99

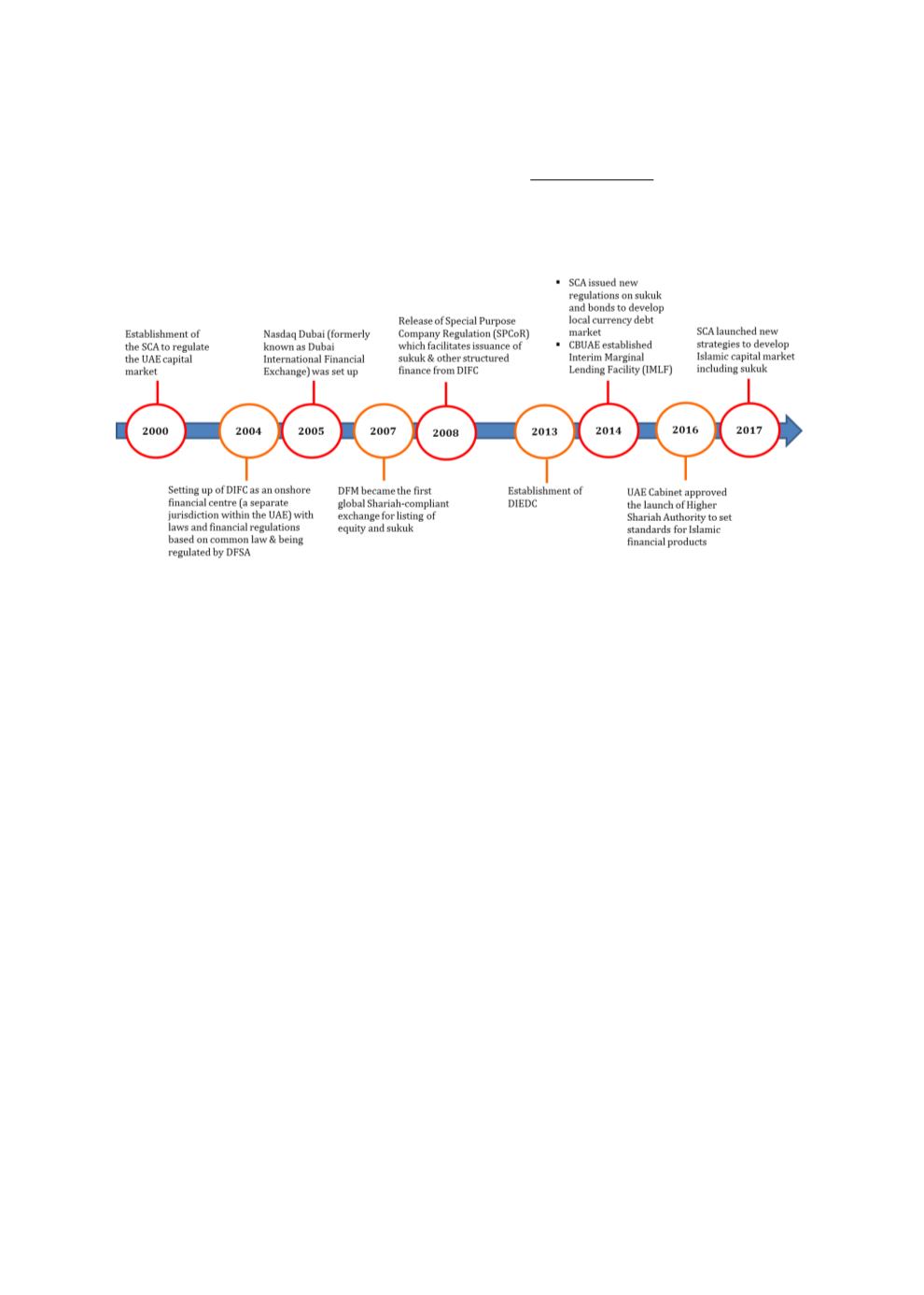

study, it is clear that the UAE sukuk market is still at the developing stage, with some degree of

advancement in certain aspects compared to other countries within the same category. Chart

4.18 summarises the evolution of the UAE bond market from 2000 to June 2017.

Chart 4.18: Evolution of the UAE Bond Market (2000–2017)

Source: DIEDC (2017a)

4.3.2

GROWTH OF THE SUKUK MARKET IN THE UAE

As noted earlier, the UAE sukuk market started in the early 2000s and charted phenomenal

growth between 2005 and 2007. Nonetheless, it declined in 2008-2010 following the global

financial crisis (GFC) and the resultant market conditions, and partly due to the

pronouncement by the AAOIFI in 2008 on purchase undertakings in equity-based sukuk

structures, as well as high-profile defaults by GCC sukuk issuers and the near-default on the

Nakheel sukuk after the GFC in 2009. The market experienced a resurgence in 2011 and has

been expanding steadily since, except in 2015. As at end-June 2017, total sukuk issuance in the

UAE had reached USD3.23 billion, representing 26% of total bond issuance, as depicted in

Chart 4.19.