Improving Public Debt Management

In the OIC Member Countries

142

liabilities. In case of a bank capital shortfall, the needed monetary injection may well be above

4% of GDP (Moody’s 2016).

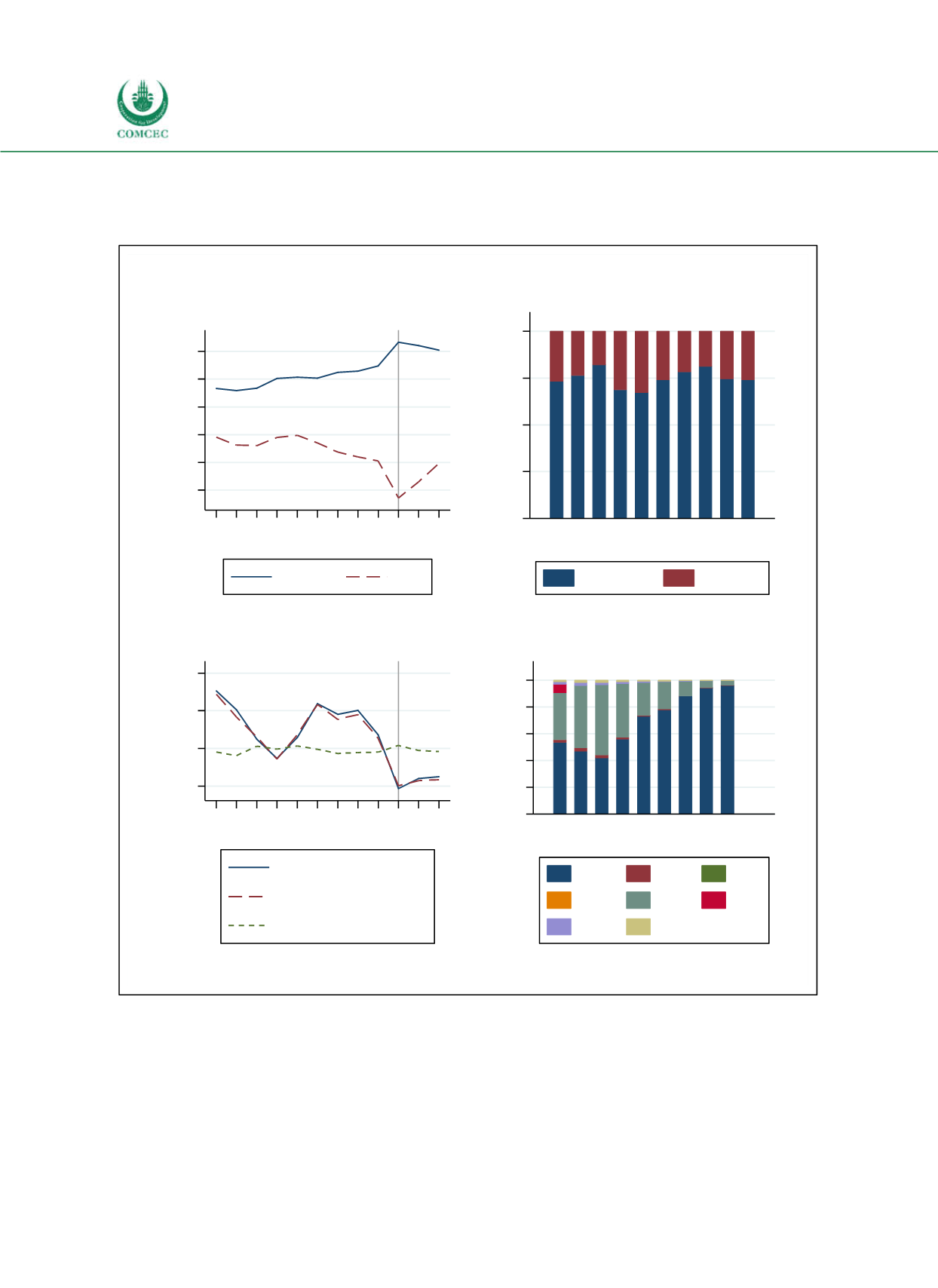

Figure 4-30: Kazakhstan – Public Debt Dynamics

Sources: WEO (2016), IMF (2015), calculations by the Ifo Institute.

-30 -20 -10 0 10 20

% of GDP

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Gross

Net

Projections

Public Debt

0

25

50

75 100

% of total public debt

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Creditor Structure of Public Debt

Domestic

External

-5 0

5 10

% of GDP

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Net lending

Primary net lending

Net interest payments

Net Lending

0 20 40 60 80 100

% of ext. public debt

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Currency Structure of Ext. Public Debt

USD EUR GBP

CHF

JPY

Mult.

Other

SDR