Financial Outlook of the OIC Member Countries 2016

2

1

BANKING

Banks are the essential elements of a financial system in providing payment tools, saving

instruments and borrowing opportunities. For the least developed countries, banks usually

comprise of almost all the financial system. Therefore, it is important to separately cover

banking for OIC member countries. However, the data for banks in OIC member countries is

difficult to collect and the main source for banks in the world is Bankscope by Bureau van Dijk.

World Bank also relies on this database for bank indicators included in Global Financial

Development Database (World Bank, 2016b). Although Bankscope is a good source to make

comparison study among OIC member countries, there needs to be explanation on how

representative this database is. To this end, a survey has been conducted and reported here.

Bankscope provides accounting information on banks from all over the world. For banks in OIC

member countries, the filtration that is used to identify the banks is as follows:

1-

Currently active banks

2-

Banks from 57 OIC member countries (note that Bankscope has no bank coverage

from Somalia)

3-

Banks from 6 out of 18 specialisation: Chosen specialization fields are 1) Commercial

banks, 2) Savings banks, 3) Cooperative banks, 4) Real Estate & Mortgage banks, 5)

Investment banks, and 6) Islamic banks.

1

With this filtration, 968 banks from 56 OIC member countries have been identified. For the list

of the banks, see Appendix I. Table 1 summarizes the number of banks covered in Bankscope

database by country and bank specialisation. Of 6 bank specialisations, commercial banks are

by far the biggest group of banks with 689. There are 155 Islamic banks and 105 investment

banks covered in the database. Somalia is the only country that has no bank coverage among

OIC member countries.

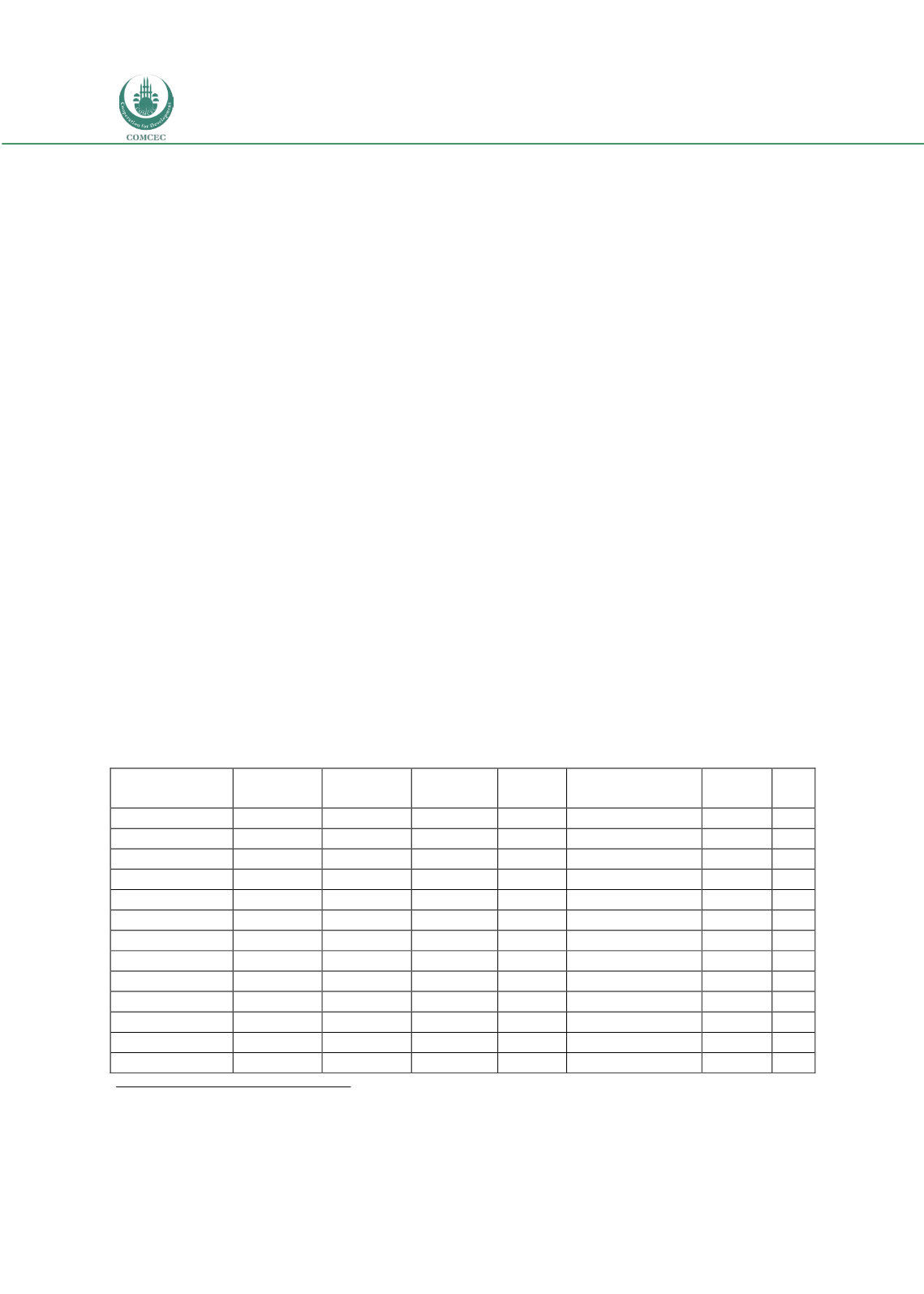

Table 1: Number of Banks Coverage by Countries and Specilisation

Commercial

Banks

Cooperative

Banks

Investment

Banks

Islamic

Banks

Real Estate &

Mortgage Banks

Savings

Banks

Total

Afghanistan

9

0

0

0

0

0

9

Albania

12

0

2

0

0

1

15

Algeria

17

0

0

0

0

0

17

Azerbaijan

26

0

1

0

0

0

27

Bahrain

10

0

6

18

2

0

36

Bangladesh

40

0

1

8

0

0

49

Benin

5

0

1

0

0

0

6

Brunei Darussalam

1

0

0

1

0

0

2

Burkina Faso

6

0

0

0

0

0

6

Cameroon

9

0

0

0

0

0

9

Chad

3

0

0

0

0

0

3

Comoros

1

0

0

0

0

0

1

Cote D'ivoire

12

0

0

0

0

0

12

1

Specialisations that are not included are 1) Other non-banking credit institutions, 2) Specialized governmental credit

institutions, 3) Bank holding & Holding companies, 4) Central banks, 5) Multi-lateral governmental banks, 6) Micro-financing

institutions, 7) Securities firms, 8) Private banking / Asset management companies, 9) Investment & Trust corporations, 10)

Finance companies, 11) Clearing & Custody institutions, and 12) Group finance companies.