Improving Public Debt Management

In the OIC Member Countries

121

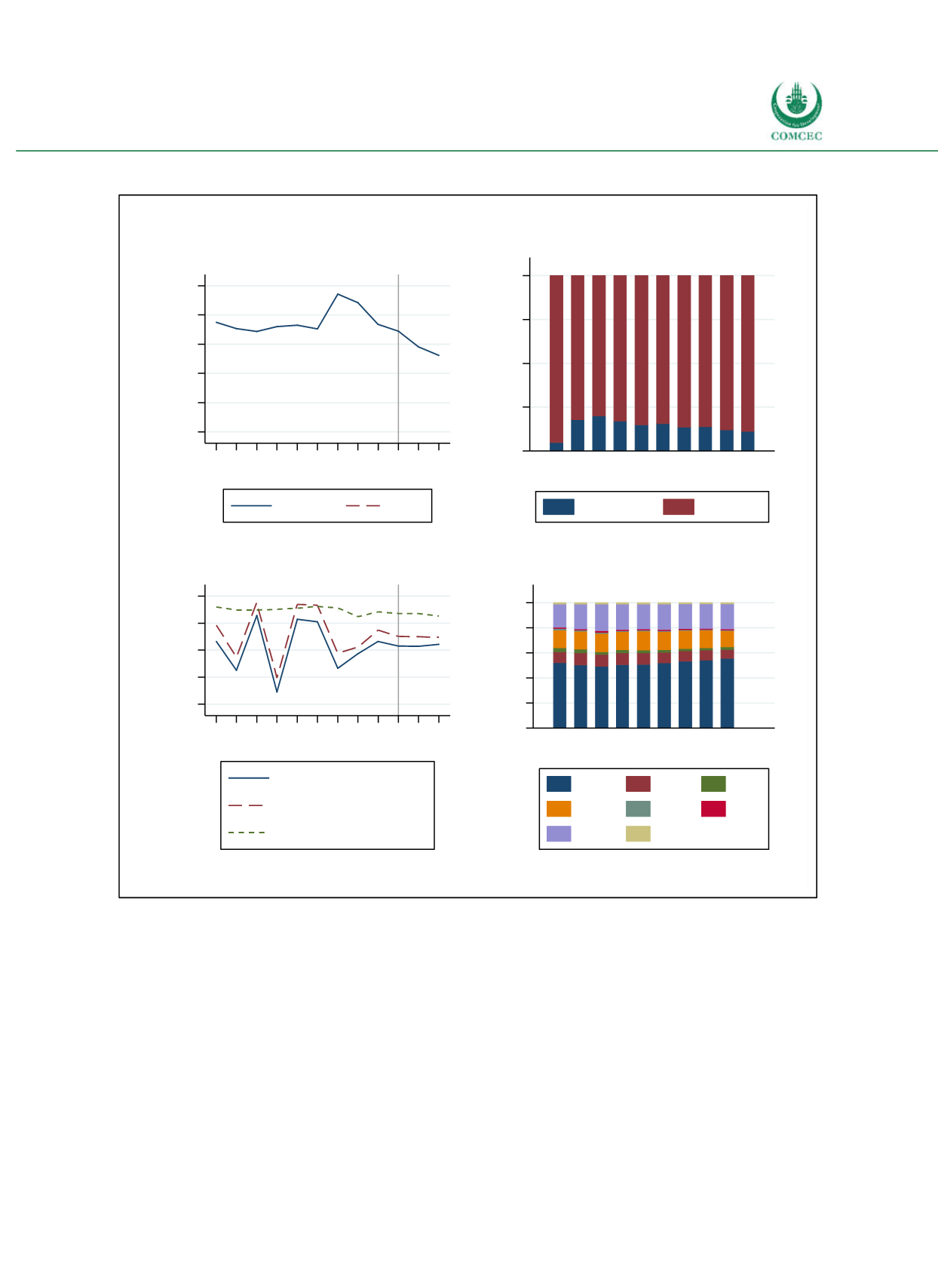

Figure 4-23: Sudan – Public Debt Dynamics

Sources: WEO (2016), IMF (2007, 2010, 2012, 2013b, 2014a, 2016a), calculations by the Ifo Institute.

Sudan’s primary budget balance fluctuated strongly between 2006 and 2012 (see Figure 423).

Major disruptions were caused by the global financial crisis, when the general government net

lending declined to 5.08% in 2009. Although there was a shortlived recovery in the following

years, the secession of South Sudan and the subsequent decline of oil revenues, down from

11.5% of GDP in 2010 to only 1.5% of GDP in 2012 (IMF 2014a), gave rise to another sharp

decline of the budget balance. Due to resolute efforts of the Sudanese government with regards

to macroeconomic stability and growth following the shock of the secession, the budget

balance improved and is expected to stabilize around 1.7% of GDP in 2015. Policy

adjustments, growth and poverty reduction programs as well as institutional reforms helped

to achieve this narrowing of fiscal deficit, which is also estimated to be relatively stable even

beyond 2015 (IMF 2016a).

0 20 40 60 80 100

% of GDP

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Gross

Net

Projections

Public Debt

0

25

50

75

100

% of total public debt

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Creditor Structure of Public Debt

Domestic

External

-6 -4 -2 0 2

% of GDP

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Net lending

Primary net lending

Net interest payments

Net Lending

0 20 40 60 80 100

% of ext. public debt

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Currency Structure of Ext. Public Debt

USD EUR GBP

CHF

JPY

Mult.

Other

SDR