Reviewing Agricultural Trade Policies

To Promote Intra-OIC Agricultural Trade

100

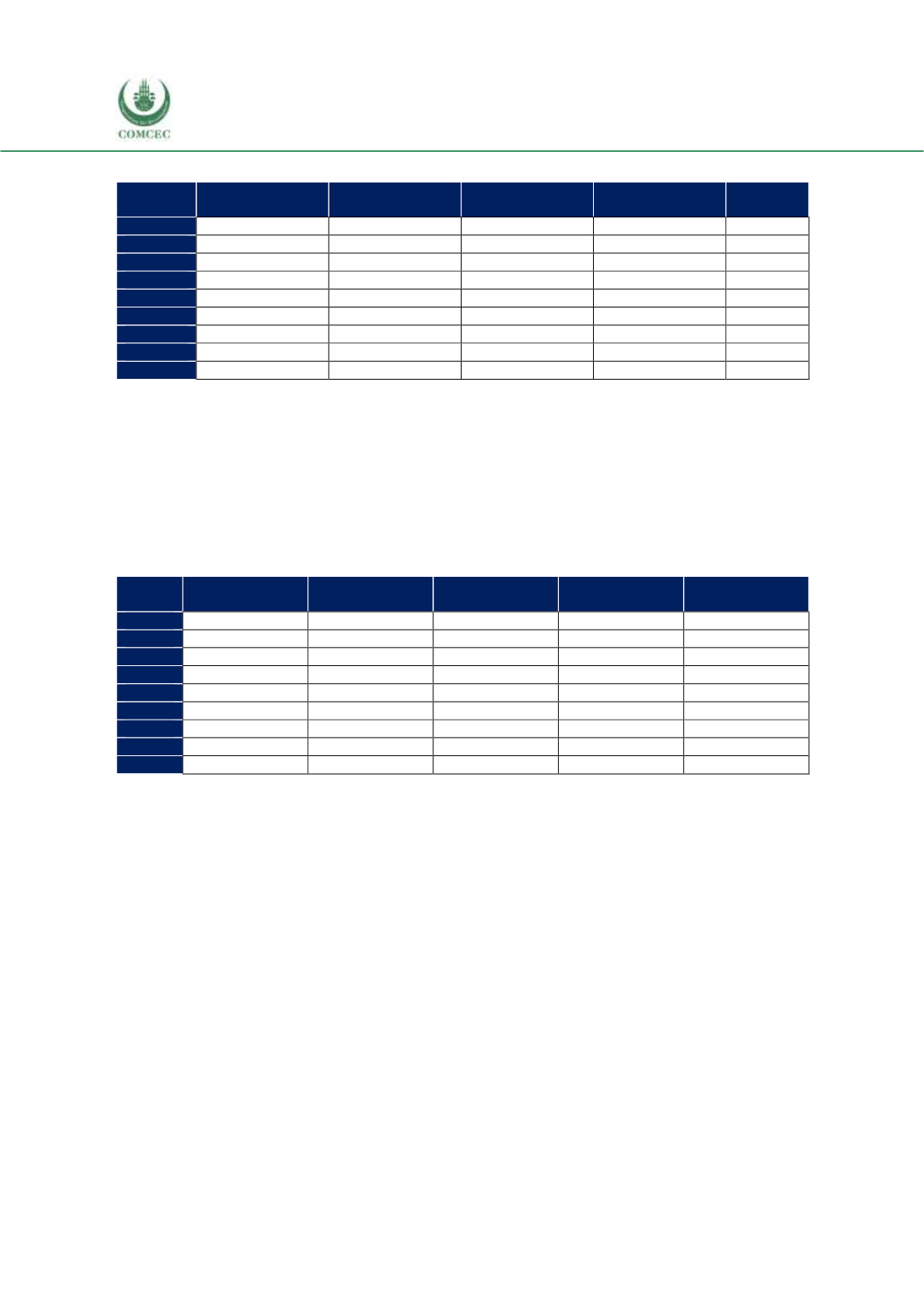

Table 4. 17 Distribution of Morocco’s Top 5 Export Products, by Destination, %

African group

Asian group

Arab group

Non-OIC

Countries

Total

2008

1.3

0.3

3.3

95.1

100

2009

1.3

0.2

4.1

94.4

100

2010

1.0

0.6

3.7

94.8

100

2011

0.8

0.4

2.5

96.2

100

2012

1.0

0.5

3.5

94.9

100

2013

1.8

1.2

3.1

93.9

100

2014

2.4

1.5

2.9

93.2

100

2015

4.4

1.9

6.0

87.7

100

2016

3.4

2.4

6.2

87.9

100

Source: CEPII BACI, Eurostat RAMON, UN Comtrade, UN Trade Statistics, and authors’ calculations

The distribution of Morocco’s top 5 agricultural exports to the OIC according to destination has

been shown in Table 4.17. The share of non-OIC countries in total OIC exports of top five

agricultural export products has declined from 95.1% to 87.9% from 2008 to 2016. During the

observation period, all country groups exhibited increases in shares of total exports at the

expense of non-OIC countries, with Arab group’s share increasing from 3.3% to 6.2%, followed

by African group and Asian group with their respective increases from 1.3% to 3.4% and 0.3%

to 2.4%.

Table 4. 18 Distribution of Morocco’s Top 5 Import Products, by Origin, %

African group

Asian group

Arab group

Non-OIC

Countries

Total

2008

0.5

0.6

11.5

87.4

100

2009

1.2

0.8

9.8

88.1

100

2010

0.6

0.3

8.5

90.5

100

2011

0.7

0.6

7.5

91.2

100

2012

0.3

0.2

7.9

91.5

100

2013

1.3

0.4

9.3

89.1

100

2014

1.4

0.4

8.1

90.2

100

2015

2.1

0.5

11.8

85.6

100

2016

2.5

0.5

10.5

86.5

100

Source: CEPII BACI, Eurostat RAMON, UN Comtrade, UN Trade Statistics, and authors’ calculations

The distribution of Morocco’s top 5 import products from OIC countries according to the region

of origin has been shown in Table 4.18. The share of non-OIC countries did not change much

during the 2008-2016 period. As of 2016, Arab group accounts for the major share in total OIC

imports, despite exhibiting a slight decrease from 11.5% in 2008 to 10.5% in 2016. During the

same period, Asian group’s share remained relatively stable, while African group’s share slightly

increased from 0.5% to 2.5%.

It has been shown in Table 4.19 that Turkey is the largest importer of Morocco’s top five

agricultural export products in the OIC market. The share of Turkey in the last available three-

year average is 16.9%, followed by Lebanon, Côte d'Ivoire and Mauritania with their respective

shares of 8.7, 8.2, and 6.7. The higher shares are due to the geographic proximity of these three

countries to Morocco. The fifth largest market is Syria, for which the lower share can again be

associated with the ongoing conditions.