Improving Public Debt Management

In the OIC Member Countries

156

B) Public Debt Management

Governance and Strategy Development

Legal framework

In Turkey “effective debt management has an important role for the continuity of economic

stability” (Undersecretariat of Treasury 2015, p.7). Article 12 of the Law No. 4749 on

regulating public finance and debt management defines the Debt and Risk Management

Committee as the institution in charge of public debt management, which takes all strategic

decision.

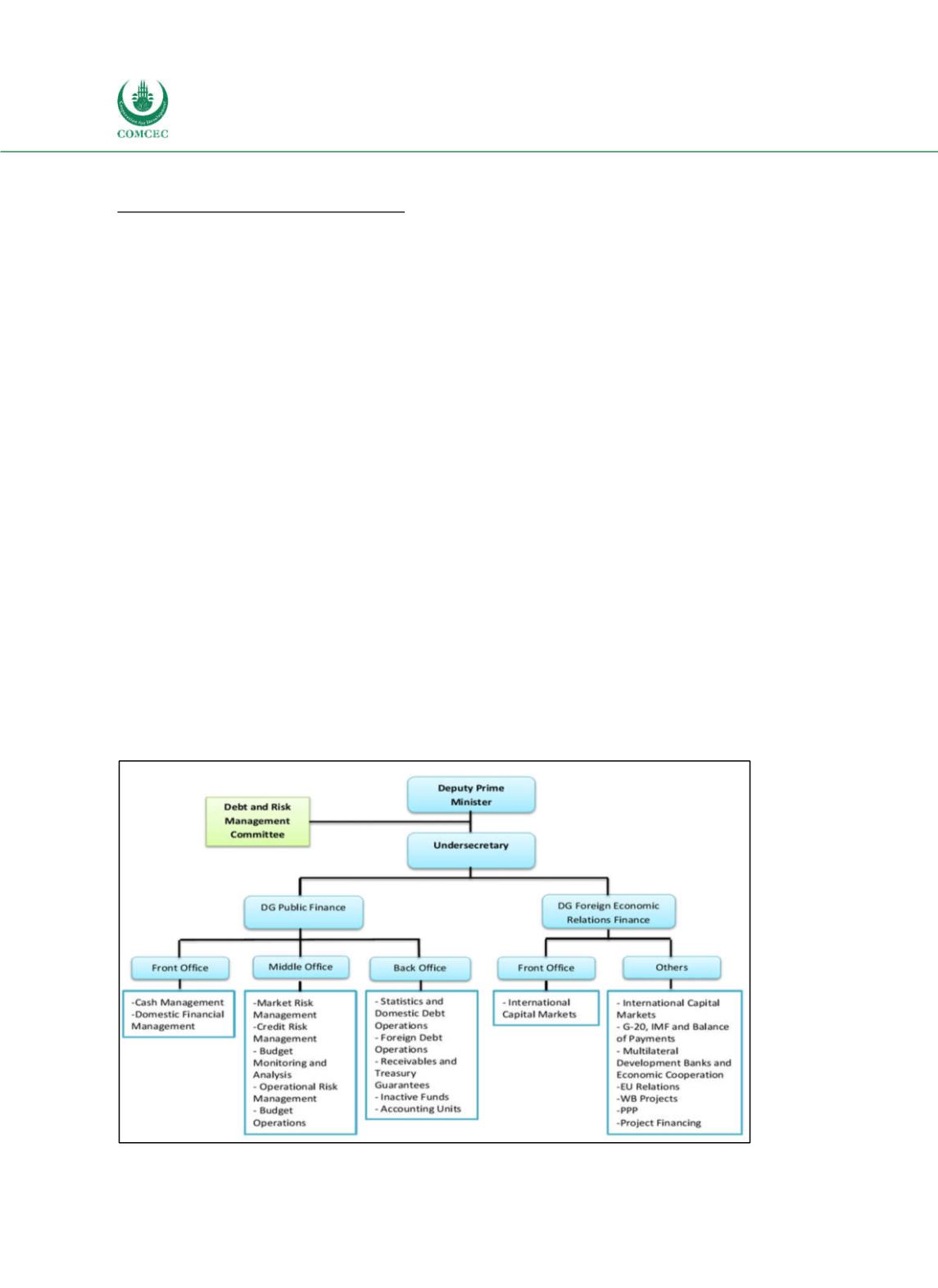

Managerial structure (including coordination with other policies)

Whereas the Debt and Risk Management Committee (DRMC) provides the general strategic

benchmarks and implementation framework, the operationalization of these benchmarks is

carried out by the General Directorate of Public Finance and the General Directorate of Foreign

Economic Relations, which are both part of the Undersecretary of Treasury (see Figure 436).

The Undersecretariat of Treasury operates in close coordination and communication with the

Central Bank of Turkey and the MoF.

The General Directorate of Public Finance (DGPF) is responsible for domestic borrowing, cash

management, management of Treasury receivables, risk management, accounting and

statistics operations as well as activities regarding the compulsory savings account. Middle

office, back office and front office for domestic borrowing are under DGPF. The General

Directorate of Foreign Economic Relations is responsible for bond issuances in international

capital markets, project financing via external loans and budget financing with program loans

from international institutions. All strategic decisions on debt management are taken by the

DRMC, which is chaired by the Undersecretary (except for certain cases when the minister

chairs the committee). DRMC consists of deputies of Undersecretary and three Directors

General.

Figure 4-36: Turkey - Organization of Public Debt Management

Source: Undersecretariat of Treasury (2015, 2016a).