Improving Public Debt Management

In the OIC Member Countries

151

Compared to other Islamic countries, Islamic finance in Lebanon is of low importance. In 2013,

Islamic bank deposits accounted for only around 0.4% of total bank deposits (Henry 2016).

Although this marks a slight increase from 0.33% in 2007 (Beck et al. 2013), the Lebanese

Islamic banking sector still is very small in comparison to the conventional banking sector. At

the moment, only four banks in Lebanon are

shariah

compliant (Al Baraka Bank Lebanon, Arab

Finance House, BLOM Development Bank and Lebanese Islamic Bank). Islamic windows of

conventional banks do not exist as only independent Islamic banks are legally allowed to offer

Islamic banking services and products (El Hachem 2014, Halal Times 2015). In contrast to

other countries in the region, Lebanon does not issue debt in the form of

sukuk

. Besides the

lack of sovereign

sukuk

issuance and the prohibition of Islamic banking activities for

conventional banks, a number of legal restrictions such as the double taxation of Islamic banks

inhibit further development of Islamic banking in Lebanon (Daily Star 2014, El Hachem 2014).

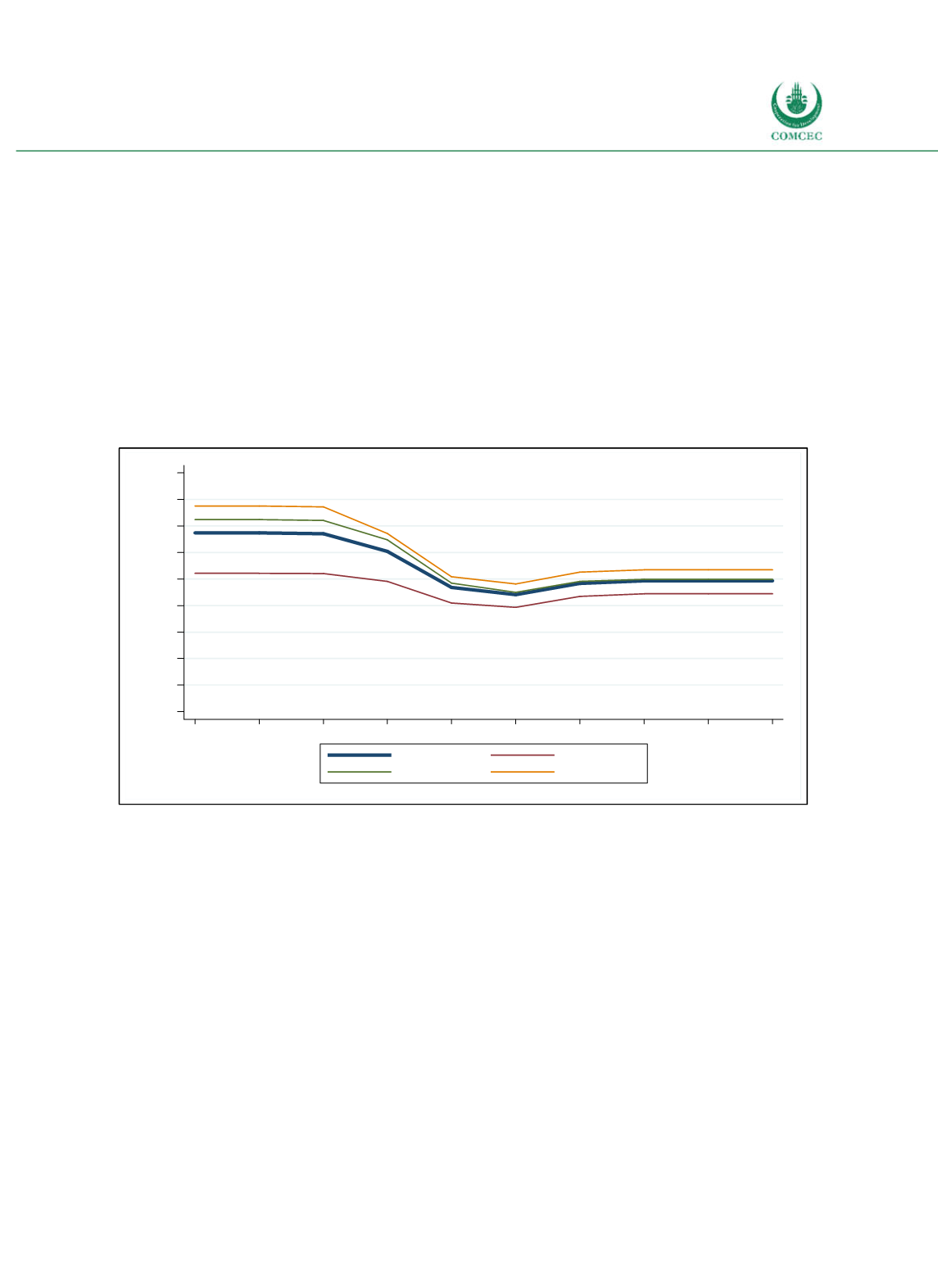

Figure 4-34: Lebanon - Yields on T-Bills

Source: Credit Libanais (2016).

Domestic debt market

The share of domestic general government debt in total general government debt was about

86.2% in 2015 (see Figure 433). In March 2016, 43.9% of outstanding domestic currency debt

(TBills and TBonds) was held by commercial banks, 39.8% by the central bank and 12.5% by

public institutions. The banking sector currently holds around 53% of total gross (foreign and

domestic) general government debt.

Foreign borrowing

The share of external public debt in total public debt has consistently decreased since 2006

and is currently among the lowest of all OIC countries (13.8%). In a similar vein, the share of

foreigncurrency public debt in total public debt declined from 50.4% in 2008 to 38.5% in

2015. Lebanon has, however, recently increased the share of foreign currency debt to 41% of

total debt by exchanging $2 billion of local currency debt into Eurobonds (Barrington 2016).

Foreigncurrency public debt is largely held by domestic financial institutions. This explains

why the share of foreigncurrency public debt is higher than the share of external public debt

0

1

2

3

4

5

6

7

8

9

Percent

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Average

3-month

6-month

12-month