Reviewing Agricultural Trade Policies

To Promote Intra-OIC Agricultural Trade

138

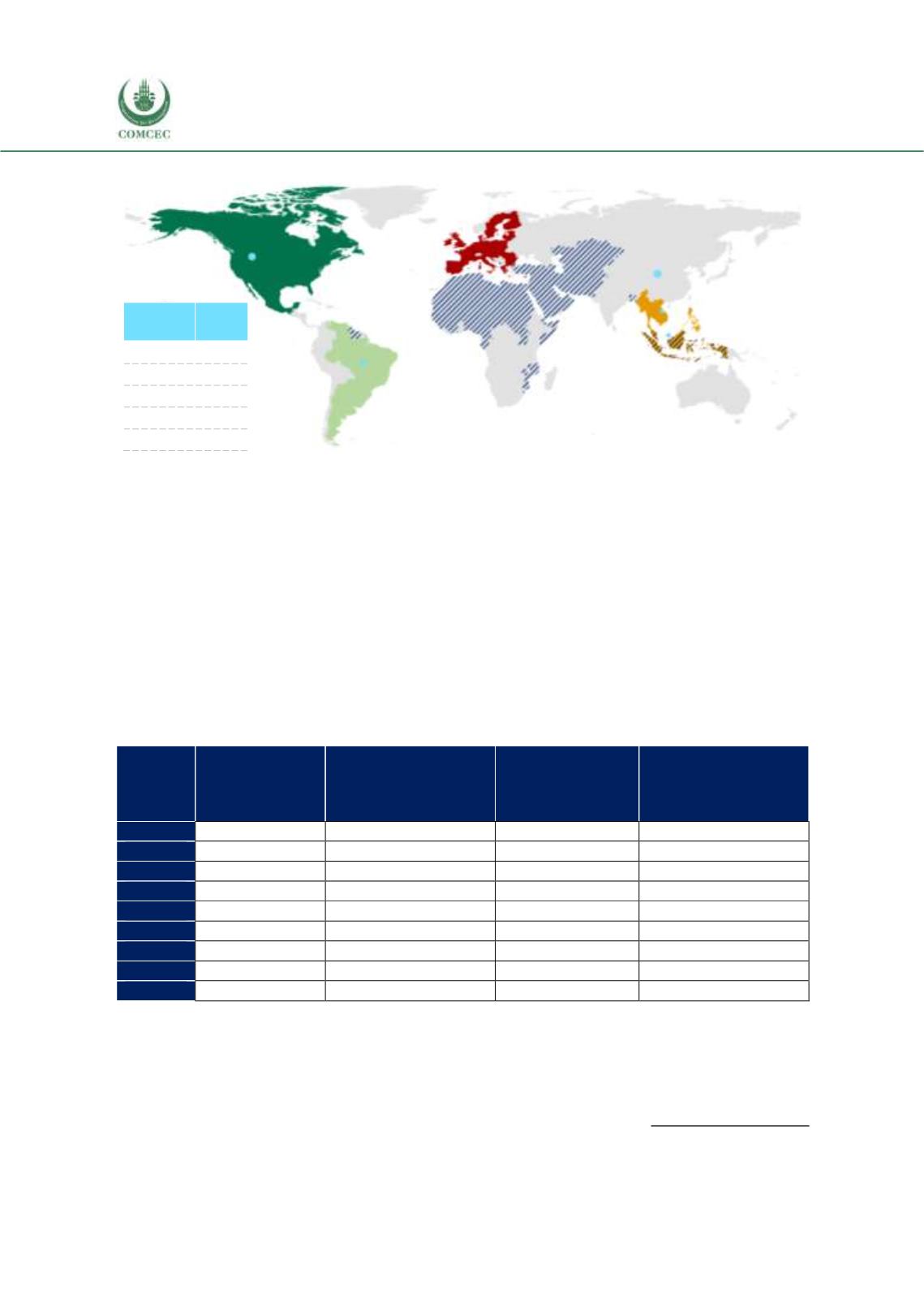

Figure 4. 51 Breakdown of Thailand’s Agricultural Import Origins, 2016

Source: CEPII BACI, Eurostat RAMON, UN Comtrade, UN Trade Statistics, authors’ visualizations

4.5.1. Agricultural Trade with the OIC Countries

General overview

In spite of its status as a founding member of the ASEAN, the bloc’s share in Thailand’s exports

and imports have been relatively low (23 percent and 21 percent respectively, in 2016). Thai

imports made up 16 percent of the ASEAN agricultural exports, and Thai exports amounted to 8

percent of total agricultural imports of ASEAN.

By contrast, the OIC member countries’ share in the external trade of Thailand decreased during

2008-2016. Thailand recorded an agricultural trade surplus of 4.5 billion USD with the OIC

partners in 2016, down from 5.7 billion USD in 2008.

Table 4. 47 Value & Share of OIC Countries in Thailand’s Agricultural Trade

Year

Value

(exports)

billion USD

Share in Thailand’s

total agricultural

exports, %

Value

(imports)

billion USD

Share in Thailand’s

total agricultural

imports, %

2008

7.1

22.3

1.4

14.1

2009

5.8

20.7

1.1

12.9

2010

6.8

19.6

1.4

12.9

2011

9.4

20.0

1.8

13.2

2012

8.1

19.2

1.8

11.9

2013

7.4

18.2

1.7

11.7

2014

7.7

19.1

1.7

11.8

2015

6.1

16.7

1.7

11.9

2016

6.2

16.7

1.7

11.3

Source: CEPII BACI, Eurostat RAMON, UN Comtrade, UN Trade Statistics, and authors’ calculations

Figure 4.52 shows the distribution of Thailand’s agricultural exports to the three OIC member

country groups. The shares of all three groups’ in total agricultural exports of Thailand fell from

2008 to 2016. The Asian group’s share slightly declined from 10.6 to 9.2 percent, while the

African group’s share went down from 6.2 to 4.1 percent. Similarly, the share of the Arab group

decreased from 5.5 percent and 3.4 percent in total agricultural exports. While the Arab group

EU-28

%9

NAFTA

%14

MERCOSUR

%11

ASEAN

%21

OIC %11

Top 5

Partner

Share

China

15%

USA

12%

Brazil

8%

Malaysia

5%

Viet Nam 4%