Improving Public Debt Management

In the OIC Member Countries

124

expected to continue to fall to single digits by 2017 (IMF 2014b), which would allow average

real rates of return to increase again.

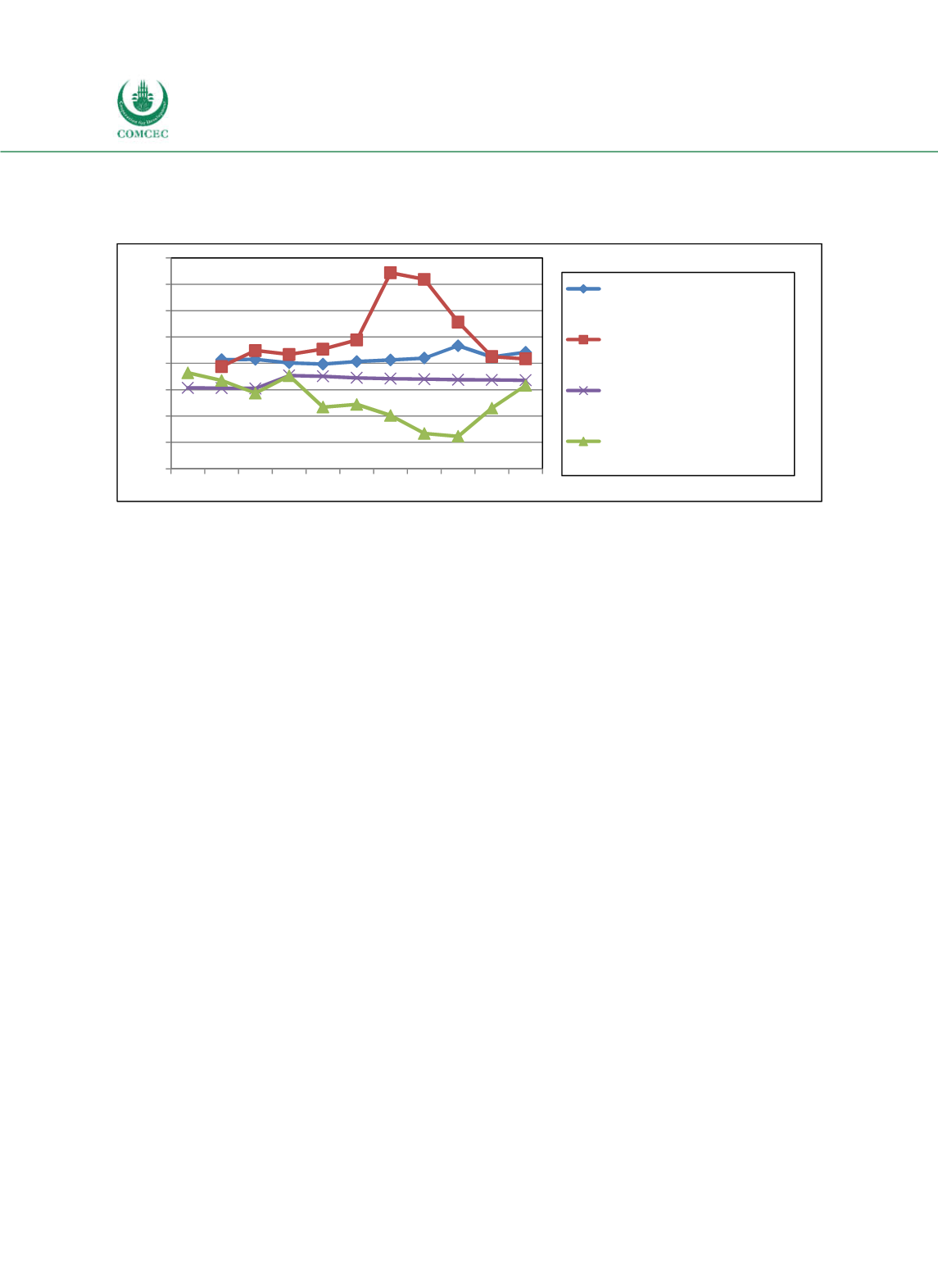

Figure 4-24: Sudan - Rates of Return and Inflation

Sources: CBoS (2016a, 2016b), IMF (2007, 2010, 2012, 2013b, 2014a) calculations by the Ifo Institute.

The return on government securities depends on the public finance accounts of the

government, whereas the return of securities issued by the CBoS is determined in advance

(IMF 2013a). For the year 2015, the average return on GICs was equal to 20% p.a. (CBoS

2016b), while the GMCs market yield was 11.8% p.a. (CBoS 2016a). Currently GMCs are

expected to achieve a yield of 18% p.a. (CBoS 2016b). The average nominal rate of return on

foreign currency general government debt is much lower and more stable than the domestic

murabaha

profits margin and hovers at around 4% (see Figure 424).

Domestic debt market

The majority of Sudan’s general government debt is external (see Figure 423). Domestic

borrowing is likely to increase which would lead to additional macroeconomic risks as

borrowing from domestic banking sources is expected to increase inflation further (UNDP

2014, AEO 2012). In July 2016, the annual inflation rate stood at 16.5% (Abdelaziz and

Noureldin 2016).

The largest share of government

sukuk

is held by commercial banks (41%) followed by

companies and funds (25%) and the Central Bank of Sudan (22%). Only 12% of total

government

sukuk

is owned by individuals (IIFM 2016).

Foreign borrowing

Since 2008, the share of external public debt in total public debt has continuously grown from

around 80% to nearly 90% today. A huge part of this increase is the result of accumulated lateinterest as approximately 86% (2013) of Sudan’s external debt is in arrears (ADB 2014, EIU

2016). Due to U.S. sanctions, the unfinished “zerooption” agreement and the related high debt

of Sudan, external borrowing options are limited. In order to finance infrastructure and other

development projects, the government continues to seek loans from GCC states, as well as

China and India (UNDP 2014). A large share of Sudan’s external debt is owed to the Arab Gulf

states, in particular Saudi Arabia and Kuwait (Leo 2010, Sudan Tribune 2012). As of end 2013,

these and other NonParis Club Creditors represented the largest share of Sudan’s external

debt (see Figure 425). Paris Club creditors hold 32%, while the remainder is held by

-30

-20

-10

0

10

20

30

40

50

20062007200820092010201120122013201420152016

in percent

Murabaha Profits margin (%)

Inflation (%)

Average nominal rate of return

on foreign public debt (%)

Average real rate of return on

domestic public debt (%)