Financial Outlook of the OIC Member Countries 2016

30

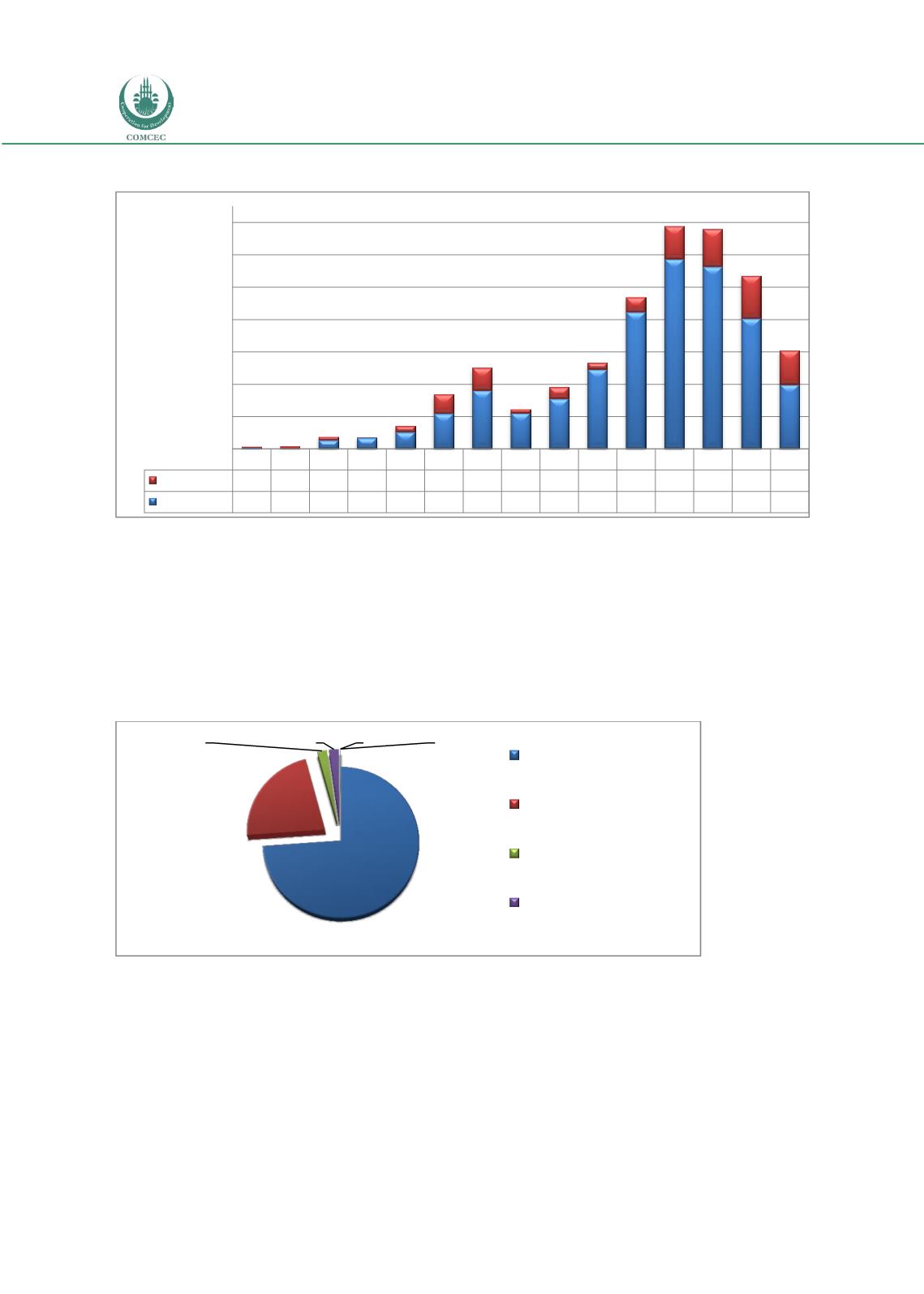

Figure 24: Total Global Sukuk Issuance (Jan 2001-Dec 2015) - Billion USD

Source: IIFM Sukuk Report 5

th

Edition

According to IIFM (2016), Asia accounts for 74 percent of global Sukuk issuances since the

inception of the market. GCC is the second largest destination of Sukuk, however, at 22 percent

of global Sukuk issuance, it’s a long way from Asia’s share of the total market. Malaysia, the

leader country with 67 percent of the global Sukuk issuances, is being flowed by UAE (8.1

percent), Saudi Arabia (7.8 percent), Indonesia (3.7 percent), Qatar (3.0 percent), Bahrain

(2.76 percent) and Sudan (2.1 percent).

Figure 25: Global Sukuk Issuance By region (Jan 2001-Dec 2015)

Source: IIFM Sukuk Report 5

th

Edition

As of 31 December 2015 total global Sukuk outstanding was 321 billion USD. Total domestic

sukuk outstanding was 230.6 billion USD while international sukuk outstanding was 90.4

billion USD (IIFM, 2016).

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

International 0,43 1,18 1,88 0,25 3,72 11,85 13,86 2,21 7,17 4,10 9,08 20,27 23,31 26,39 20,88

Domestic

0,75 0,19 5,33 6,69 10,29 21,76 36,18 22,13 30,90 49,03 84,49 117,33 112,57 80,57 39,81

0

20

40

60

80

100

120

140

74%

22%

2%

2%

0,18%

0,01%

Asia

GCC

Europe

Africa