105

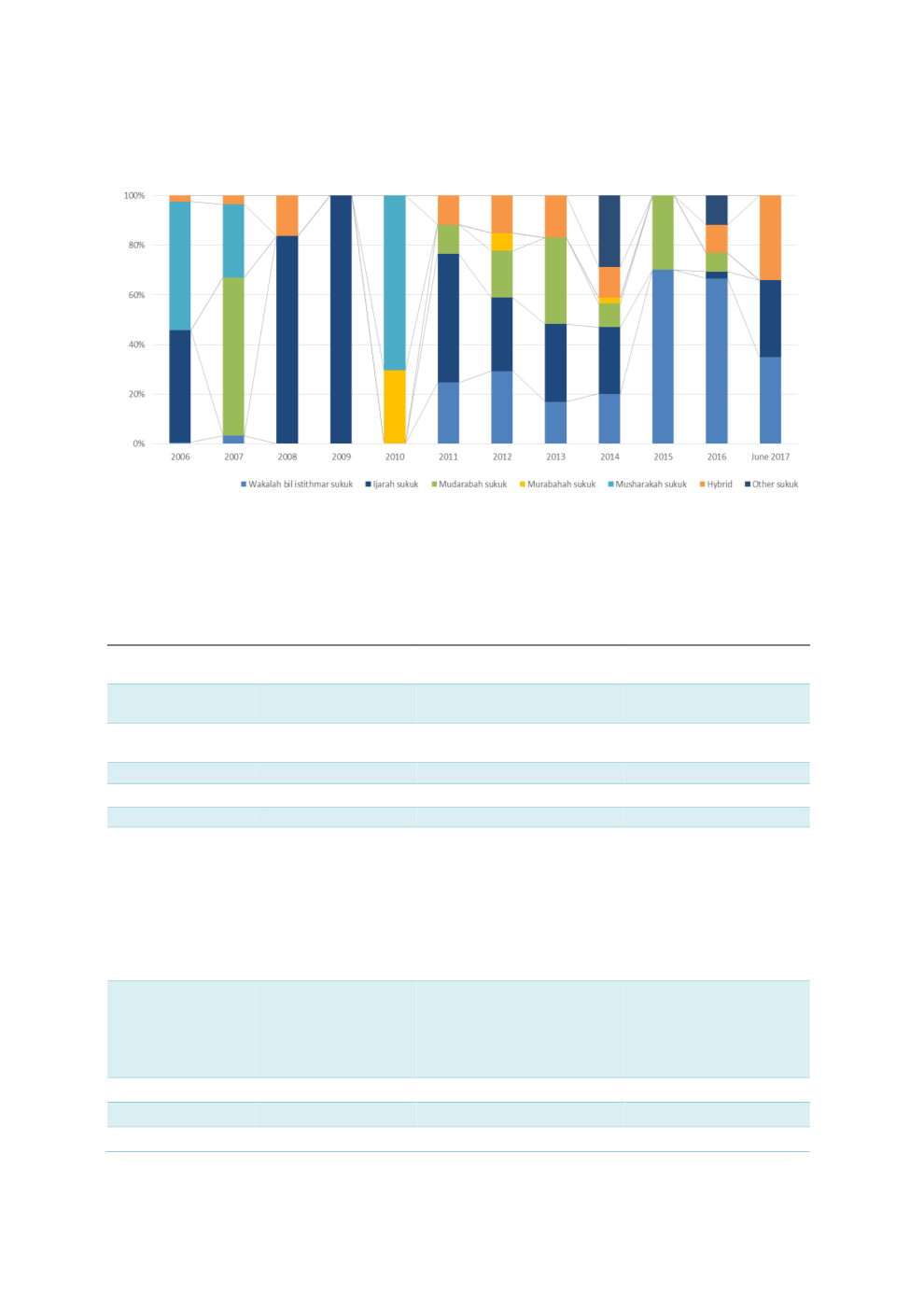

Chart 4.25: UAE Corporate Sukuk Issuance by Type of Shariah Contract (2006-June 2017)

Source: Bloomberg

UAE issuers stand among the global key players that have been actively issuing benchmark

sukuk, with quite a few ”world’s first” innovative structures. Table 4.9 provides a snapshot of

some benchmark corporate sukuk issuances in the UAE.

Table 4.9: A Snapshot of Benchmark Corporate Sukuk Issuances in the UAE

Abu Dhabi Islamic

(ADIB) sukuk 2012

Medjool sukuk 2013

Khadrawy sukuk

2015

Sukuk issuer

ADIB Capital Invest

1 Ltd

Medjool Limited

Khadrawy Limited

Originator/

Obligor

Abu Dhabi Islamic

Bank

Emirates airline

Emirates airline

Currency format

USD

USD

USD

Structure

Mudarabah

Wakalah

Ijarah

Credit ratings

A2/―/A+

n/a

n/a

Sukuk assets

General business of

ADIB

Rights to travel

Rights to travel and all

services

ordinarily

provided by Emirates

to passengers, except

any service relating to

the sale of alcohol, pork

or

tobacco-related

products.

Purpose

Raising Tier-1

capital.

General corporate

purposes including, but not

limited to, the financing of

aircraft and working-

capital requirements.

To purchase 4 new

Airbus

A380-800

aircraft.

Issuance date

19 November 2012

19 March 2013

31 March 2015

Tenure

6 years

10 years

10 years

Maturity

16 October 2018

19 March 2023

31 March 2025