Improving Public Debt Management

In the OIC Member Countries

14

Making prudent borrowing decisions based on an analysis of costs and risks

Facilitating intragovernmental and creditoraddressed communication and coordination

to reduce uncertainty

Giving debt managers a clear mandate, thereby ensuring good governance and

accountability

Fostering the development of a domestic debt market by making the government’s debt

goals transparent to market participants

Overall, a sound risk management is essential for fiscal sustainability. The most important

risks to be taken into account are the following:

Refinancing risk or rollover risk, i.e. the risk that the government is unable to refinance

maturing debt. The shorter the maturity of debt is, the higher is the amount of debt to be

rolledover in a given year and the higher the refinancing risk.

Interest rate risk or refixing risk, i.e. the risk that borrowing costs increase due of

unfavorable developments in interest rates. Interest rate risk is higher if contracts are

based on variable interest rates. With fixed interest rates, it covers the risk that refinancing

of maturing debt is realized at higher interest rates.

Exchange rate risk, i.e. the risk that a devaluation of the exchange rate increases the value

of debt expressed in domestic currency. Hence, exchange rate risk is relevant for debt

denoted in foreign currency.

Additionally, debt managers face operational risks that should be managed through

governance and control functions (see Table 12). Indicators to be assessed in the debt

management strategy also include projections of the total debt service and the maturity

structure under different scenarios.

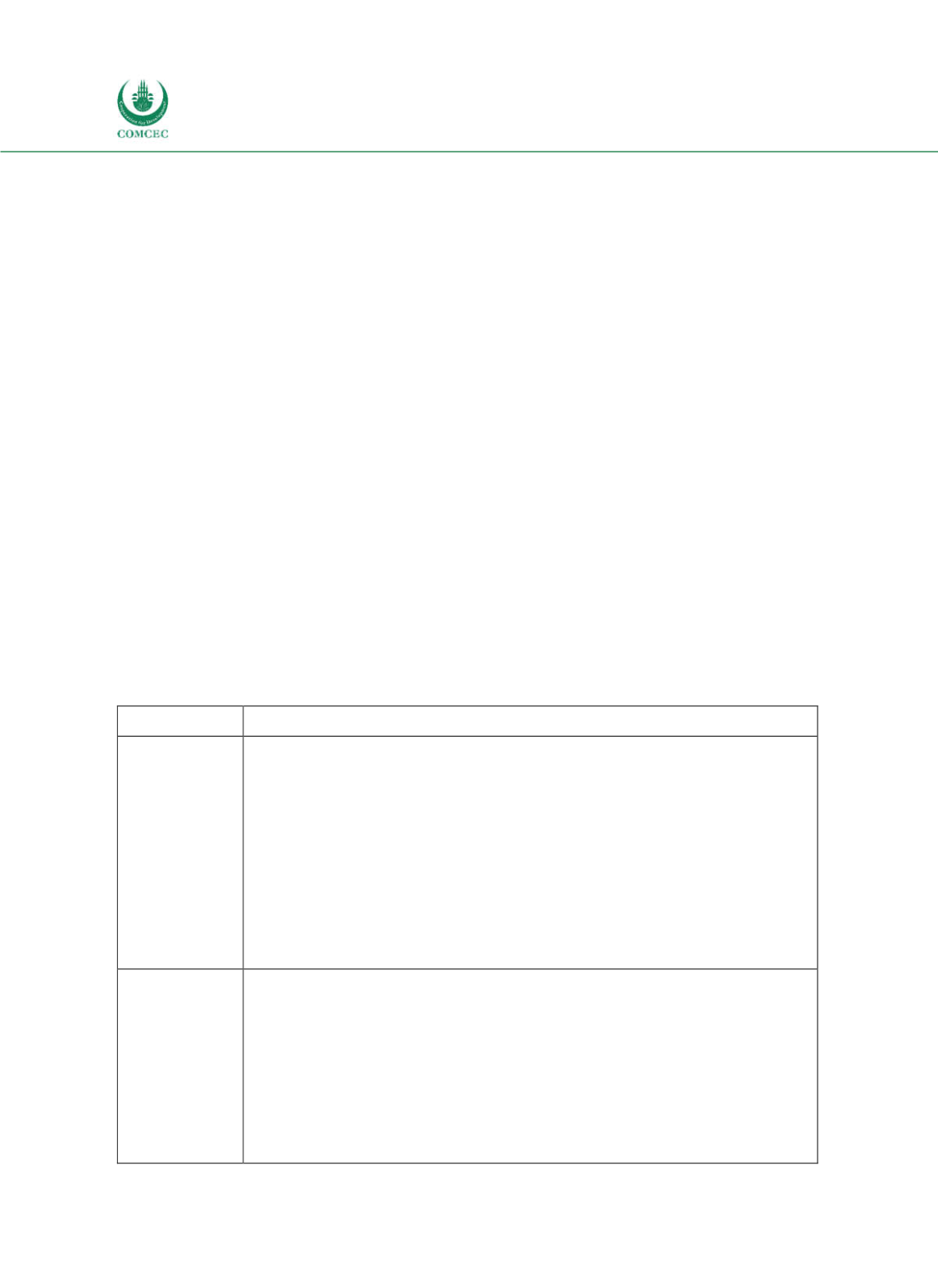

Table 1-2: Risks Relevant for Public Debt Management

Risk

Description

Refinancing

risk or rollover

risk

Refers to the risk that debt will have to be refinanced at a higher cost or cannot

be refinanced at all. To the extent that refinancing risk is limited to the risk that

debt might have to be financed at higher interest rates, including changes in

credit spreads, it may be considered a type of interest rate risk. However, it is

often treated separately, because the inability to refinance maturing debt

and/or exceptionally large increases in government funding costs are likely to

give rise to a debt crisis. Additionally, bonds with embedded put options may

potentially exacerbate refinancing risk.

Measures of refinancing risk include the share of debt maturing within one,

two and three years to total debt the average time to maturity (ATM), the share

of shortterm to longterm debt, or the redemption profile.

Interest rate

risk or refixing

risk

Refers to the risk of increases in the cost of debt arising from changes in

interest rates. For both domestic and foreign currency debt changes in interest

rates influence debt servicing costs on new issuances when fixed rate debt is

refinanced, and on existing and new floatingrate debt at the rate reset dates.

Generally, shortterm and floating rate debt is considered to be the subject to a

higher risk than longterm, fixedrate debt.

Measures of interest rate risk include the average time to maturity (ATM), the

share of fixedrate to floatingrate debt and the average time to interest rate

refixing (ATR).