Improving Public Debt Management

In the OIC Member Countries

149

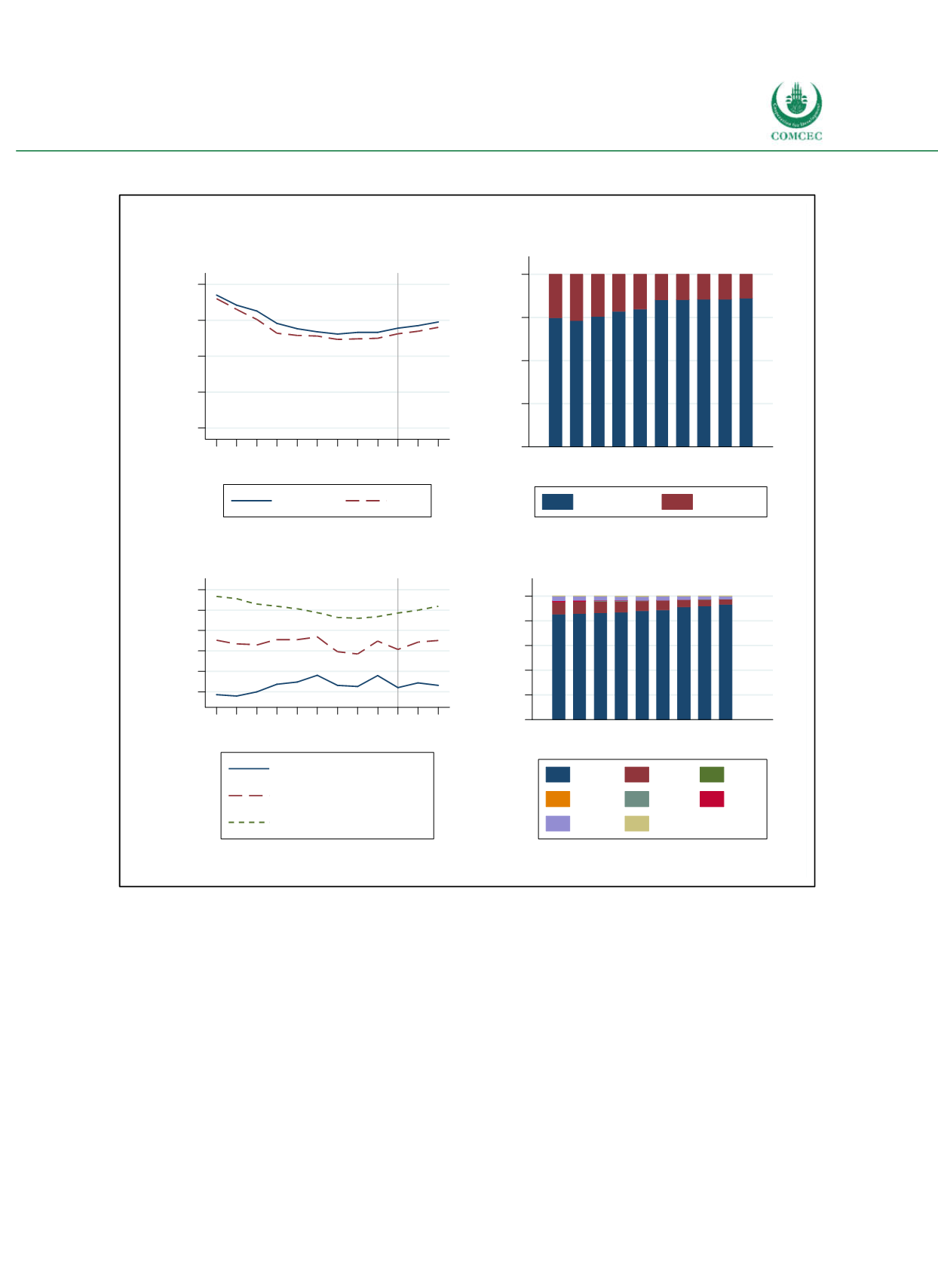

Figure 4-33: Lebanon – Public Debt Dynamics

Sources: WEO (2016), IMF (2015a), calculations by the Ifo Institute.

Debt management strategy (incl. risk management)

The PDD has developed a mediumterm debt management strategy (MDTS) for the years

20142016, which is embedded in the macrofiscal framework of the government and updated

annually. While the main objective of the strategy is “to ensure that the government’s financing

needs and its payment obligations are met at all times, at the lowest possible cost over the

medium to long run and consistent with a prudent, acceptable degree of risk” (MoF 2014, p. 2),

the strategy also puts emphasis on the development of primary and secondary domestic debt

markets. Restrained domestic financing capacities have presented an obstacle for economic

development in Lebanon. For this purpose, the strategy stresses the importance of proactive

support of market development, for example through a transparent and predictable domestic

0 50 100 150 200

% of GDP

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Gross

Net

Projections

Public Debt

0

25

50

75 100

% of total public debt

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Creditor Structure of Public Debt

Domestic

External

-10 -5 0 5 10 15

% of GDP

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Net lending

Primary net lending

Net interest payments

Net Lending

0 20 40 60 80 100

% of ext. public debt

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Currency Structure of Ext. Public Debt

USD EUR GBP

CHF

JPY

Mult.

Other

SDR