Financial Outlook of the OIC Member Countries 2017

7

Figure 6: Unemployment Rates (% of total labor force)

Source: IMF WEO April 2017

Downside risks to global growth include rising protectionism, high policy uncertainty, and the

possibility of financial market disruptions. U.S. monetary policy has tightened gradually so far,

but a faster pace would impact global financing conditions. Central banks in advanced

economies will gradually normalize monetary policy as inflation increases and economic slack

diminishes. While the U.S. tightening cycle is well ahead of other major advanced economies, it

is proceeding at a substantially slower pace than in the past

.

12

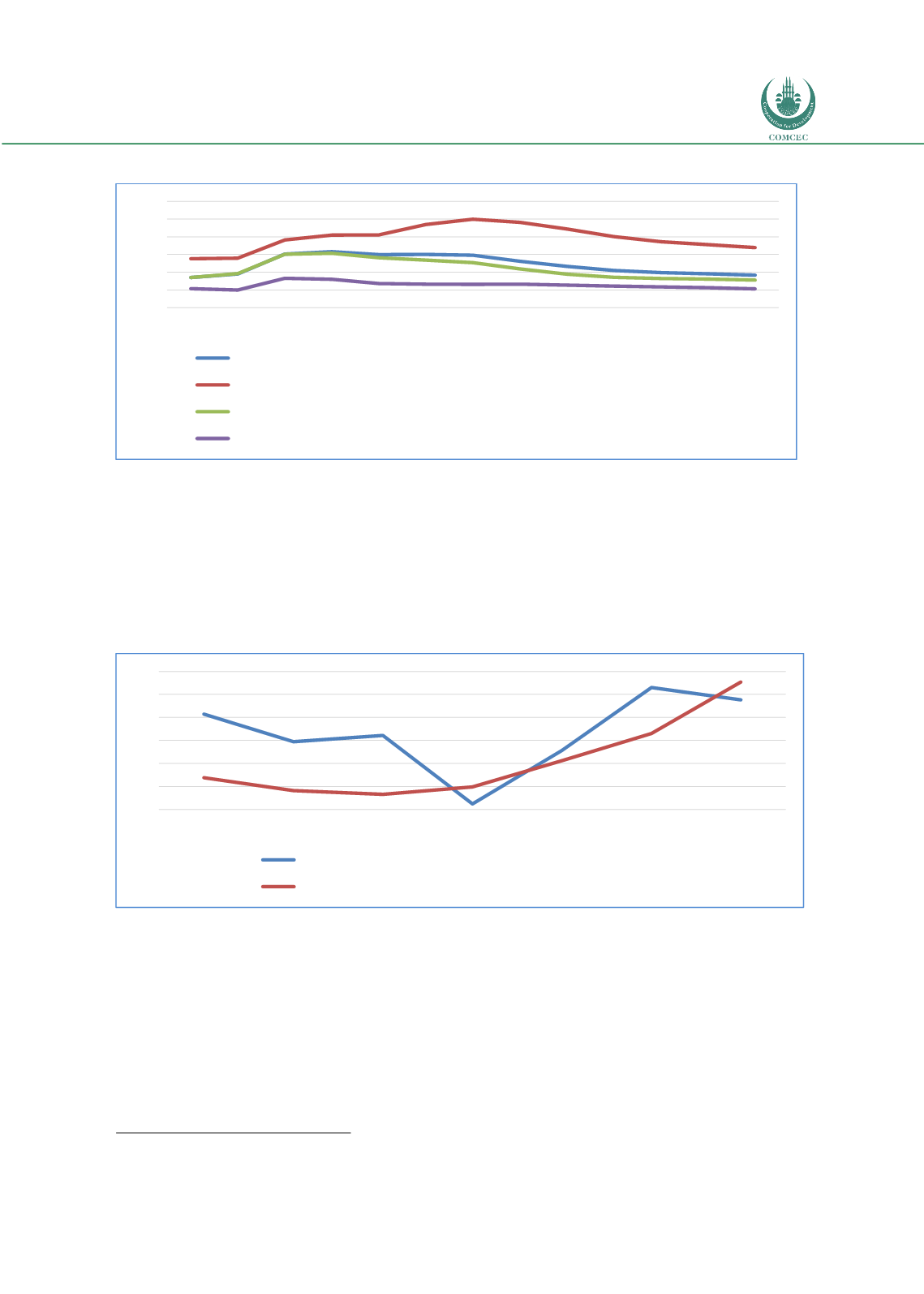

Figure 7: Inflation and Interest Rates in the US (%)

Source: IMF WEO April 2017

As shown in the above figure, after the global financial crisis the real interest rates have

recorded negative levels in the US; however after 2015 inflation rates have started increasing

in parallel to the interest rates and it is expected to reach zero level real interest rate by 2018.

Global trade growth has rebounded in early 2017 from a post-crisis low of 2.5 percent in 2016,

despite rising trade policy uncertainty. The recovery, which began in the second half of 2016,

has been supported by stronger industrial activity. Investment growth in advanced economies

is firming, and the post- crisis deceleration in capital spending observed in EMDEs appears to

be easing as the earlier terms-of-trade shock for commodity exporters wanes. A recovery in

12

World Bank Global Economic Prospects, June 2017

2,0

4,0

6,0

8,0

10,0

12,0

14,0

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Advanced economies

Euro area

Major advanced economies (G7)

Other advanced economies (Advanced economies excluding G7 and euro area)

0,0

0,5

1,0

1,5

2,0

2,5

3,0

2012

2013

2014

2015

2016

2017

2018

Inflation, average consumer prices (% Change)

Six-month London interbank offered rate (LIBOR)-Percent