Improving Public Debt Management

In the OIC Member Countries

116

The National Debt Management Framework for the years 20132017 sets the following debt

management objectives (DMO 2013, p. 3):

Efficiently managing the nation’s public debt in terms of welldiversified and sustainable

debt portfolio, supportive of government and private sector needs;

Meeting the government’s financing needs at minimal cost and with prudent degree of risk

over the medium to longterm;

Ensuring the growth and development of the country’s domestic and international

securities markets.

The DMO prepared the first mediumterm debt management strategy (MTDS) for the years

20122015 (DMO 2012). In 2016, the DMO and other stakeholders

24

developed the MTDS for

the years 20162019 (DMO 2016). The MTDS describes how the government’s primary budget

balance should optimally be financed, with respect to macroeconomic developments and

market conditions such as interest and exchange rates, inflation, output and external reserves.

Public debt management faces three main challenges (see also Table 49):

Cost of debt: the weighted average interest rate was high at 10.77%, caused mainly by the

high interest rates on domestic debt;

Refinancing risk: more than 30% of domestic debt matures within one year;

Interest rate risk: more than 30% of domestic debt has to be refixed within one year.

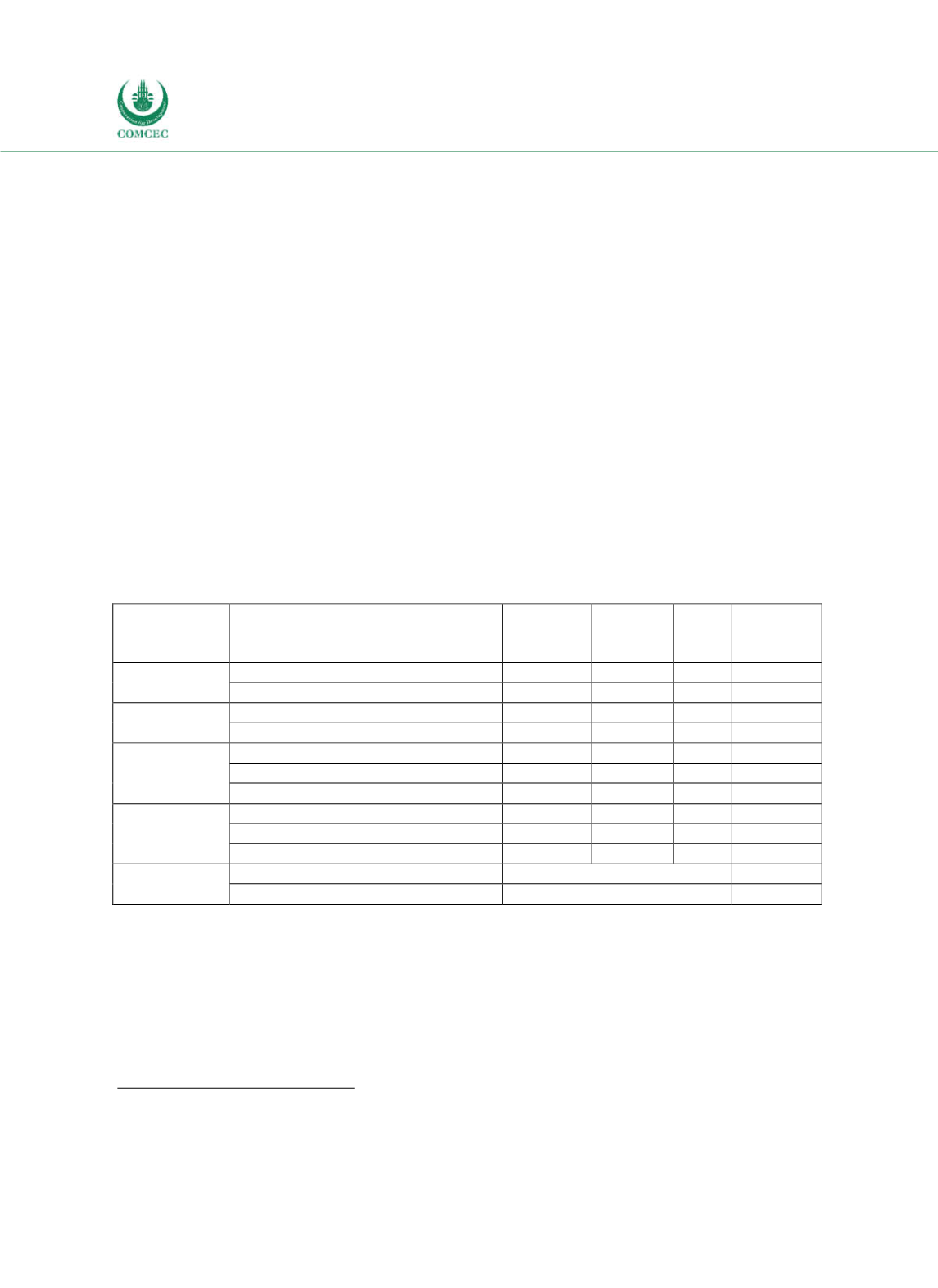

Table 4-9: Nigeria - Risk Indicators for the Government's Debt Portfolio (2015)

Type of risk

Risk indicator

Domestic

Debt

External

Debt

Total

Debt

Targets

(tot.

debt)

Solvency

Nominal debt (% of GDP)

8.91

2.20 11.11

NPV of debt (% of GDP)

8.91

1.44 10.35

Cost of Debt

Interest payment (% of GDP)

1.16

0.04 1.20

WAIR (%)

13.00

1.74 10.77

Refinancing

risk

ATM (years)

5.35 14.39 7.15 Min: 10

Debt maturing in 1 year (% of total)

36.08

1.16 29.15 Max. 20

Debt maturing in 1 year (% of GDP)

3.21

0.03 3.24

Interest rate

risk

ATR (years)

5.35 13.86 7.04 Min: 10

Debt refixing in 1 year (% of total)

36.08

6.40 30.19

Fixed rate debt (% of total)

100.00 94.77 98.96

Exchange

rate risk

FX debt (% of total)

19.84

40

ST FX debt (% of reserves)

0.44

Note: ATM = Average Time to Maturity; ATR = Average Time to Refixing; FX = Foreign exchange; NPV = Net

present value; ST = hort-term; WAIR = Weight d average interest rate.

Source: DMO (2016).

24

Stakeholders include the Federal Ministry of Finance, the Federal Ministry of Budget and National Planning, the central

bank, the Budget Office of the Federation, the National Bureau of Statistics, and the Office of the AccountantGeneral of

the Federation.