Improving Public Debt Management

In the OIC Member Countries

66

The avoidance of interest and the somewhat limited secondary market gives rise to concerns

with regards to the tradability of

sukuk

bonds. This limited tradability, the high issuance costs

and the rather limited volume of

sukuk

bonds may constrain market liquidity and hence a

government’s flexibility in fiscal policy and a central bank’s flexibility in monetary policy.

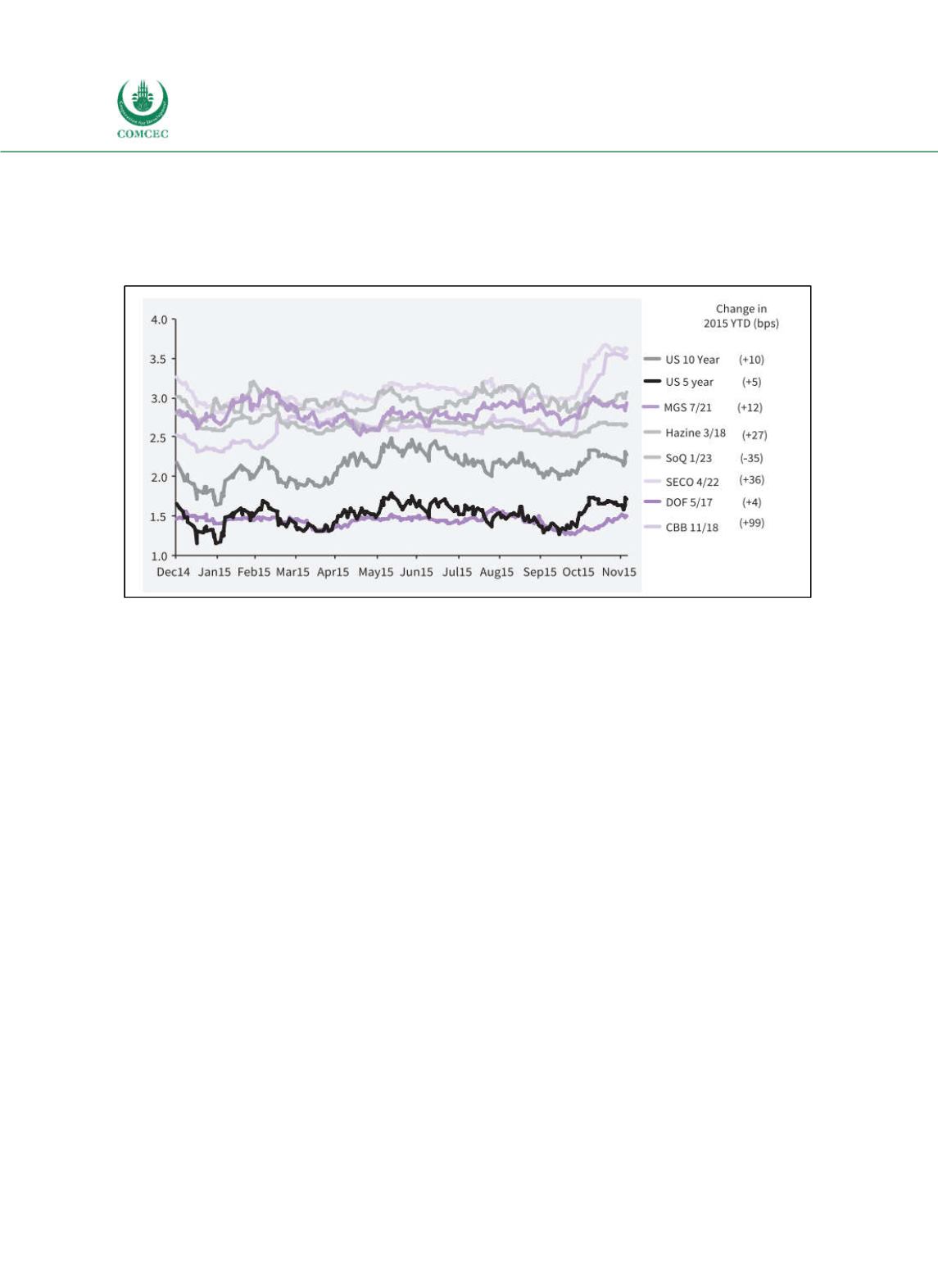

Figure 3-21: Selected USD Sukuk Yields vs. U.S. Government Securities Yield

Note: CBB = Central Bank of Bahrain, DOF = Dubai Department of Finance, SECO = Saudi Electricity Company,

SoQ = State of Qatar, Hazine = Hazine Mustesarligi (Turkish Under Secretariat), MGS = Malaysia Global Sukuk

Wakalah, US 5Y = US 5-Year Generic Government Yield, US 10Y = US 10-Year Generic Government Yield. Source:

IFSB (2016, p. 17).

3.4

Lessons Learned

The average debttoGDP ratio in the OIC member countries has increased from 36.7% in 2012

to 46.1% in 2015 and is expected to rise to 51.1% in 2017. However, the amount of

outstanding gross public debt as a share of GDP is very heterogeneous among OIC member

countries, ranging between 3% and 139%. The highest average debttoGDP ratios are

expected in lowincome countries in the next years. Average debttoGDP ratios in middleincome countries are expected to slightly decrease. Highincome countries are projected to

experience the largest increase in the average debttoGDP ratio. Different debt dynamics can

also be observed at the regional level: several African countries have been granted debt relief

or restructuring in the last decade. Consequently, debt ratios have substantially decreased

between 2006 and 2009 in the African group and have only slightly risen again afterwards.

The average debttoGDP ratio in the Asian group has been on a relative stable path. The

average debttoGDP ratio in the Arab group has increased since 2014, as the decline in oil

prices had a substantial negative effect on the economies of oilproducing countries. While the

fiscal buffers of some OIC member countries are expected to be capable of absorbing the

budget deficits potentially following lower oil revenues for a period of years, other OIC

member countries may have to issue substantial amounts of additional debt obligations.

The average grant element in OIC countries has been about 50% since 2006, a share being

similar to the worldwide average. Grants are primarily extended by official creditors, i.e.

international organizations and governments, while private credit contracts have a small grant

element. Grants to low income countries are more generous than to middleincome countries.

The grant element is particularly high in the African group.