Financial Outlook of the OIC Member Countries 2017

16

economies with better-developed banking and credit system tend to grow faster over long

periods of time (Demirgüç-Kunt, Levine 2008)

27

. In this regard, domestic credit to private

sector to GDP ratio is a significant indicator to measure financial depth of any country.

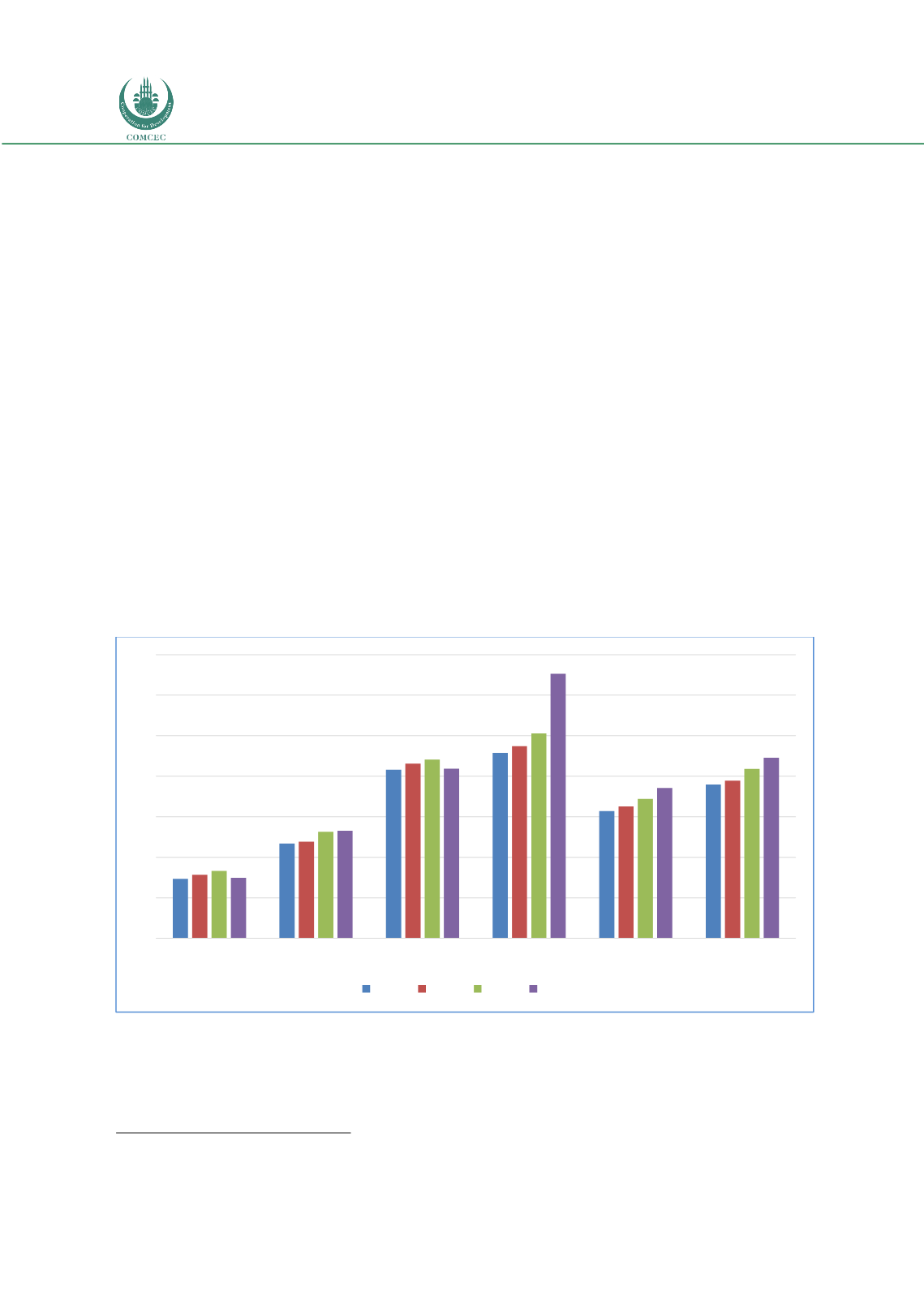

As shown in the Figure below, OIC average of the private sector credit given by the domestic

banks are lower than the world average. While there has been slight improvement in recent

years, the size of the private sector credit as a share of the GDP clearly indicates the under

developed nature of the private sector in the OIC countries. OIC average in 2015 reached to

37.1% while the world average for the same period realized as 44.5%. Among the OIC

countries, the rates have been differed significantly across different income groups. As seen

from the graph below and as expected from level of economic development, OIC-LIG and OIC-

LMIG countries have low levels of private credits from banking sector. While the rate has not

shown any improvement for the OIC-LIG countries, LMIG countries has recorded slight

increase over the last 4 years. On the other hand, OIC-UMIG and OIC-HIG countries have

performed better during this period. Especially the rate for the OIC-HIG countries have

increased significantly over the years surpassing the world average and reached to 65.3% in

2015.

As a result, it is found that there is a considerable gap between the World and OIC Member

States average. This is a clear indication of the underdeveloped nature of the private sector and

banking in these countries and this issue can be seen as an important obstacle for investment

and economic growth of the OIC member countries.

Figure 13: Private Credit by Deposit Money Banks to GDP (%)

Source: Authors’ calculation from the World Bank Database

Another indicator used to measure the depth of the financial institutions and markets is

Deposit money banks' assets as a share of GDP

. This measure refers to ‘total assets held by

deposit money banks as a share of GDP. Assets include claims on domestic real nonfinancial

27

Benchmarking Financial Systems Around The World 2012, World Bank

0

10

20

30

40

50

60

70

OIC-LIG

OIC-LMIG OIC-UMIG

OIC-HIG OIC-Average World Average

2012 2013 2014 2015