109

functions of the centre bodies. They also contain important exemptions and prohibitions in the

DIFC. Table 4.10 summarises key laws that had been passed to create a conducive

environment for the DIFC as a financial free zone.

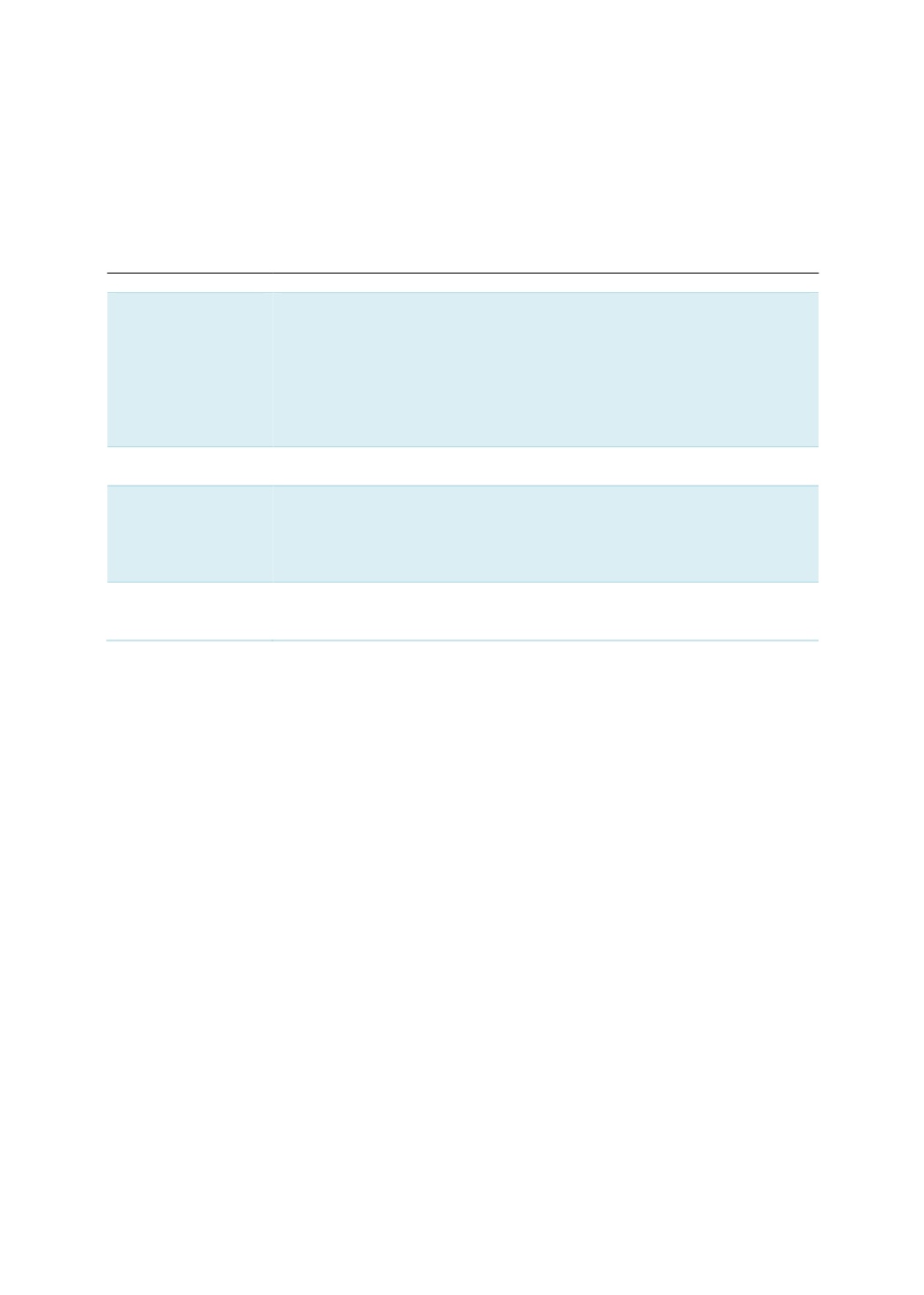

Table 4.10: Key Laws for the Establishment of the DIFC

Laws

Details

Federal Law No. 8

of 2004 (Financial

Free Zone Law)

Establishes the financial free zones in the UAE, hence:

Allows the creation of a financial free zone in any emirate of the UAE.

Exempts the financial free zones and financial activities from all

federal civil and commercial laws.

Confirms the application of federal criminal laws in the financial free

zones, including the federal laws on anti-money laundering.

Prohibits DIFC-authorised firms from dealing in “deposit taking from

the State’s markets […] [and] in the UAE dirham”.

Federal Decree No.

35 of 2004

Creates the DIFC as a financial free zone in Dubai (the DIFC Law).

Dubai Law No. 9 of

2004

Acknowledges the establishment of the DIFC, hence:

Recognises the financial administrative and independence of the DIFC.

Creates the DIFC centre bodies, including the DFSA.

Exempts the DIFC from Dubai laws and regulations and certain

conditions.

DIFC Law No. 1 of

2004 (Regulatory

Law 2004)

Sets out the DFSA’s regulatory powers, functions and objectives.

Sources: DIFC (2009), DIFC (2009a)

The DIFC’s exclusive legal and regulatory system based on common law has enabled the

registration of SPCs/SPVs for sukuk issuers that prefer a domestic domicile, instead of

traditional offshore centres such as the Cayman Islands. In addition, the DIFC has enacted laws

related to dispute resolution, i.e. the Court Law (DIFC Law No. 10 of 2004) and the Arbitration

DIFC Law No. 1 of 2008 (Amended in 2013 – DIFC Law No. 6 of 2013). This law had led to the

setting up of t

he Dispute Resolution Authority (DRA) in 2014. The DRA has overall

responsibility for the DIFC courts, an arbitration institute and other tribunals or ancillary

bodies that may be required to perform the functions of the DRA. The creation of the DRA

takes the DIFC a significant step towards offering a serious alternative to the traditional

arbitration hubs of London, Paris and Singapore.

Currently, there are 3 established arbitration

centres within the UAE:

the Dubai International Arbitration Centre (DIAC), the Abu Dhabi

Commercial Arbitration Centre and the DIFC-LCIA Arbitration Centre, which is run by the

Dubai International Financial Centre (DIFC) and the London Court of International Arbitration

(LCIA).

The DIFC has also established Nasdaq Dubai, which enables the public listing of sukuk issues.

This has helped issuers maximise the number of potential foreign investors. Nonetheless, the

exchange only facilitates institutional investors. As such, an accommodative infrastructure for

retail investors should also be considered.

In addition, the DIFC is home to many international and recognised rating agencies such as

Standard & Poor’s (S&P), Moody’s and Fitch Ratings, which provide more transparency on the

credit risks of sukuk issues and enhance their marketability.