Improving Public Debt Management

In the OIC Member Countries

119

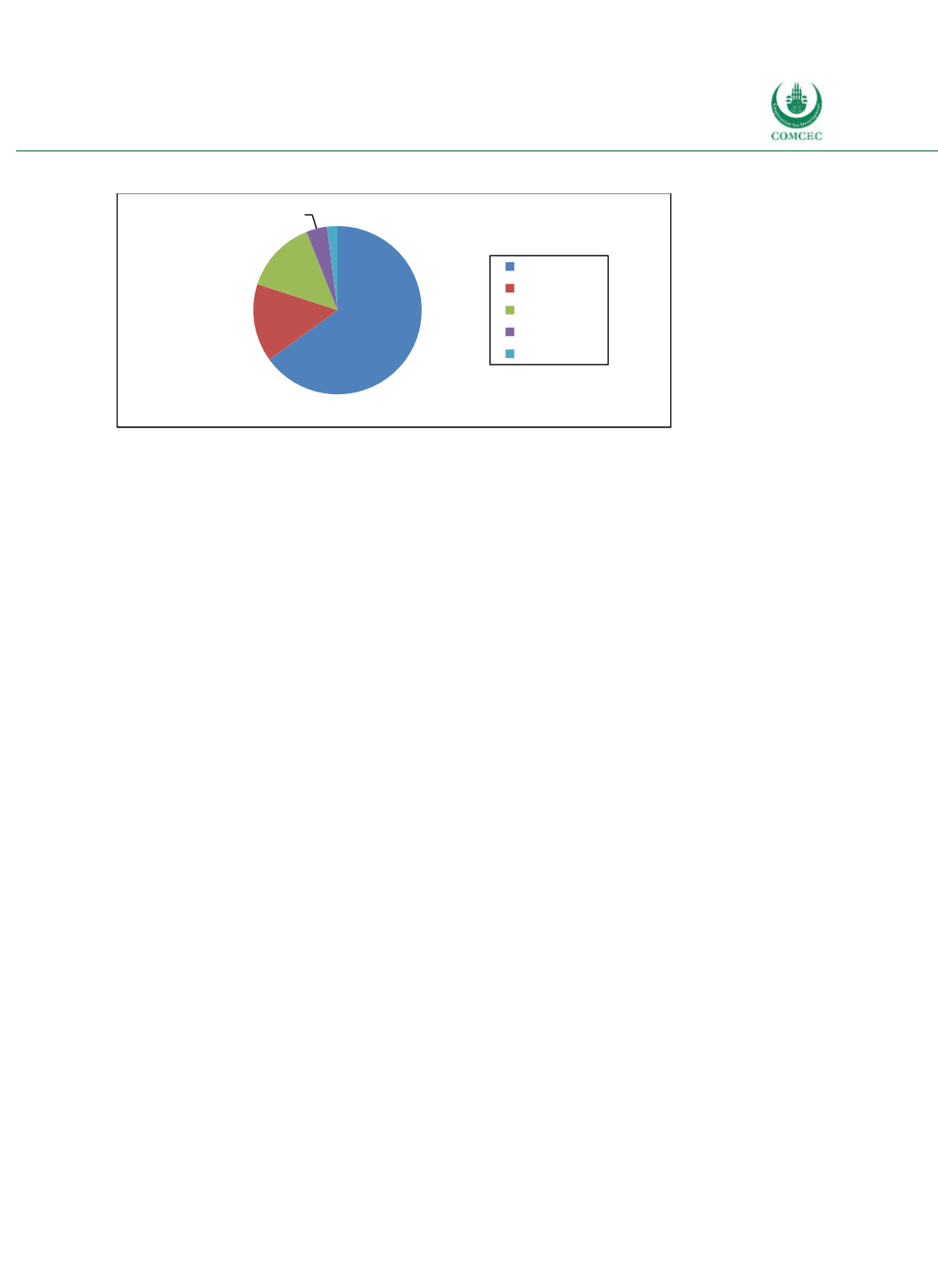

Figure 4-22: Nigeria – Creditor Structure of External Public Debt (2015)

Source: DMO (2016, p. 5).

The government plans to increase the share of external debt in total debt by maximizing

available funding from concessional and semiconcessional external sources. Foreign debt

instruments to be used are issuing Eurobonds, Diaspora Bonds and International

sukuk

. To

reduce the exchange rate risk the government intends to issue longterm foreign debt

instruments for funding infrastructure projects.

C) Policy Recommendations

Nigeria has established a very professional public debt management. The DMO acts as an

independent agency responsible for debt management. The DMO is even sharing its experience

of debt management and is currently advising South Sudan in developing a debt management

office (Emejo 2015). Transparency is high as the DMO publishes various and detailed reports

about all relevant aspects of the government’s debt portfolio and also other institutions such as

the SEC and the central bank adhere to these standards. There could be, however, more

information about the structure of domestic creditors (for example about the composition of

“nonbank public” creditors).

The share of Nigeria’s domestic debt in total debt is high (about 80%). Domestic debt is

characterized by high interest rates, and a high share of debt maturing and refixing within one

year. The DMO thus targets a debt composition of 60% domestic and 40% external debt and

aims at accessing longterm external borrowing to reach this target. Nigeria has, however,

attained the status of a middleincome country and is therefore less likely to have access to

concessional funding in the future (Uwalek 2016). The expected limited account to

concessional funding and the recent exclusion from the J.P. Morgan local government bond

indexes might make it difficult to achieve the current targets of debt composition, even in the

medium term. Nigeria is recommended to diversify and expand the sources of foreign lending

(see also Oladunjoye 2014). Nigerian authorities are currently expending the institutional

infrastructure for the issuance of Islamic bonds which might attract foreign lenders and can

support the general effort to expand foreign borrowing (see also IMF 2016).

As the DMO pointed out Nigeria still is recommended to diversify the economy to reduce its

dependency on oil exports and foreign exchange risks. During the last years the proportion of

U.S. Dollar in external debt increased constantly. This is aligned with the dominant role of

Nigeria’s oil exports, but may be reduced when it comes to a diversification of the country’s

economy. In particular strengthening the revenue side of the budget might reduce risks of the

government’s debt portfolio.

65%

15% 14%

4% 2%

IDA/AfDB

Bilateral

Eurobond

IBRD/ADB

Others