101

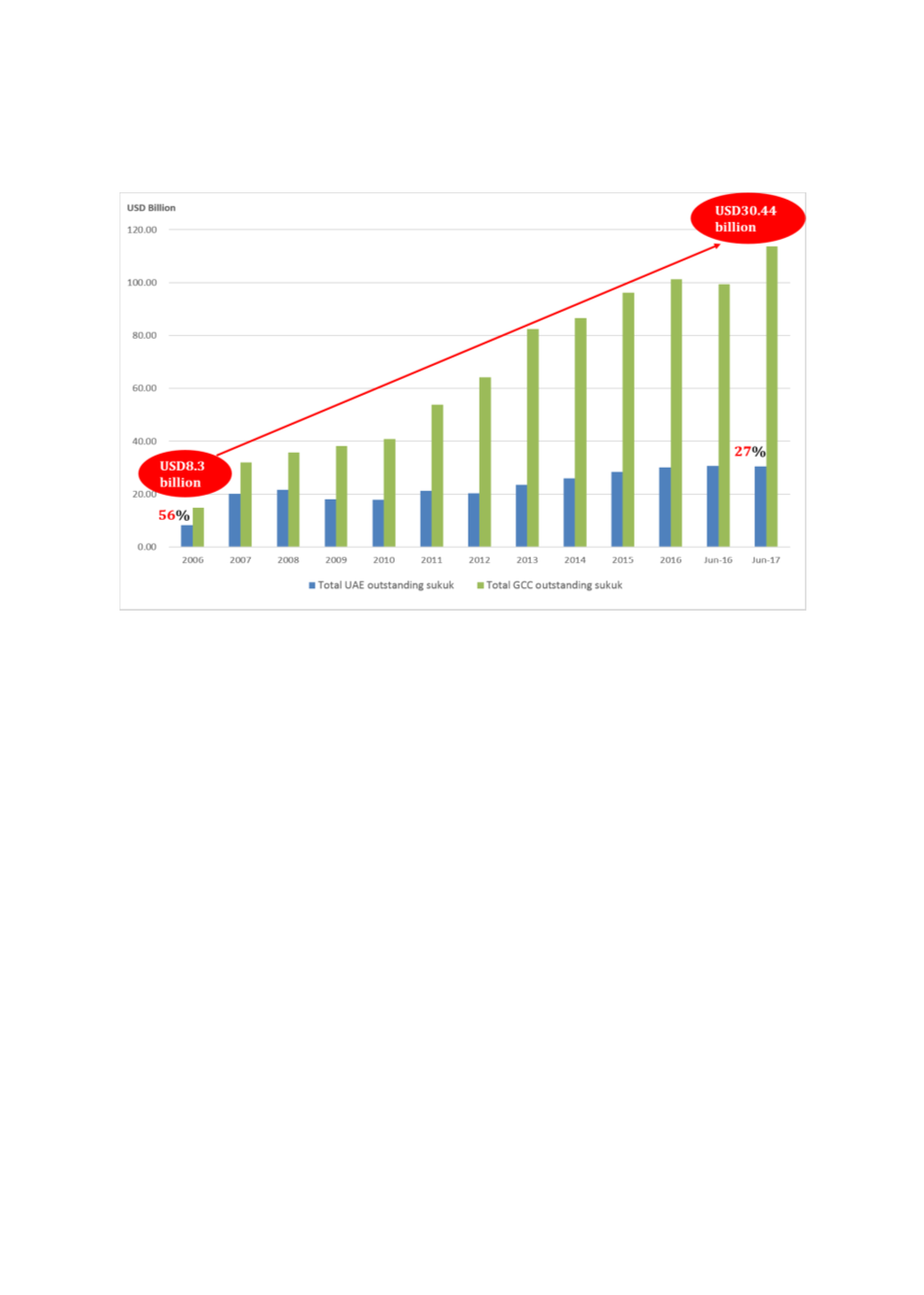

Chart 4.21: UAE vs GCC Total Outstanding Sukuk (2006-June 2017)

Source: Bloomberg

The growth of the bond market in the UAE has been predominantly led by USD-denominated

issues due to the pegging of the dirham (AED) against the USD, the influence of global investor

sentiment, and the various benefits offered by the DIFC to firms and institutions, such as zero

tax on profits, no restriction on foreign exchange, and double-taxation treaties. The advantages

of issuing USD-denominated bonds and sukuk for UAE entities include the following:

No currency risk as the AED is pegged to the USD at 3.70.

Low interest rates, hence reducing borrowing cost.

Enhances the liquidity of bond markets.

Nonetheless, overdependence on external funding also poses some challenges, which will be

discussed later.

Domestic Market – Public Sector Issuance

According to the IMF Report (2017), the UAE has very minimal domestic government debt

because large fiscal surpluses during the oil price boom had weakened the incentive for the

government to issue domestic debt. Emirati governments issue external debt (i.e. FCY bonds

and sukuk) or tap sovereign wealth funds (SWFs) to finance budget deficits. Up to June 2017,

only 3 emirates had issued sukuk, i.e. Dubai, Ras al Khaimah and Sharjah (only 2 issues had

been in AED while the rest were in USD); the Abu Dhabi government had only raised

conventional bonds. The peak of sovereign sukuk issuance occurred in 2009, with the Dubai

government leading the UAE market. The high-profile sukuk defaults of Dubai’s GREs in 2009

triggered a slump in the UAE sukuk market in 2010. Investors’ perception of Dubai credit had,

however, improved by 2012, leading the Dubai government to issue a 10-year benchmark-