Improving Public Debt Management

In the OIC Member Countries

146

of sovereign

sukuk

is expected to create a benchmark for the issuance of corporate

sukuk

and is

planned to increase flexibility to the funding of strategic projects supporting the

industrialization of the country (NBK 2016). This statement, however, has not been followed

by implementation action up till now.

Domestic debt market

Kazakhstan’s general government debt is largely domestic debt, whose share remained

relatively constant between 2006 and 2015 at around 74% (see Figure 430). Domestic

general government debt of Kazakhstan can be categorized into longterm treasury liabilities

(59%), longterm treasury balanced liabilities (33%) and mediumterm treasury liabilities

(8%). The United Pension Fund (almost $20 billion) has been used up to more than 45% to

purchase bonds issued by the MoF.

Foreign borrowing

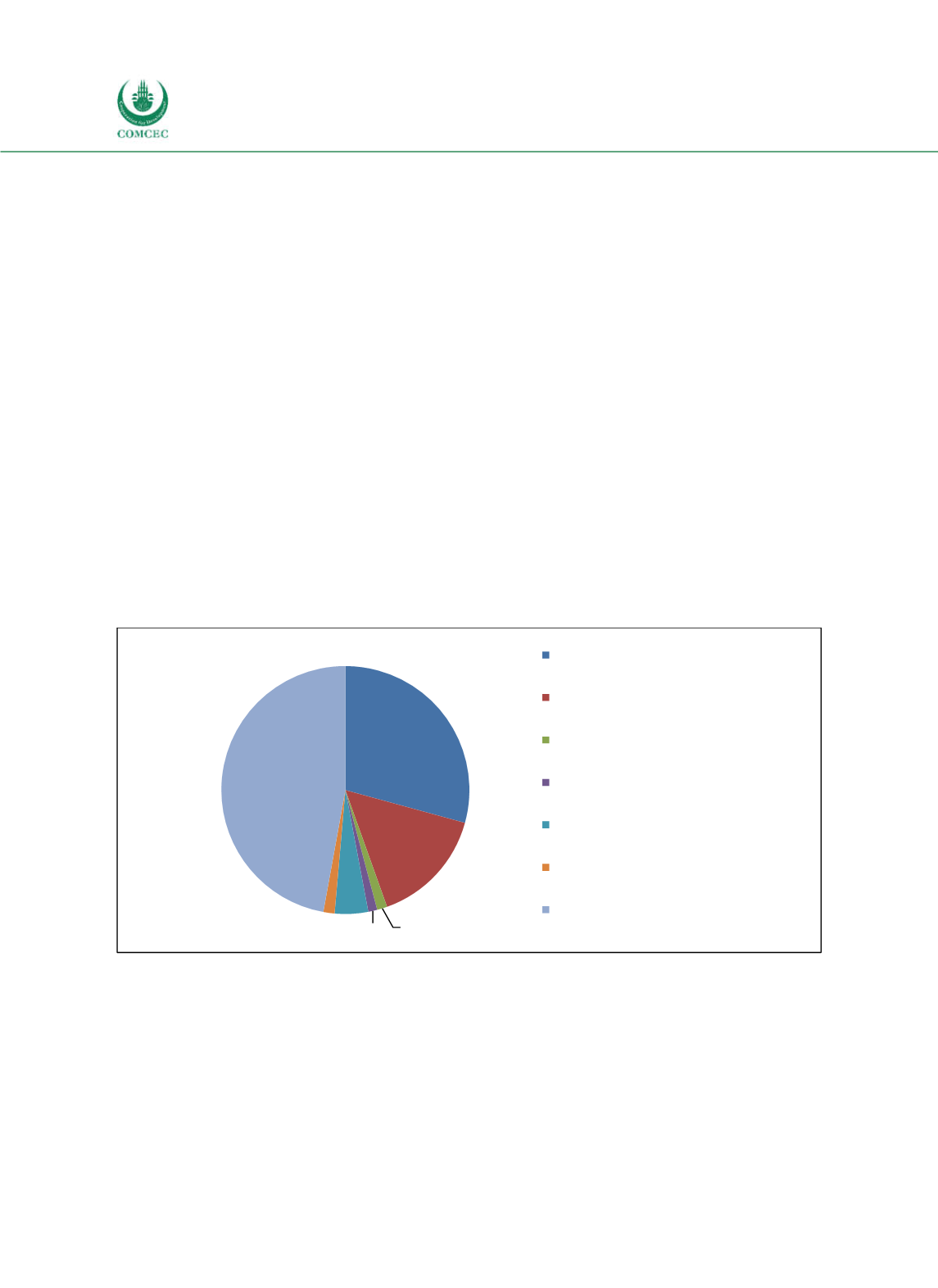

The largest share of external debt (47%) consists of international bonds issued at the

Eurobond market (see Figure 432). With a share of 29%, the International Bank for

Reconstruction and Development represents the secondlargest part of external debt. Other

creditors are the Asian Development Bank (15%), the Japan International Cooperation Agency

(5%), the European Bank for Reconstruction and Development (1%) and the Islamic

Development Bank (1%). The share of external debt owed to foreign commercial banks equals

2%.

Figure 4-32: Kazakhstan – Creditor Structure of External Public Debt (2016)

Sources: NBK (2016), calculations by the Ifo Institute.

External debt, which is dominated by longterm debt (99% in 2016), is predominantly

denominated in U.S. Dollar, whose share increased between 2008 and 2014 from around 42%

to 96%. The reason for the high U.S. Dollar share is a policy to lend predominantly from

International financial Institutions which is cost efficient and risk reducing. Over the same

period, the share of Pound Sterling in external debt decreased from 53% to around 3%. The

remainder represents SDRs and other currencies, including but not limited to Euro (Figure 430).

29%

15%

1% 1% 5% 2%

47%

International Bank for Reconstruction and

Development

Asian Development Bank

European Bank for Reconstruction and

Development

Islamic Development Bank

Japan International Cooperation Agency

Foreign commercial banks

Eurobonds