Improving Public Debt Management

In the OIC Member Countries

145

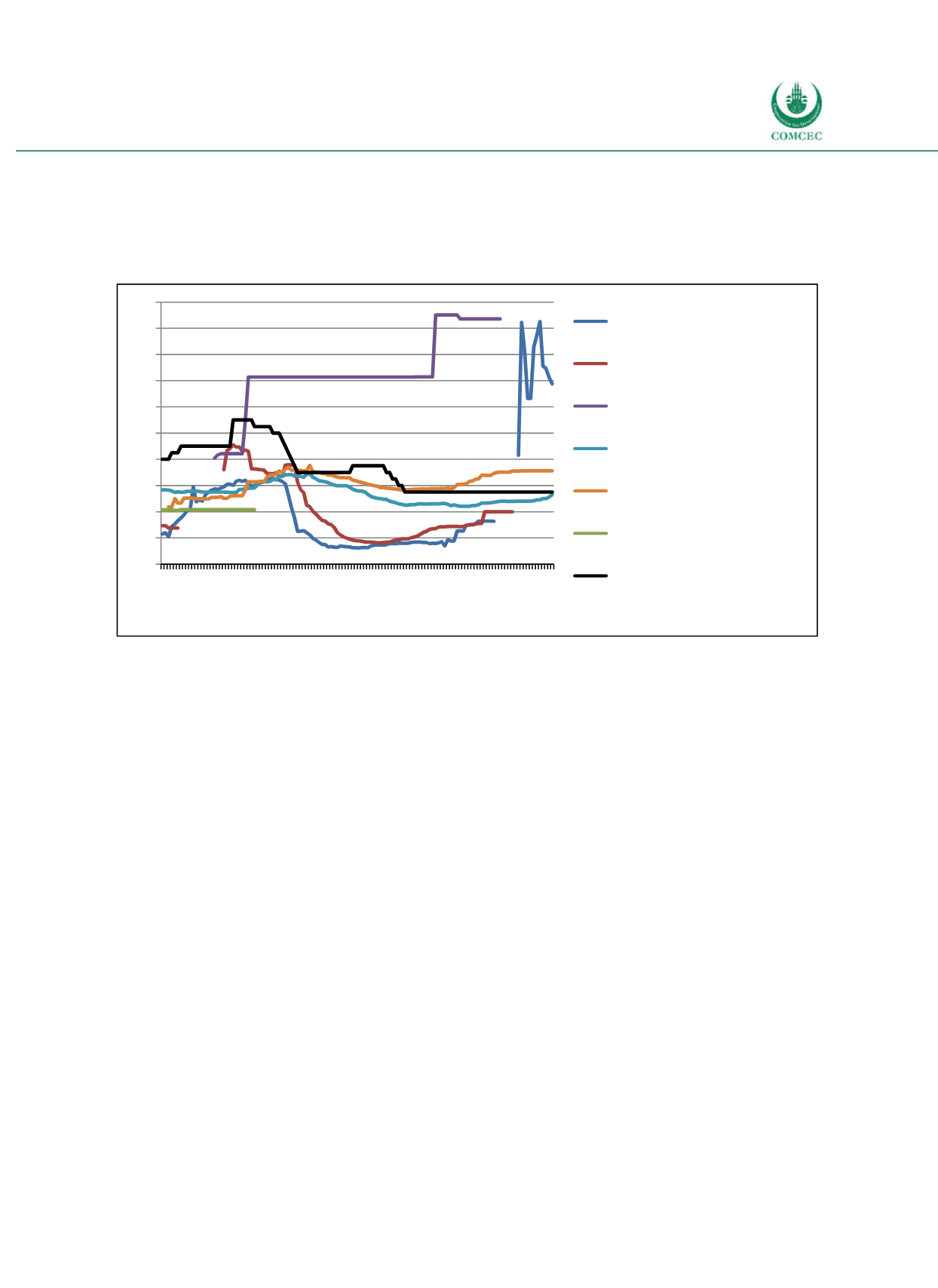

obligations started to increase in 2014, which can be attributed to the general increase in

public debt levels after 2013 and the oil price decline in 2014/2015. The recent large

fluctuations of the yield on shortterm notes of the NBK may be the result of the decision of the

government to float the Tenge in 2015.

Figure 4-31: Kazakhstan - Yields on Government Securities

Sources: National Bank of the Republic of Kazakhstan (2016), calculations by the Ifo Institute.

Kazakhstan is actively participating in the international bond markets. In 2014, Kazakhstan

has issued its first international dollardenominated bond since 2000 (Cox 2014). The issuance

was worth of $2.5 billion and consisted of 10year bonds (1.5 billion) with a yield of 1.5

percentage points above midswaps and 30year bonds with a yield of 2 percentage points

over midswaps. Longterm maturities were chosen in order to build out a yield curve

(Porzecanski and Pronina 2014). In 2015, Kazakhstan issued the same amount with the same

maturities again (Pronina 2015).

With the introduction of the law on Islamic banks and Islamic finance in 2009, Kazakhstan has

approved Islamic finance. The laws specify the rules concerning Islamic finance instruments

and allow the issuance of Islamic finance instruments both for private and public institutions

(NBK 2013). The first Islamic Bank in Kazakhstan opened in 2009 (a subsidiary of the bank AlHilal from the United Arab Emirates). With the transfer of the Financial Centre from Almaty to

Astana (supposed to be implemented in 2017) the bank is intended to open a major Islamic

finance market. The first quasisovereign

sukuk

was issued in 2012 by the stateowned

Development Bank of Kazakhstan in Malaysia and amounted to around $73 million (Vizcaino

2015). The NBK held an international workshop about “Islamic Modes of Finance and Sukuk”

in 2012 (NBK 2012) and legislative amendments have been adopted in order to facilitate

Islamic finance further.

There is no use of Islamic finance in public debt management until now, although the budget

code makes provision for issuing state securities in the form of state Islamic securities. The

state Islamic securities are allowed to be issued in accordance with the basic principles of

Islamic finance and certify “the right of the holder to receive income from the assets on the

basis of the sublease agreement” (Republic of Kazakhstan 2008, Article 206). The introduction

0 2 4 6 8 10 12 14 16 18 20

01.06 08.06 03.07 10.07 05.08 12.08 07.09 02.10 09.10 04.11 11.11 06.12 01.13 08.13 03.14 10.14 05.15 12.15 07.16

Shortterm Notes of NBK with 7 days to 1 year

maturity

МЕIКАМ: Indexed Government Treasure

obligation with 3 month and above maturity

MEOKAM: Mediumterm Government Treasure

obligation with above 1 year till 10years

maturity МЕUКАМ: Longterm Government Treasure

obligation with above 5 years maturity

МЕUZКАМ: Longterm Savings Government

Treasure obligation with above 5 years

maturity МUIКАМ: Longterm Indexed Treasury Bill

Refinancing Rate of NBK