Improving Public Debt Management

In the OIC Member Countries

150

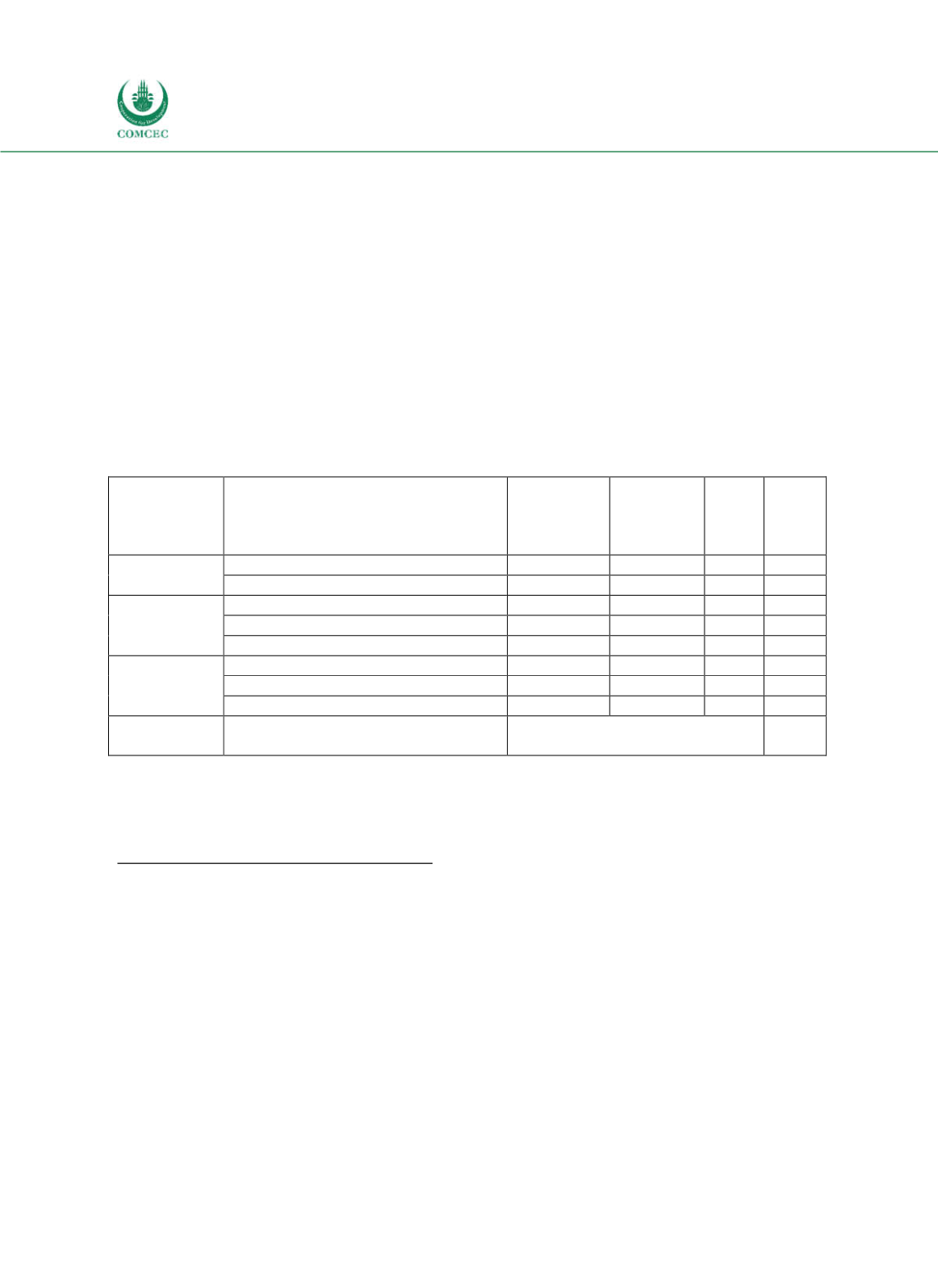

debt issuance strategy. Moreover, public debt management should create a yield curve of

government bonds and bills to support the transmission process of monetary policy.

The strategy identifies the refinancing risk of maturing debt and potentially adverse interest

rate movements as primary risk factors (see also Table 411). Given these risks, the strategy

proposes the further extension of both the average time to maturity and the average time to

refixing of the debt portfolio as it guards government finances from the negative implications

of prospective increases in interest rates. In order to cover redemptions and interest payments

of foreign currency debt, the strategy aims to increase annual foreign currency borrowing by

raising the ceiling on annual foreign currency borrowing (currently 30% of total borrowing).

To enable higher foreign currency borrowing, additional legislature might be needed.

According to the strategy, the quantification of borrowing and risk targets will remain an

internal matter of the MoF with support from the High Debt Committee and actual

performance will be compared to these targets regularly (MoF 2014).

Table 4-11: Lebanon – Cost and Risk indicators for the Government's Debt Portfolio (2013)

Type of risk

Risk indicator

Domestic

debt

External

debt

Total

debt

Targe

ts

(tot.

debt)

Cost of debt

Interest as % of govt. revenues

24

17

40

WAIR (in %)

6.7

5.9

6.4

Refinancing

risk

ATM (years)

3.5

5.6

4.3 > 4.3

Debt maturing in 1 year (% of total)

20.4

8.9

15.7

Debt maturing in 1 year (% of GDP)

Interest rate

risk

ATR (years)

3.5

5.5

4.3 > 4.3

Debt refixing in 1 year (% of total)

20.4

9.9

16.1

Fixed rate debt (% of total)

96.3

98.8

97.3

Exchange

rate risk

FX debt (% of total)

41.3

Note: Note: ATM = Average Time to Maturity; ATR = Average Time to Refixing; FX = Foreign exchange; ST = Short-

term; WAIR = Weighted average interest rate. Classification of domestic and external debt based on currency

denomination.

Source: MoF (2014).

Borrowing and Related Financial Activities

Operations (incl. Islamic finance)

The government issues TBills (maturities of three, six and twelve months) and TBonds

(maturities of 215 years). Over 97% of domesticcurrency debt has a maturity of two years or

more. Since 2012, Lebanon has also issued domesticcurrency debt with maturities of eight

years or more. In March 2016, the average time to maturity of domestic currency debt (TBills

and TBonds) was 3.41 years, up from 1.6 years in 2009. Shortterm TBills are usually used

for cash management. The government has also idle cash reserves, i.e. public sector deposits in

commercial banks and the Banque du Liban.

The average yields on Lebanese TBills have decreased since 2002 when the international

donor convention in Paris restored confidence in the government and in the economy (Credit

Libanais 2016). Between 2006 and 2015 the average yield of Lebanese shortterm rates (three,

six and twelve months) decreased from 6.74% to 4.93% (see Figure 434).