Financial Outlook of the OIC Member Countries 2016

31

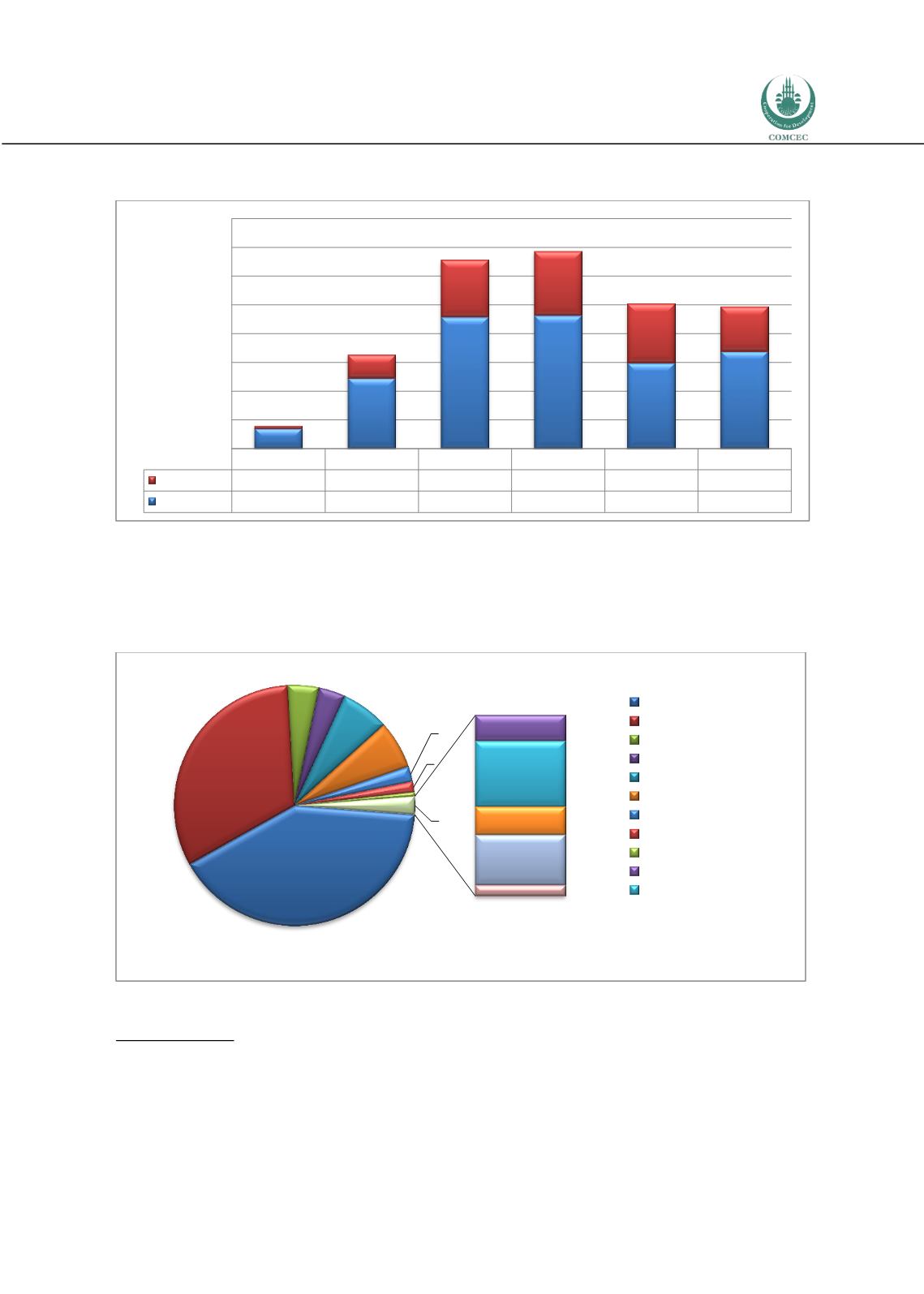

Figure 26: Total Global Sukuk Outstanding as of 31st December 2015- Billion USD

Source: IIFM Sukuk Report 5

th

Edition

Analyzing the Sukuk market by sector, although there is a dramatic fall according to 2014 (60.5

percent in 2014), the leading sector is government sector followed by financial services,

transportation, power & utilities, construction, real estate.

Figure 27: Sukuk Issuance by Sector (11M2015) - %

Source: IFSB, Islamic Financial Stability Report 2016

Islamic Indices:

As a consequence of demand for sophisticated investment solutions that are

adhere to the tenets of Islamic law, Shariah compliant benchmarks, which are subsets of

conventional benchmarks that include only those companies passing rules-based screens for

2010

2011

2012

2013

2014

2015

International

0,823

8,066

19,825

22,288

20,59

15,47

Domestic

7,071

24,55

45,76

46,315

29,761

33,86

0

10

20

30

40

50

60

70

80

43,48

34,43

4,48 3,82

6,9

6,89

2,19

1,54

0,59

0,37

0,94

0,4

0,72

0,15

2,58

Governmnet

Financial Services

Power & Utilities

Construction

Transportation

Other

Real Estate

Agriculture

Telecommunications

Healthcare

Retail