Financial Outlook of the OIC Member Countries 2017

10

an

d liquidity.Quantitative easing has been implemented a lot in recent times. Following the

global financial crisis of 2007-08, the U.S. central bank, the Federal Reserve, implemented

several rounds of quantitative easing. More recently, the Bank of Japan and the European

Central Bank have implemented quantitative easing (Investopedia).

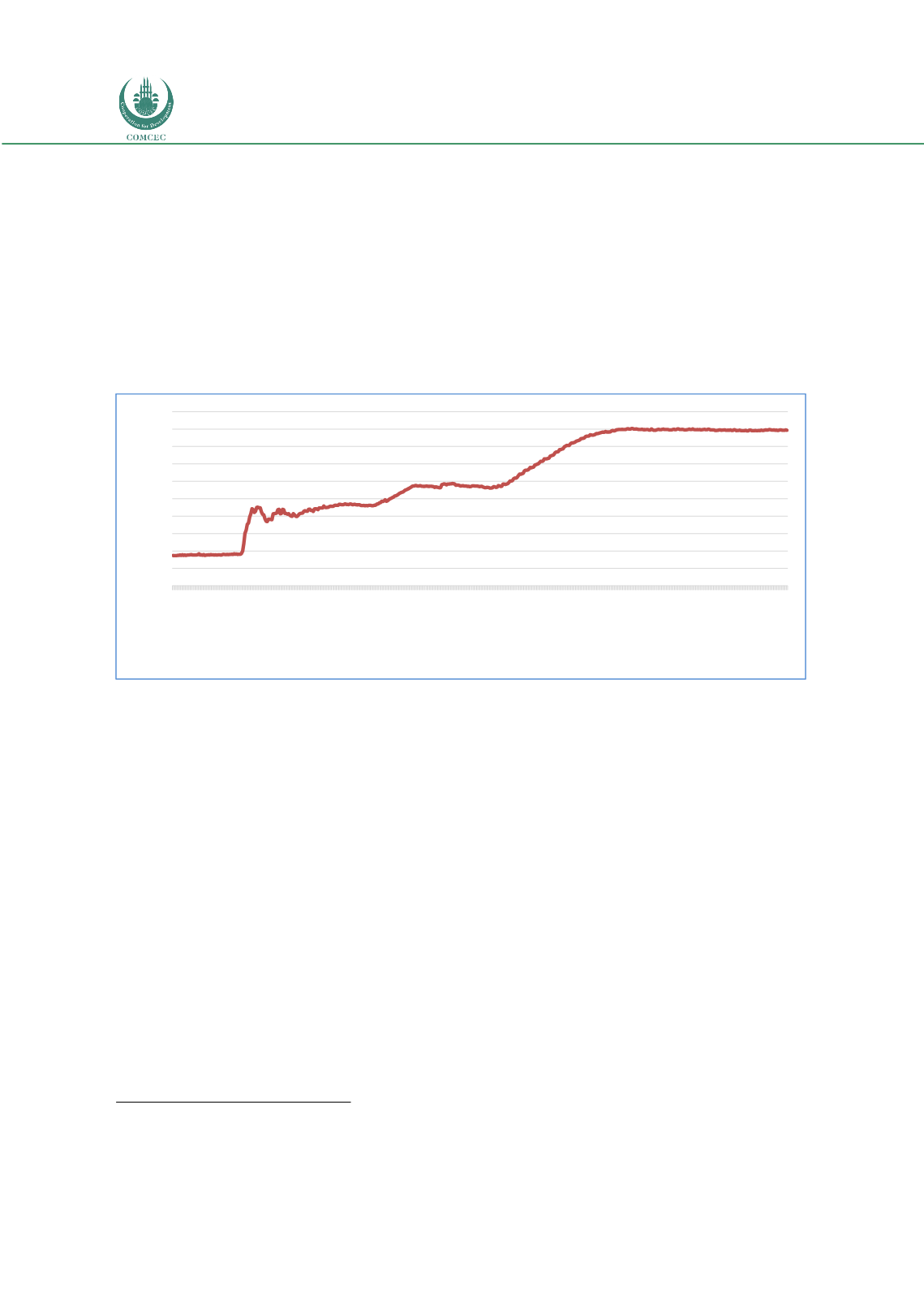

In response to extreme disturbances in the credit market in the fall of 2008, the Federal

Reserve lowered the policy rate target close to zero, announced unprecedented interventions

in the bond market, and offered forward guidance to the markets. From November 2008 to

2013 the Fed announced three rounds of asset purchases, totaling over $3 trillion, to address

poor economic activity.

17

Figure 11: FED Total Assets (Billion US$)

Source: Federal Reserve

(https://www.federalreserve.gov/monetarypolicy/bst_recenttrends_accessible.htm)

Global financing conditions have been benign since the start of 2017. After November 2016,

U.S. long-term yields rose sharply, similar to their surge during the mid-2013 Taper Tantrum.

Unlike the Taper Tantrum, the late-2016 increase reflected market expectations of

strengthening growth and higher inflation in the United States, and was not accompanied by a

sudden and sustained re-pricing of risk, including of emerging market assets. Since early 2017,

U.S. long-term yields have plateaued, even as the Federal Reserve has continued to raise short-

term rates.

18

The policy actions related to the quantitative easing of the major central banks have had

substantial spillover effects on the financial markets of the emerging-market economies. As

interest rates in developed economies remained low, investors were attracted to the higher

rates in many emerging economies and this has been reversed during the normalization of the

monetary policy in the US recently with the surge of the interest rates. As a result, these

policies have significant effects on exchange rates, capital flows, interest rates and asset prices

in the emerging market economies. The following figure just depicts the fluctuations of

exchange rates of some emerging market economies against US dollar during this period.

17

Agostini, G., Garcia, J. , “Comparative Study of Central Bank Quantitative Easing Programs”, SIPA Columbia University, April

2016.

18

World Bank Global Economic Prospects, June 2017

0

500

1000

1500

2000

2500

3000

3500

4000

4500

5000

1-Aug-2007

7-Nov-2007

13-Feb-2008

21.May.08

27-Aug-2008

3-Dec-2008

11.Mar.09

17-Jun-2009

23-Sep-2009

30-Dec-2009

7-Apr-2010

14-Jul-2010

20-Oct-2010

26-Jan-2011

04.May.11

10-Aug-2011

16-Nov-2011

22-Feb-2012

30.May.12

5-Sep-2012

12-Dec-2012

20.Mar.13

26-Jun-2013

2-Oct-2013

8-Jan-2014

16-Apr-2014

23-Jul-2014

29-Oct-2014

4-Feb-2015

13.May.15

19-Aug-2015

25-Nov-2015

02.Mar.16

8-Jun-2016

14-Sep-2016

21-Dec-2016

29.Mar.17

5-Jul-2017