107

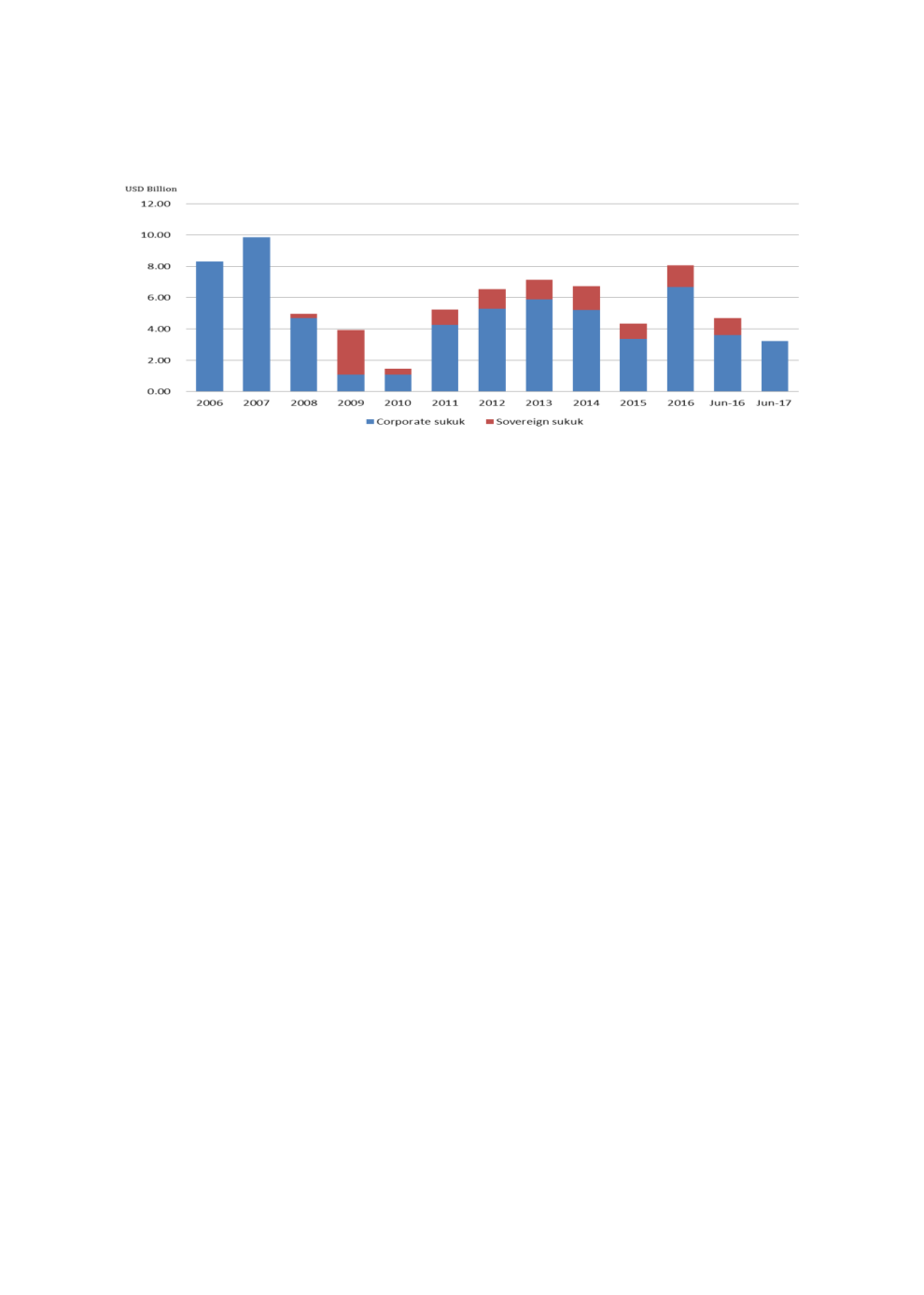

Chart 4.27: UAE Sovereign vs Corporate Sukuk Issuance (2006-June 2017)

Source: Bloomberg

Both sovereign and corporate sukuk in the UAE have short tenures, with the majority with 5-

year maturities. To date, the longest tenure is a 10-year sukuk, mostly issued by the Dubai

government to fund its expansion as the global capital of the Islamic economy. For corporate

issuance, Emirates airline offered 2 series of 10-year sukuk in 2013 (Medjol sukuk) and 2015

(Khadrawy sukuk), to finance the expansion of its headquarters and to purchase aircraft.

The UAE debt market is dominated by international USD issues. As such, the LCY domestic

bond market is very limited, causing overdependence on global investors. Foreign investors’

appetite for UAE papers can, however, dry up if they find more attractive investment

opportunities elsewhere, or if there is a challenging macroeconomic situation in their home

countries. The ICD-Thomson Reuters Islamic Finance Development Indicator (2012-2017)

reported that only 21% of sukuk issuance was domestic while the remaining 79% was issued

internationally.

The scarcity of an active AED-based bond market in the UAE also leads to the absence of a yield

curve for different maturities. This poses major challenges for banks in pricing long-term loan

facilities. According to some commentators, the USD yield curve cannot be considered a proxy

for the AED yield curve because of differences in economic factors in the US and the UAE

(Baby, 2016). Chart 4.28 illustrates the USD yield curve for 10-year government bonds.