Financial Outlook of the OIC Member Countries 2016

32

Shariah-compliance, have been developed.5 All major global index providers, such as Dow

Jones, Standard & Poor’s, FTSE, MSCI and Russell Investments supply Islamic indexes.

One of the examples of these indexes is S&P OIC/COMCEC 50 Shariah Index which has been

launched on June 22

nd

, 2012 in İstanbul. S&P/OIC COMCEC 50 Shariah index shows an

aggregate return on the exchanges of OIC member countries

6

(S&P Indices, 2016a). The index

covers at most 50

7

companies from the OIC member countries spanning 9 sectors,

Telecommunication Services, Financials, Materials, Consumer Staples, Industrials, Health Care,

Consumer Discretionary, Utilities and Energy. All eligible stocks must pass the Shariah

compliance screenings per S&P Shariah Indices Methodology. In addition, all eligible stocks

must have a minimum 3-month average daily value traded (ADVT) of 1 million USD. (S&P

Indices, 2016b).

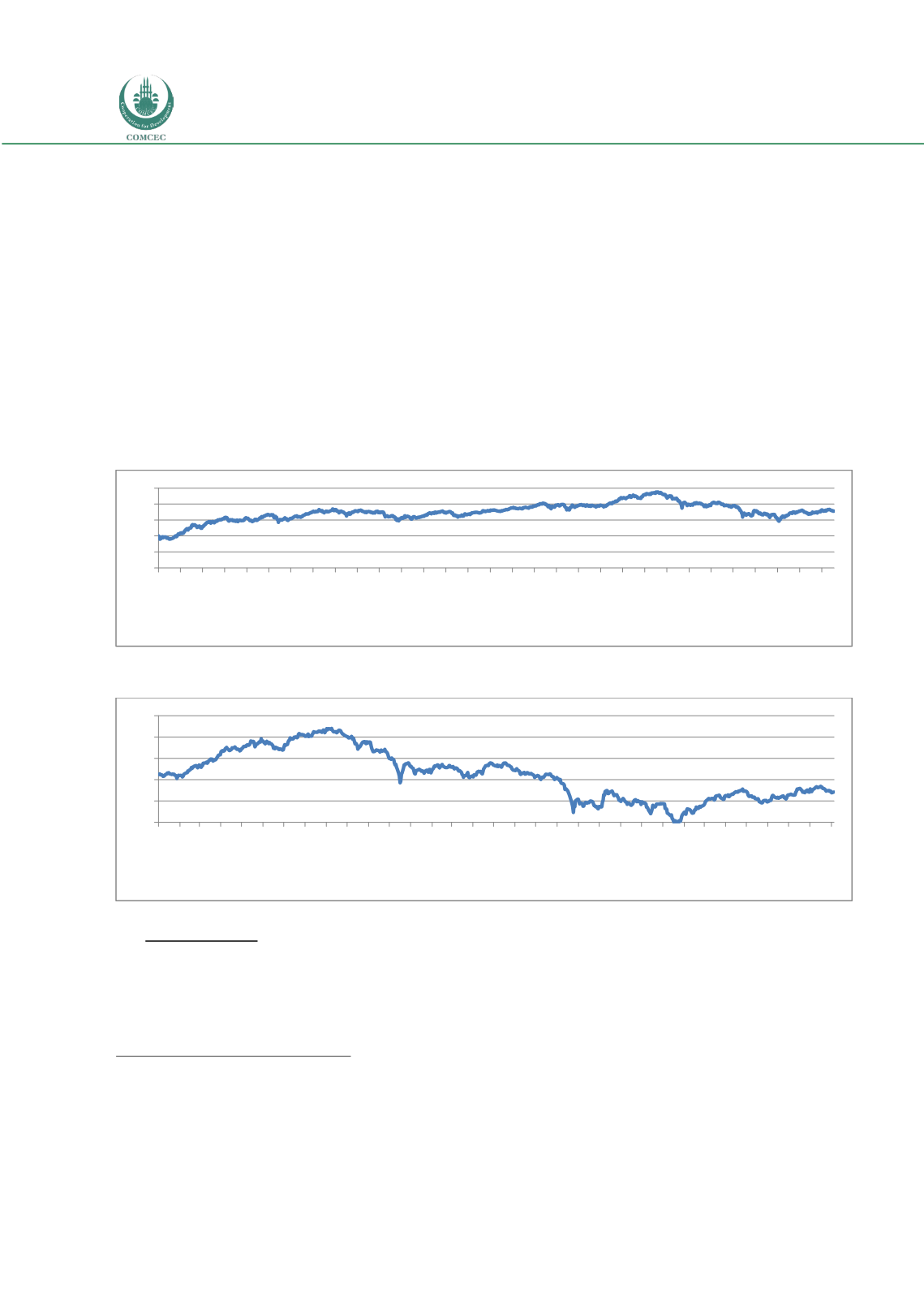

Figure 28: S&P/OIC COMCEC 50 Shariah Total Return Index (USD)

Panel A. All Data

Panel B. Last 2 years

Islamic Funds:

During the last decades, the number of Islamic funds has consistently

grown to more than 1200 as of October 2015 since it was just over 800 in 2008. The total

value of the Islamic Funds as of October 2015, declined 4.5 billion USD under the total

value of the Islamic funds as of September 2014 (75.8 billion USD), was 71.3 billion USD

5

http://eu.spindices.com/documents/education/shariah-pe-0913.pdf?force_download=true6

S&P Indices (2016b:4) states that “All stock exchanges of OIC member states that are covered by S&P Dow Jones Indices

are eligible for the index. This includes Bahrain, Bangladesh, Cote d'Ivoire, Egypt, Indonesia, Jordan, Kazakhstan, Kuwait,

Lebanon, Malaysia, Morocco, Nigeria, Oman, Pakistan, Qatar, Saudi Arabia, Tunisia, Turkey, and the United Arab Emirates”.

7

Currently number of constituents is 48 due to lack of enough companies satisfying index inclusion criteria, see S&P Indices

(2016a) for details.

0

50

100

150

200

250

16.01.2009

16.04.2009

16.07.2009

16.10.2009

16.01.2010

16.04.2010

16.07.2010

16.10.2010

16.01.2011

16.04.2011

16.07.2011

16.10.2011

16.01.2012

16.04.2012

16.07.2012

16.10.2012

16.01.2013

16.04.2013

16.07.2013

16.10.2013

16.01.2014

16.04.2014

16.07.2014

16.10.2014

16.01.2015

16.04.2015

16.07.2015

16.10.2015

16.01.2016

16.04.2016

16.07.2016

150

170

190

210

230

250

01.01.2014

01.02.2014

01.03.2014

01.04.2014

01.05.2014

01.06.2014

01.07.2014

01.08.2014

01.09.2014

01.10.2014

01.11.2014

01.12.2014

01.01.2015

01.02.2015

01.03.2015

01.04.2015

01.05.2015

01.06.2015

01.07.2015

01.08.2015

01.09.2015

01.10.2015

01.11.2015

01.12.2015

01.01.2016

01.02.2016

01.03.2016

01.04.2016

01.05.2016

01.06.2016

01.07.2016

01.08.2016

01.09.2016