Preferential Trade Agreements and Trade Liberalization Efforts in the OIC Member States

With Special Emphasis on the TPS-OIC

89

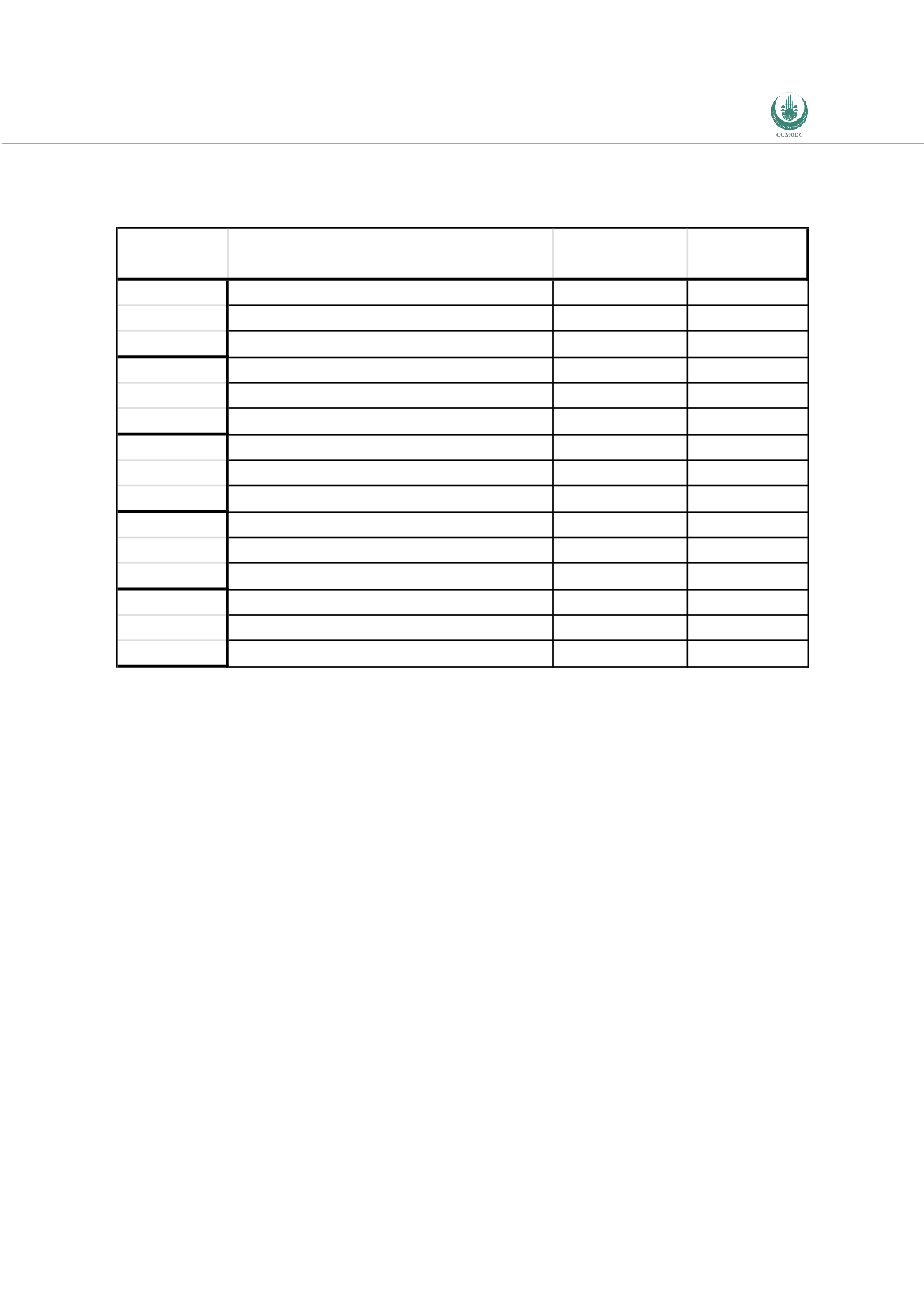

Table 12:

Main products imported from OIC countries and key OIC partners by countries

with highest shares of OIC imports in their total imports, 2010

Country Main exports to OIC (HS 4 digit code)

Share of X to

OIC

OIC X

partners

Oils petroleum (2710)

34% Uzbekistan*

Afghanistan Commodities nes (9999)

29%

Pakistan*

Wheat or meslin flour (1101)

8%

Iran*

Oils petroleum (2710)

41%

UAE

Pakistan Petroleum oils crude (2709)

21% Saudi Arabia*

Palm oil (1511)

10%

Kuwait

Petroleum oils, crude (2709)

30% Saudi Arabia*

Jordan

Oils petroleum (2710)

11%

Egypt

Petroleum gases etc (2711)

8%

Turkey

Oils petroleum (2710)

12%

UAE*

Oman

Baked bread.. (1905)

3% Saudi Arabia*

Parts for lifting, moving machy (8431)

3%

Kuwait

Iron and non-alloy steel (7206)

8%

UAE

Iran Hot-rolled products, iron/steel (7208)

4%

Turkey*

Commodities not specified (9999)

4%

Source: Comtrade via WITS. Note: * denotes a neighbouring country (common land border)

As well as looking at changes in the amount of trade over time, it is also interesting to consider

the changing composition of trade. To do this we take the OIC-2000 group and compare the

structure of trade in the year 2000 with the structure of trade in 2010. We find that for the

OIC-2000 group, the index is equal to 0.6 for total exports, and 0.56 if we consider non-oil and

gas exports. Hence this suggests that there is approximately a 55%-60% overlap in the

structure of trade when comparing 2000 with 2010. By way of comparison if the same

calculation is done for the exports of the EU27, the US and China the corresponding figures are

0.65, 0.78 and 0.57. This suggest that the OIC countries have seen a greater change in the

composition of their exports over time in comparison to the EU and the US, and a similar

degree of restructuring as that experienced by China.

Overview of Tariff Trends

A central issue when considering the possible impact of further integration concerns the level

of barriers to trade between countries. The main data that we have on such barriers, is data on

tariffs (and tariff levels are often highly correlated with non-tariff barriers for reasons of

domestic political economy).