Improving Public Debt Management

In the OIC Member Countries

125

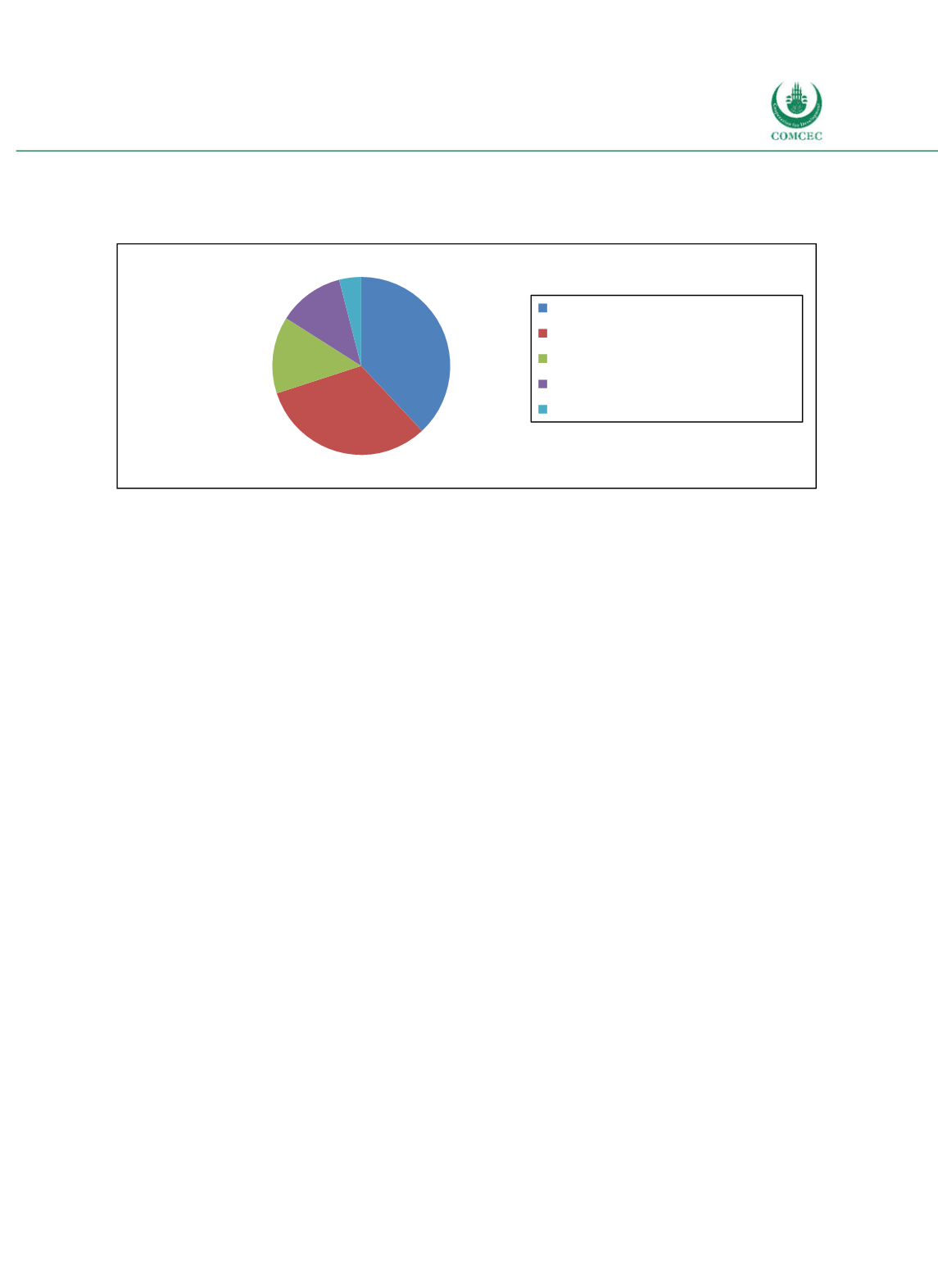

international financial institutions (14%), commercial banks (12%) and other foreign

suppliers (4%) (ADB 2014).

Figure 4-25: Sudan – Creditor Structure of External Public Debt (2013)

Source: ADB (2014).

Within Sudan’s public and publicly guaranteed debt, the largest share is Dollardenominated

debt, which has accounted for an increasing share since 2008 and was equal to 55.5% in 2014.

Other currencies which represent substantial shares of external public debt are the Swiss

Franc (12.9%) and the Euro (7.3%). The remaining 24.3% represent other currencies,

including but not limited to Pound Sterling and Japanese Yen. The currency structure is

expected to remain relatively stable, mainly because the debt load is already high and the

potential for new external loans is limited. Between 2013 and 2033, the IMF (2014) estimates

that new external loans will represent about 0.4% of GDP.

C) Policy Recommendations

Facing huge challenges following the secession of South Sudan in 2011 and the unsecure

economic environment due to the low oil price, it is important for Sudan to develop a credible

policy dialogue, in particular with respect to the high public debt levels (ADB 2014). Overall, it

is recommended to reduce the substantial foreign debt overhang. It is thus important to

develop the domestic debt market and diversify the domestic investor base.

In order to reach an agreement concerning debt relief, Sudan has to show the international

community that it strengthens its efforts both in stabilizing the political environment and

improving macroeconomic conditions (ADB 2014). The IMF has repeatedly encouraged the

authorities to continue their engagement with international partners to secure comprehensive

support for debt relief and the lifting of sanctions, which would “pave the way for foreign

investment and financing for growth and poverty reduction” (IMF 2016a). One important

determinant of future borrowing requirements is the settlement of a dispute between Sudan

and South Sudan about fees for the transit of South Sudanese oil, which represents a key

revenue source for Sudan (UNDP 2014). Due to the global decline of oil prices, Sudan is under

pressure to further decrease these fees, which would leave the country with higher borrowing

needs (EIU 2016). It is important to reduce the fiscal deficit and pursue a tight monetary policy

to achieve lower inflation (IMF 2016a).

It would be helpful to strengthen the legal and institutional framework to ensure a

professional process of borrowing at different levels, both domestically and externally (Osman

2013), and to strengthen the public disclosure of economic data. Although the MoFNE has

38%

32%

14% 12%

4%

Non Paris Club Creditors

Paris Club Creditors

International Financial Institutions

Commercial Banks

Foreign Suppliers