in comparison to sovereign bonds as at end-June 2017.

Chart 4.22: UAE Sovereign Sukuk vs Conventional Issuance (2006-June 2017)

Source: Bloomberg

The plunge in global oil prices in 2015-2016 had slashed the UAE government’s revenue (refer

to Table 4.8), leading to the diversification of its funding sources, including international bonds

and sukuk, to finance its budget deficit.

Table 4.8: UAE’s Budget Deficits (2014–2017f)

AED billion

2012

2013

2014

2015

2016e*

2017f**

Government revenue

550.032

582.839

550.439

391.542

358.419

388.863

Government

expenditure

400.893

434.489

477.31

420.203

412.176

427.305

Budget deficit

149.14

148.35

73.13

(28.66)

(53.76)

(38.44)

Source: IMF

* IMF estimate

**IMF forecast

Since each emirate is autonomous in terms of managing its individual budget and raising funds

to finance budget deficits, the federal government has not issued any debt instrument.

However, the UAE government’s proposed (in 2017) federal debt-management law will allow

the federal government to tap the bond market; the latter is expected to issue sukuk in the

future. This is in line with the SCA’s newly launched development strategy (in October 2017)

for the UAE ICM, which includes the SCA’s role in updating regulations on sukuk and

introducing a system of Shariah board governance. In addition, the UAE government, in

collaboration with the Central Bank of the UAE (CBUAE) and the UAE Banks Federation, are

working on the guidelines to set up a higher Shariah authority, as a national regulator to

formulate guidelines, policies and regulations for Islamic financial products. Approval for the

setting up of Shariah authority was secured in May 2016. The CBUAE’s establishment of an

Interim Marginal Lending Facility (IMLF) ― similar to collateralised repo ― for both