Improving Public Debt Management

In the OIC Member Countries

11

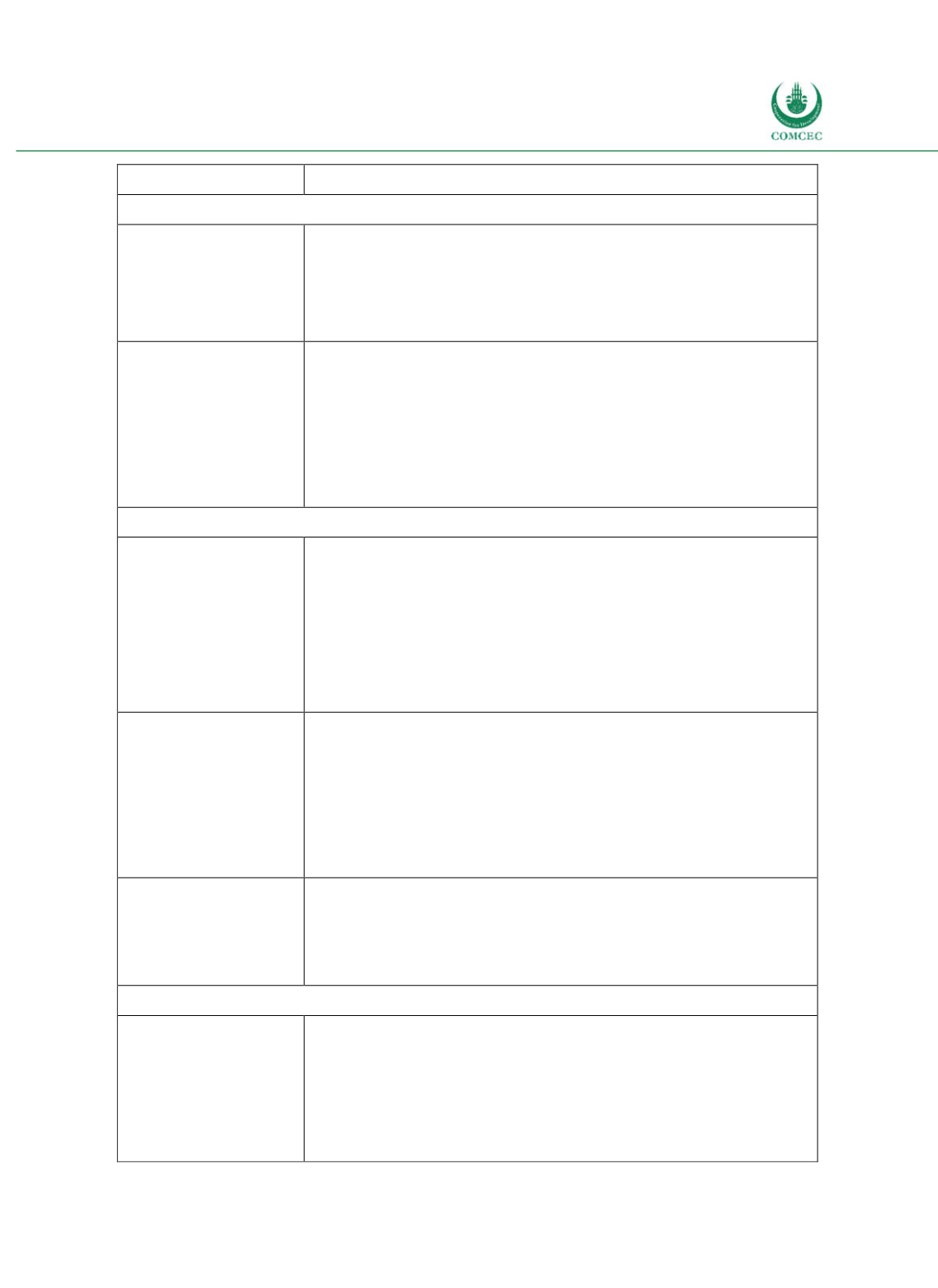

Performance Indicator Description

2. Coordination with Macroeconomic Policies

Coordination with

Fiscal Policy

(1) Supporting fiscal policy makers through the provision of accurate

and timely forecasts on total central government debt service under

different scenarios

(2) Availability of information on key macroeconomic variables, as

well as the quality and frequency of debt sustainability analyses

Coordination with

Monetary Policy

(1) Clarity of separation between monetary policy operations and

DeM transactions

(2) Coordination with the central bank through regular information

sharing on current and future debt transactions and the central

government’s cash flows

(3) Extent of the limit of direct access to financial resources from the

central bank

3. Borrowing and Related Financial Activities

Domestic Borrowing

(1) The extent to which marketbased mechanisms are used to issue

debt; the preparation of an annual plan for the aggregate amount of

borrowing in the domestic market, divided between the wholesale and

retail markets; and the publication of a borrowing calendar for

wholesale securities

(2) Availability and quality of (documented) procedures for

borrowing in the domestic market and interactions with market

participants

External Borrowing

(1) Documented assessment of the most beneficial or costeffective

borrowing terms and conditions (including lender or source of funds,

currency, interest rate and maturity) and a borrowing plan

(2) Availability and quality of documented procedures for external

borrowings

(3) Availability and degree of involvement of legal advisers before

signing of the loan contract

Loan Guarantees, Onlending and derivatives (1) Availability and quality of documented policies and procedures for

approval and issuance of central government loan guarantees

(2) Availability and quality of documented policies and procedures for

approval and issuance of central government onlending

4. Cash Flow Forecasting and Cash Balance Management

(1) Effectiveness of forecasting the aggregate level of cash balances in

government bank accounts

(2) Decision of a proper cash balance (‘liquidity buffer’) and

effectiveness of managing the intended cash balance in government

bank accounts (including the integration with any domestic debt

borrowing program, if required)