Improving Public Debt Management

In the OIC Member Countries

118

IBTC Plc. and the Jaiz Bank Plc. (Sapovadia 2015, Oladunjoye 2014). At the beginning of 2016

the SEC and the DMO agreed to cooperate in order to issue Nigeria’s first sovereign

sukuk

and

in October 2016 the Nigerian central bank published guidelines to specify the granting of

sukuk

(SEC 2016, CBN 2016). The DMO plans a first issuance of a sovereign

sukuk

in 2016/2017, in

line with the MTDS 20162019.

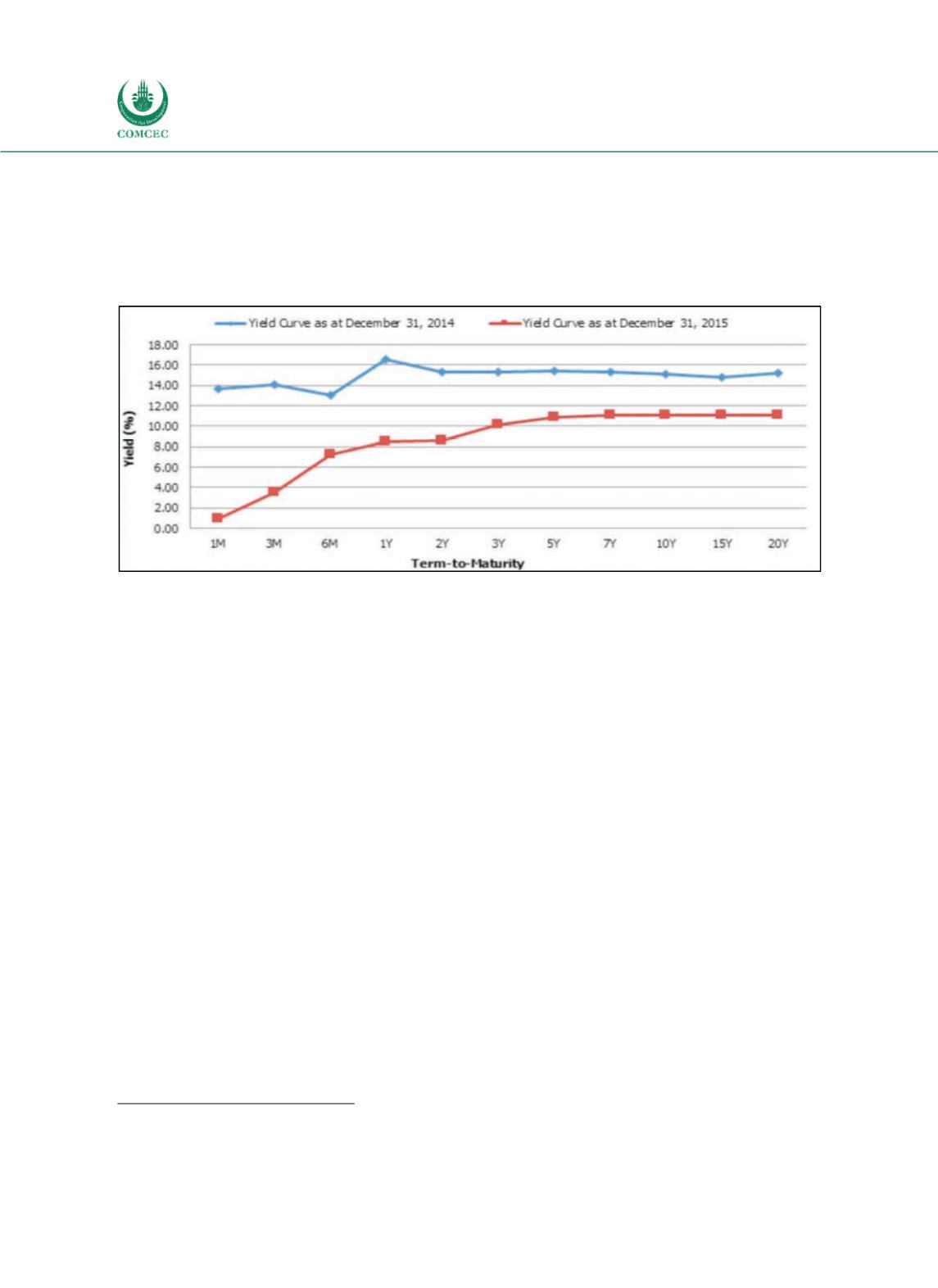

Figure 4-21: Nigeria - Yield Curve of FGNs

Source: DMO (2015, p. 56).

Domestic debt market

Since 2005, government budget deficits have been mainly financed by domestic borrowing in

the bond market (Central Bank 2013). Domestic creditors are the central bank (holding 9.9%

of domestic debt), banks (37.2%), nonbank public (51.1%) and the Sinking Fund (1.8%). Nonbank public creditors are mainly pension funds, government agencies, nonbank financial

institutions and insurance companies.

The government plans to introduce Retail Bonds, Inflationlinked Bonds and

sukuk

on the

domestic debt market.

Foreign borrowing

The share of external debt (defined as debt denominated in foreign currency) in total debt was

low at 19.8% in 2015. The external debt portfolio is composed of 73.5% of U.S. Dollars, 16.9%

of SDRs, 1.1% of Euro, 8% of other currencies in 2014 (see Figure 419).

25

Main creditors are

IDA/AfDB holding 65% of external debt and IBRD/ADB holding 4% of external debt. Bilateral

creditors (China EXIM Bank, French Development Agency, Japan International Cooperation

Agency and Kreditanstalt fuer Wiederaufbau) hold 15% of external debt. Eurobonds constitute

14% of external debt (see Figure 422). 82.2% of external debt is concessional (DMO 2015).

25

Values taken from the World Bank. The MTDS describes the following currency composition in 2015: 38.3% U.S. Dollars,

59.6% SDR, 1.2% Euro.