Improving Public Debt Management

In the OIC Member Countries

117

The preferred debt management strategy based on current economic conditions can be

summarized as follows (DMO 2016, p. 8f):

(1) Increasing external financing focusing on issuing more longterm external debt in order to

reduce cost of debt and to lengthen the average maturity. To achieve a significant reduction in

debt cost requires that the government accesses relatively cheap longterm external financing.

The DMO therefore plans to maximize available funds from concessional and semiconcessional sources, taking into account what may be readily available within a given period,

and later accessing other external sources.

(2) Further lengthening the maturity profile of the domestic debt portfolio by reducing the

issuance of new shortterm debt instruments and/or refinancing maturing Nigerian Treasury

Bills (NTBs) with external financing. The introduction of new debt instruments into the

domestic debt market is expected to have relatively low impact on debt cost , while the impact

on the maturity profile of total domestic debt could be significant, hence reducing the risk of

bunching, rollover risk, and the associated debt servicing costs.

Borrowing and Related Financial Activities

Operations (incl. Islamic finance)

Nigeria’s total central government debt is composed of Federal Government of Nigeria Bonds

(FGN), Nigerian Treasury Bills (NTB), Treasury Bonds (TBonds), Eurobonds, external bilateral

debt and external multilateral debt. FGNs constitute more than 50% of total debt (see Figure 420).

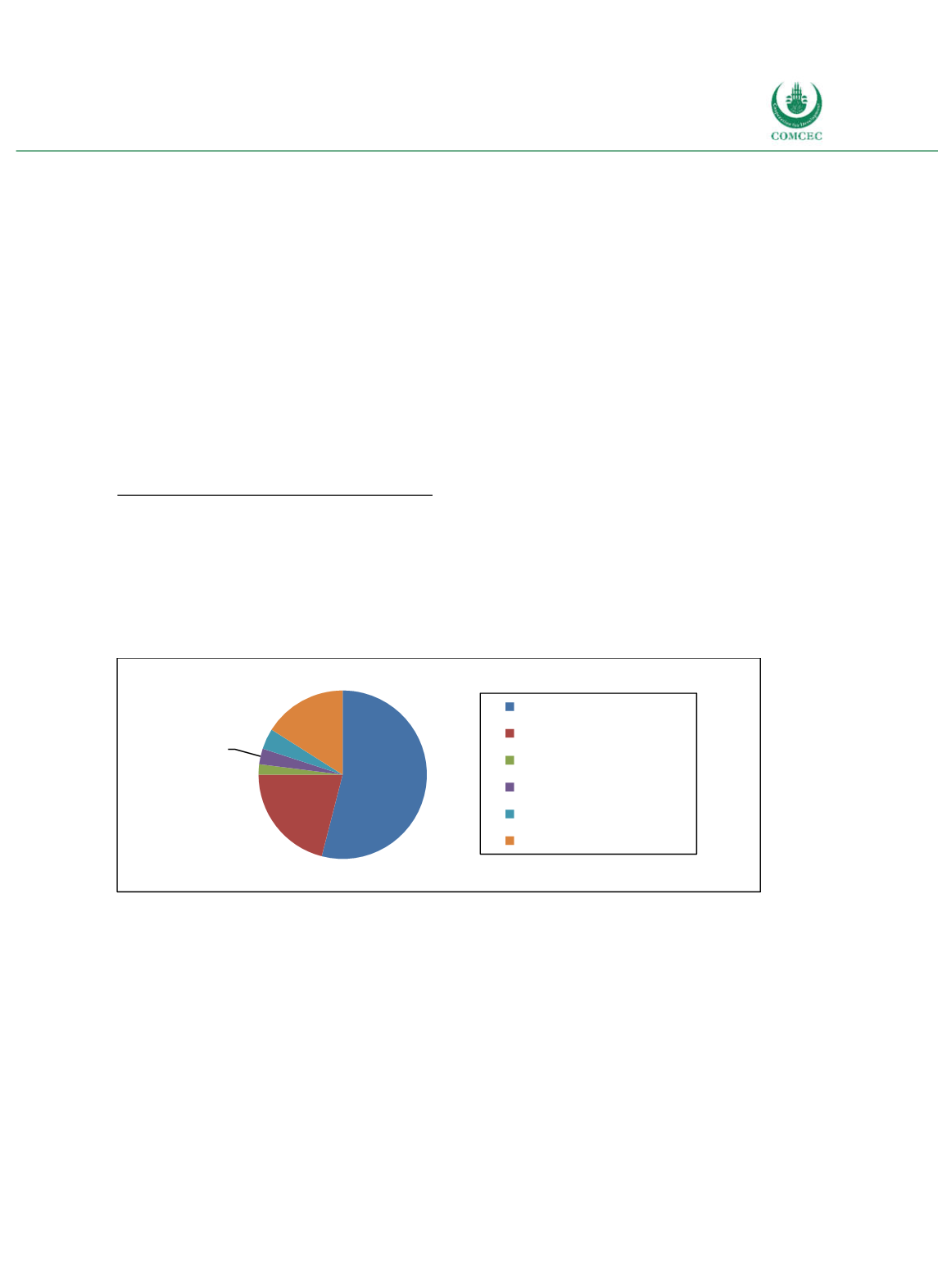

Figure 4-20: Nigeria - Public Debt Composition by Instruments (June 2016)

Source: DMO (2016).

FGN come with maturities of three to 20 years. While the yield curve of FGN was nearly flat in

2014, the yield curve in 2015 exhibited the classical expected form, which means that debt

with longer maturities has higher yields (see Figure 421).

Islamic finance instruments are not yet used in the Nigeria’s public debt management, as the

framework is currently being finalized. Currently, two major laws regulate the issuances of

sukuk

in Nigeria: the Investments and Securities Act 2007 and the rules set by the Security and

Exchange Commission of Nigeria (SEC). They specified its rules on Islamic financing in

February 2013 (SEC 2013). According to these rules state governments and agencies on all

levels are entitled to issue

sukuk

after having seeked the SEC’s approval (Oladunjoye 2014).

The first corporate

sukuk

was issued by Nigeria’s Osun State and had a volume of 10 billion

naira (or $62 million). The first Nigerian banks with Islamic Banking Services were the Stanbic

54%

21% 2% 3% 4% 16%

FGNs NTBs TBonds

Eurobonds

External bilateral

External multilateral