Financial Outlook of the OIC Member Countries 2017

14

To measure and benchmark financial systems, the outlook utilizes several measures of

following four characteristics of financial institutions and markets:

(a) Financial Depth: Measures the size of financial institutions and markets,

(b) Financial Access: Measures the degree to which individuals can and do use financial

institutions and markets,

(c) Financial Efficiency: Measures the efficiency of financial institutions and markets in

providing financial services,

(d) Financial Stability: Measures the stability of financial institutions and markets in order to

measure and benchmark financial systems in the OIC region

24

.

Although the above referred study of the World Bank has developed number of measures to

compare the characteristics of the financial markets, the following indicators are selected to

analyze the four measures of the financial markets in the OIC countries as depicted in Table-2.

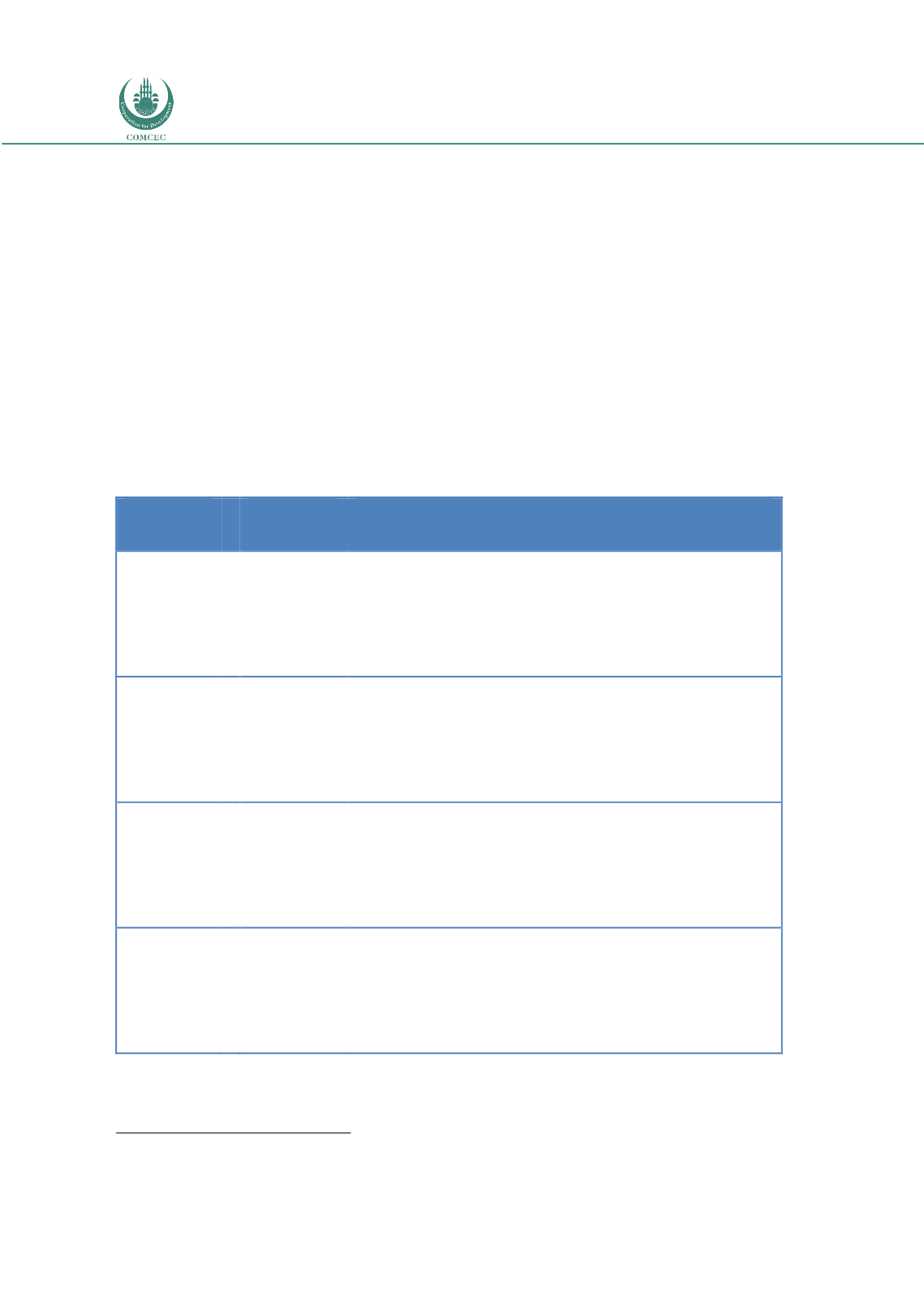

Table 2: Selected Financial Data on OIC Member States

Indicator

Code

Name of the Indicator

DEPTH

GFDD.DI.01

GFDD.DI.02

GFDD.DM.01

GFDD.DM.02

Private credit by deposit money banks to GDP (%)

Deposit money banks' assets to GDP (%)

Stock market capitalization to GDP (%)

Stock market total value traded to GDP (%)

ACCESS

GFDD.AI.01

GFDD.AI.02

GFDD.AI.03

GFDD.AI.06

Bank accounts per 1,000 adults

Bank branches per 100,000 adults

Firms with a bank loan or line of credit (%)

Saved at a financial institution in the past year (% age 15+)

EFFICIENCY

GFDD.EI.02

GFDD.EI.05

GFDD.EI.06

GFDD.EM.01

Bank lending-deposit spread

Bank return on assets (%, after tax)

Bank return on equity (%, after tax)

Stock market turnover ratio (%)

STABILITY

GFDD.SI.02

GFDD.SI.03

GFDD.SI.04

GFDD.SI.05

Bank nonperforming loans to gross loans (%)

Bank capital to total assets (%)

Bank credit to bank deposits (%)

Bank regulatory capital to risk-weighted assets (%)

Source: World Bank

24

Cihak, M., Demirgüç-Kunt, A., Feyen E., Levine, R., 2012