Reviewing Agricultural Trade Policies

To Promote Intra-OIC Agricultural Trade

102

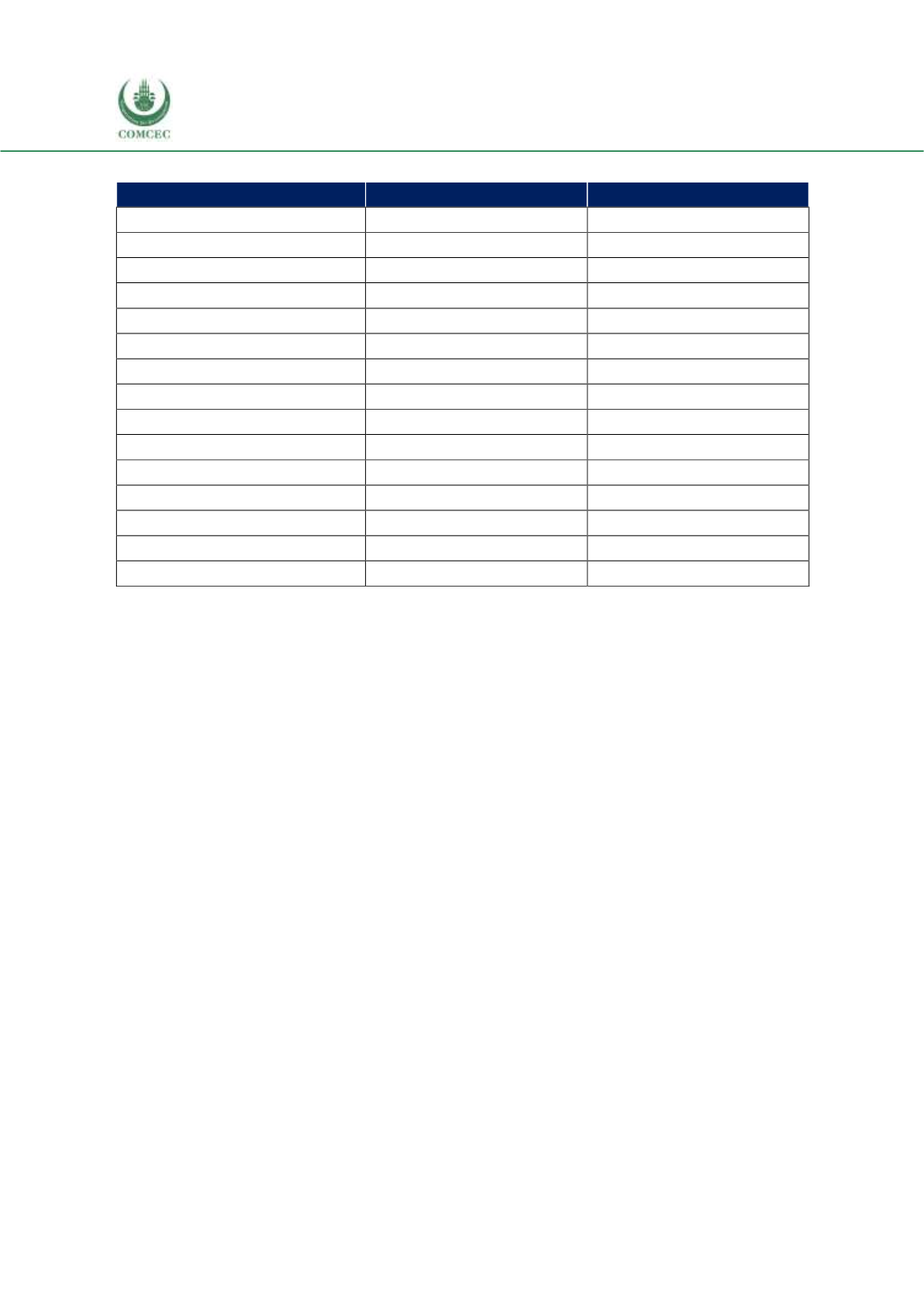

Table 4. 21 OIC Member Countries that Export to Morocco under Preferential Tariffs

African Group

Arab Group

Asian Group

Benin

Comoros

Afghanistan

Burkina Faso

Djibouti

Albania

Chad

Egypt*

Bangladesh

Côte d'Ivoire

Jordan

Indonesia*

Gambia

Mauritania

Iran

Guinea

Palestine

Kyrgyzstan

Guinea-Bissau

Somalia

Malaysia

Mali

Sudan

Pakistan

Mozambique

Tunisia*

Tajikistan

Niger

Yemen

Uzbekistan

Nigeria

Senegal

Sierra Leone

Togo

Uganda

Source: WTO RTA Database.

Note: Countries marked with an asterisk are among the top 5 OIC countries from which Morocco’s top

import products are imported. Countries written in boldface letters have a free trade agreement in force

with Morocco.

Tariffs

Themost recent WTO Tariff Profile Summary for Morocco indicates that the simple averageMFN

applied tariff for agriculture in Morocco is 27.6% in 2017 and the trade-weighted average in

2016 is 16.2%. The usual case of tariffs in agriculture being larger than tariffs in non-agricultural

sectors is also observed for Morocco. The wedge for the trade-weighted 2016 average is close

two times.

The distribution of applied MFN tariffs in agriculture indicates that, in 2017, less than 7% of all

tariff lines have tariff rates larger than 50% and around 50% of all tariff lines have rates less

than 25%.

Looking at the product line classifications shared in the WTO Tariff Profile summary, applied

MFN rates remain at 2-digit numbers. From the largest to the smallest, the five highest rates are

the following: 69.8% for animal products, 50.9% for dairy products, 36.2% for beverages and

tobacco, 26.2% for fruits, vegetables, and plants, and 21.7% for cereals and preparations.

Applied average MFN tariffs are typically larger than the EU levels in the product line

classifications of the WTO Tariff Profile Summary. The exception here is “Sugars and

confectionary” as the Moroccan MFN applied rate of 20.2% is around 3 percentage points lower

than the EU rate.

Morocco applies preferential tariffs to a diverse set of countries, and Table 4.21 lists 35 OIC

member countries that export to Morocco under preferential tariffs.