Financial Outlook of the OIC Member Countries 2017

9

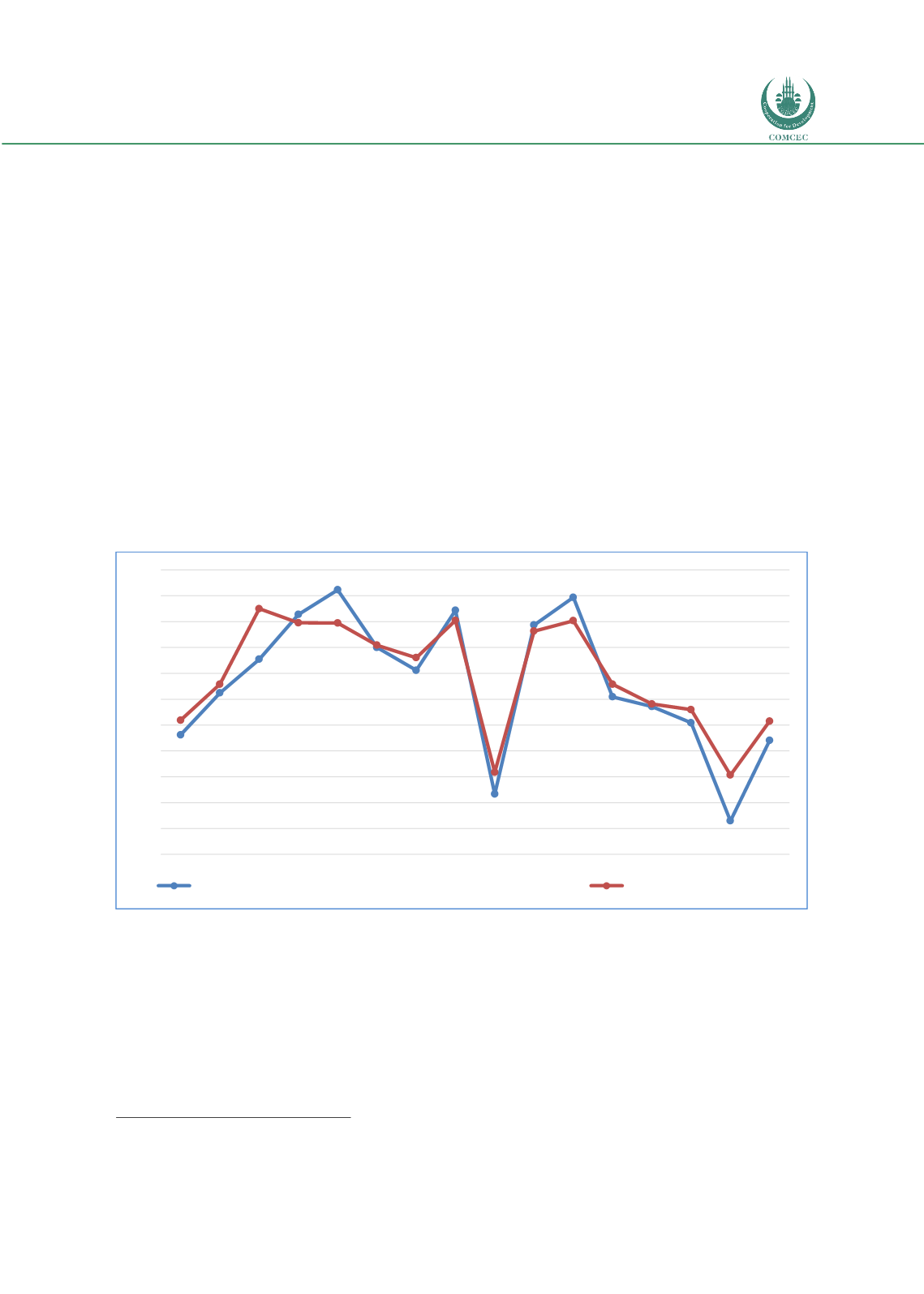

and reached its historically highest level of $2.4 trillion in 2012. This trend did not continue

and total exports fell slightly to $2.3 trillion dollars over the years of 2013 and 2014. However,

mainly because of the sharp drop in oil prices in 2015 as well as the fragility in the global

markets, export decreased by 29 percent and dropped to $1.6 trillion. The year 2016

witnessed further decline for exports from the OIC countries by 8.5 percent and realized as

$1.49 trillion.

As a result, the share of OIC countries in total exports of developing countries plunged to

24.3% in the same year, compared to 30.5% in 2012, and continued to remain below its pre-

crisis level of 32.6% observed in 2008. OIC countries’ collective share in total world

merchandise exports also followed a similar trend between 2012 and 2015, and decreased to

9.9 % in 2015, which is the lowest ratio observed since 2005.

15

The fall in exports for the years of 2015 and 2016 can be partly explained by falling commodity

prices, where OIC countries have significant concentration. Moving forward, to achieve long-

term sustainable growth in merchandise trade and higher share in total world exports, OIC

countries will apparently need more competitive economic sectors with significant

diversification levels and higher technological intensity.

16

Figure 10: OIC Exports and Oil Prices

Source: Authors’ Calculations from IMF WEO and UNCTAD Stat

One of the main financial developments after the Global Financial crisis affecting whole

financial markets is an unconventional monetary policy practice implemented by the major

developed economies called quantitative easing.

Quantitative

easing

is

an

unconventiona

l monetary policyin

which

a central bankpurchase

s government securities or other securities from the market in order to lower

interest rates and increase the money supply. Quantitative easing increases th

e money supplyby flooding financial institutions with capital in an effort to promote increased lending

15

2016 OIC Economic Outlook, SESRIC

16

2016 OIC Economic Outlook, SESRIC

-60

-50

-40

-30

-20

-10

0

10

20

30

40

50

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

Crude Oil (petroleum), Dated Brent,US$ per barrel (% Change)

OIC Export (% Change)