Improving Public Debt Management

In the OIC Member Countries

13

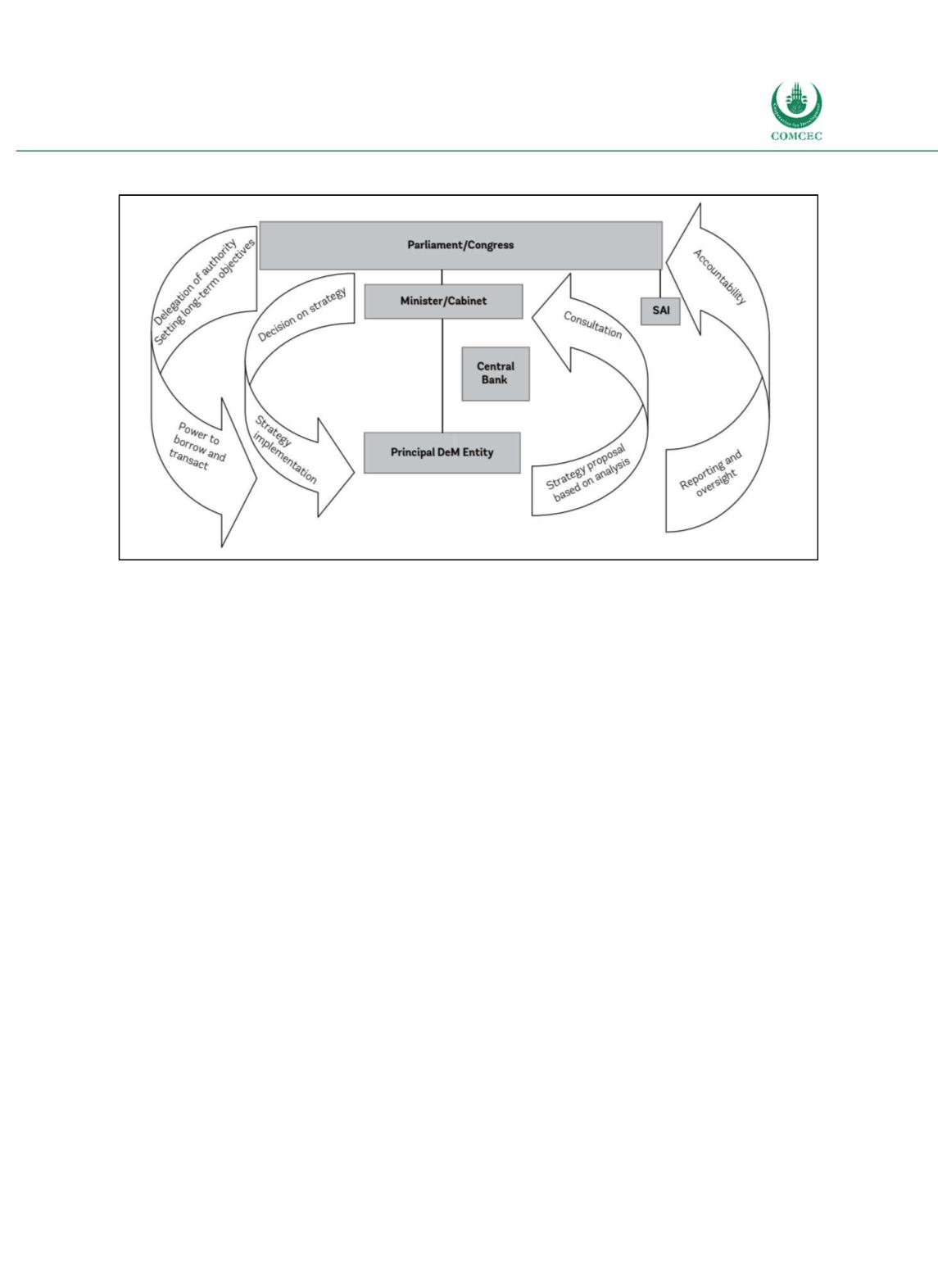

Figure 1-1: Public Debt Management Governance Structure

Note: DeM = Public Debt Management, SAI = Supreme Audit Institution

Source: World Bank (2015, p. 6).

It is advisable that public debt management operations are undertaken by one integrated

principal entity, such as a debt management office (DMO). Only as an alternative if such

integration is not feasible, multiple entities may execute specialized tasks. In that case, all

entities should ensure a regular exchange of information and a clear coordination of their

activities through formal institutional mechanisms. In principal, it proves to be beneficial if the

task of public debt management is assigned to either the national central bank or to the

Ministry of Finance. On one hand, concerns over price stability and a smooth transmission

channel of monetary policy may speak in favor of the central bank. On the other hand, the

pursuit of macroeconomic goals and, in practice most importantly, the minimization of

financing costs for the budget may make the Ministry of Finance the adequate institution for

supervising and conducting debt management operations. Moreover, locating a consolidated

debt management entity within the Ministry of Finance facilitates coordination and

information sharing. For a separate debt management office outside the mentioned

institutions, formal agency arrangements as well as stronger accountability and transparency

frameworks are required (Togo et al. 2003). Finally, debt management tasks may be assigned

to an interagency body. However, given that the Ministry of Finance is the natural authority

responsible for a country’s financial stability, such a body should be chaired by the Ministry of

Finance (Bangura et al. 2000).

Debt management strategy

The legislation should stipulate the debt management entity to develop a debt management

strategy. The strategy defines the objectives for the management of domestic and external

public debt, other financial (contingent) liabilities and related assets. In particular, the debt

management strategy refers to a document that defines target values and benchmarks for risk

indicators of the debt structure. Developing a debt management strategy may provide many

advantages (Cabral 2015), including but not limited to: