103

conventional and Islamic banks

4

in April 2014, to strengthen liquidity management by

domestic Islamic banks, would also help boost sukuk issuance. Since April 2015, the Shariah-

compliant IMLF has recognised a borrower’s holdings of sovereign sukuk or sukuk issued by

authorities in any of the emirates as collateral.

Domestic Market – Private Sector Issuance

Similar to public sector issuance, LCY domestic sukuk by corporates in the UAE is also very

limited. Instead, the UAE sukuk market is very well known for its Eurobond market. Based on

data from Blomberg (as at end-June 2017), only 10 LCY issues had been raised, mainly by

companies involved in real estate. Most GREs, which have been a major source of growth and

development for the UAE economy in Dubai and Abu Dhabi, tend to source their funding

externally to supplement their domestic borrowing, which is highly dependent on bank

loans/financing. The tendency to source external funding could be due to the absence of a

long-term benchmark domestic yield curve. A similar trend can be observed for UAE national

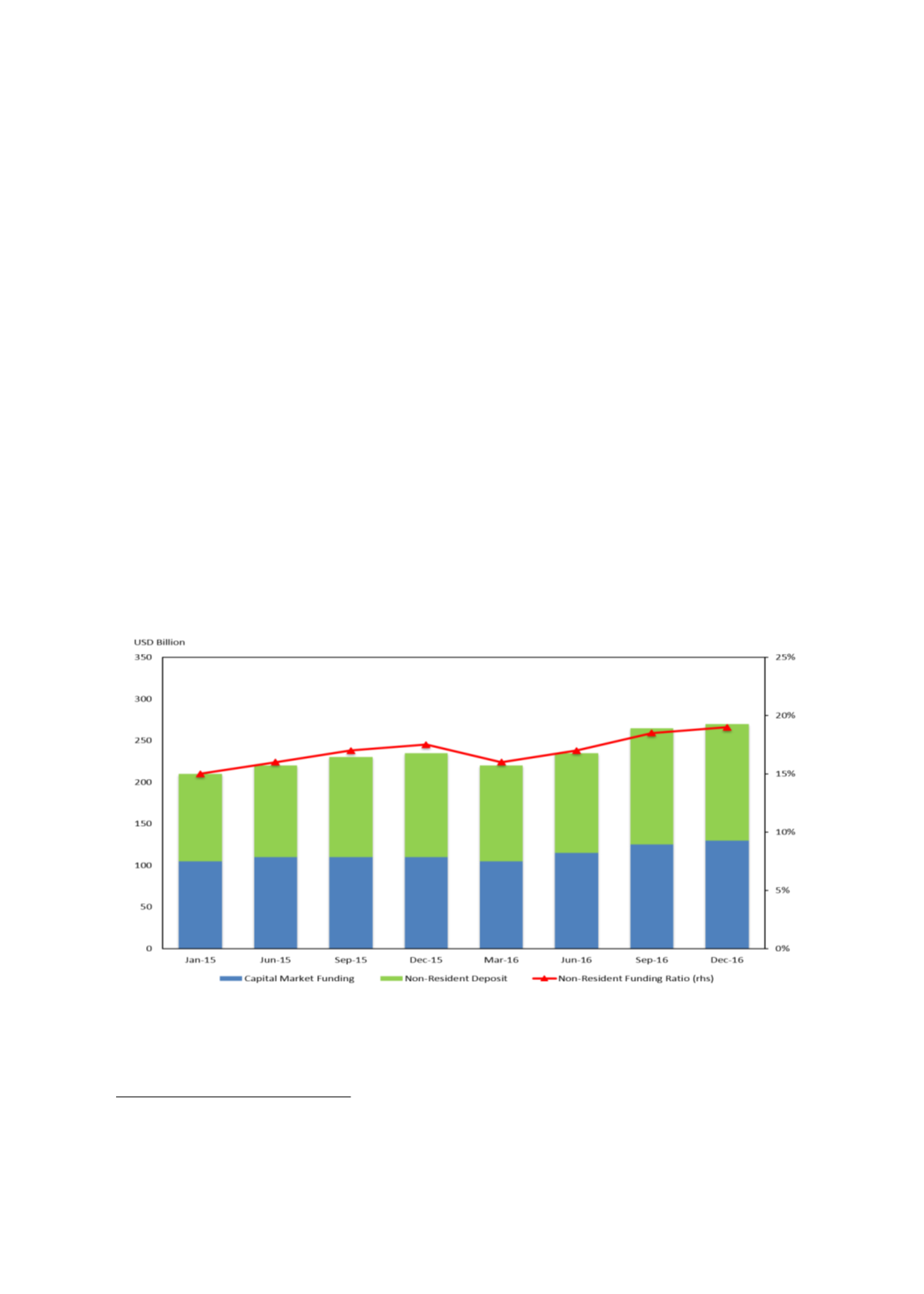

banks. According to the UAE Financial Stability Report (2016), the share of non-resident

funding to total funding of UAE national banks increased from 17.6% in 2015 to 19.6% in

2016. Non-resident funding is split almost equally between capital market funding and non-

resident deposits. External capital market funding of UAE national banks advanced 19.1% in

2016, from 16.2% in 2015, partly underpinned by the shallow domestic bond market (refer to

chart 4.23).

Chart 4.23: UAE National Banks’ Non-Resident Funding to Total Funding

Source: CBUAE (2016)

Compared to conventional bonds, sukuk issuance by corporates and quasi-government entities

in the UAE has declined significantly since 2009, partly due to major sukuk defaults by Dubai’s

4

The Shariah-compliant IMLF is based on collateralised

murabahah

. Refer to

Guidelines for Collateral Management under the

CBUAE’s Collateralized Murabaha Facility,

published on 1 April 2015.