National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

11

architecture will partly depend on the legal regimes, countries are chosen so that there is

diversity in their legal systems. Legal regimes can be broadly classified as those that are based

on Islamic law, common law and civil law. The third criterion is the size of the Islamic financial

industry. Countries with larger Islamic financial sectors will provide an indication on the

financial architecture under which the industry has evolved. Given the above criteria, the

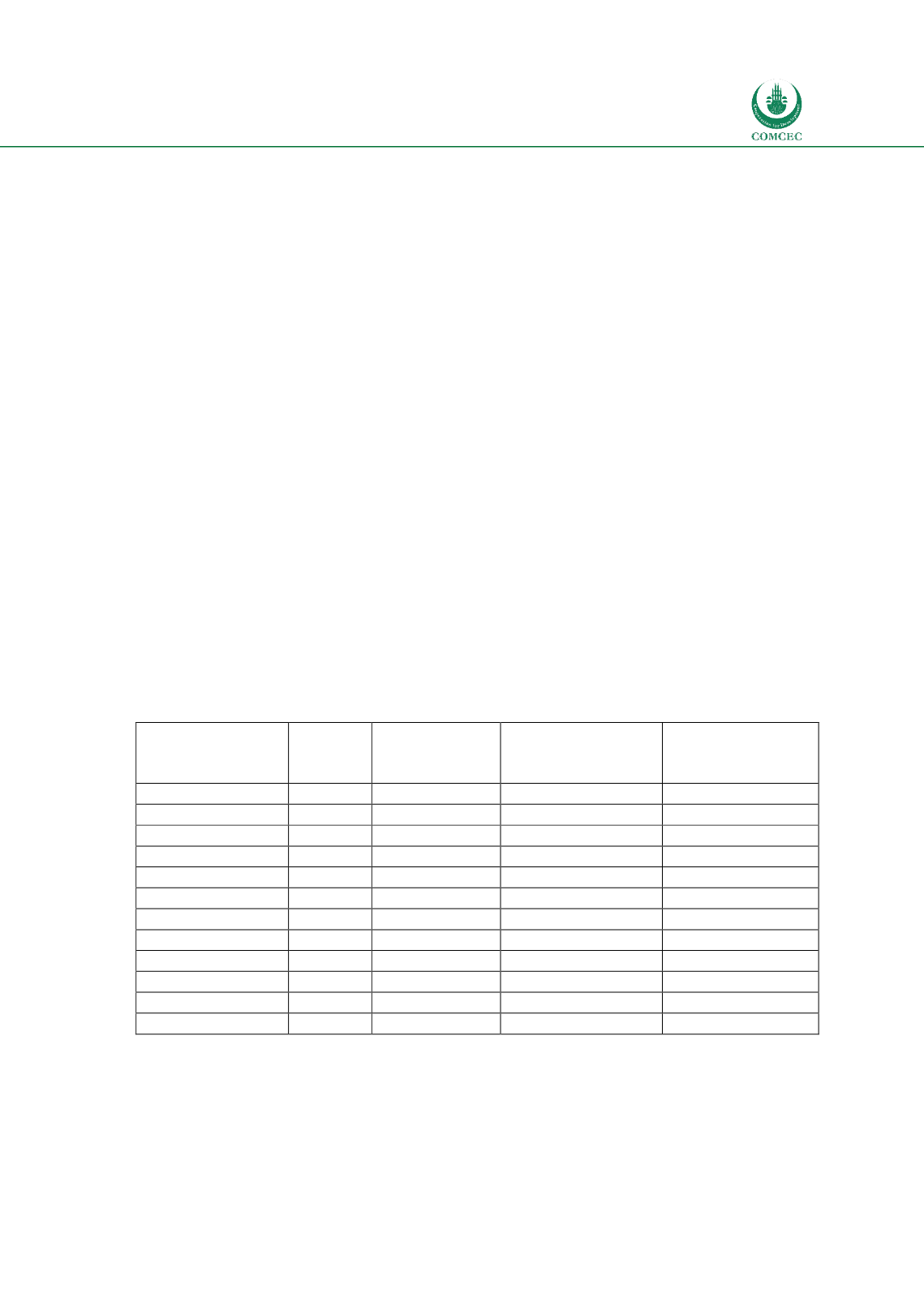

countries included as case studies for the study are shown in Table 1.1.

Note that all countries in the table, except Nigeria and Oman, fulfill the different criteria

identified above. These two countries are added as Islamic finance has emerged there

relatively recently. The reason for the inclusion of Nigeria where Islamic finance started in

2011 is to increase the number of countries from the African region to two. Oman is also

added as a new entrant with good potential of growth due to its sound legal and regulatory

infrastructure. Since the inception of the first Islamic bank in 2013 in the country, its share

has already jumped to 4.4% of the total banking assets.

Global financial centers chosen for the study are based on their importance and size on the

one hand and their potential to develop Islamic finance on the other hand. The countries

examined are UK, Germany, Luxembourg, Hong Kong and Singapore. Note that instead of

discussing the global financial centers as cities, the study examines countries where these

centers are located. This is because, for example, while Islamic financial activities in the

international financial center of Frankfurt is very small, Munich is nevertheless host to some

large insurance companies that also deal with re

takaful.

By discussing the non-OIC global

financial centers in terms of countries, the market segment in Munich can be added. Similarly,

Islamic retail banking (AlRayyan Bank) in the UK is headquartered at Birmingham. Thus,

expanding the scope of case studies to the country level will enable us to capture Islamic

finance at a broader scale.

Table

1.1: List of Countries to be used as Case Studies

Country

a

Region

Legal System

Family

e

Size of IF sector:

%

National

Banking Assets

Size of IF sector:

Global share of IF

assets

1.

Bangladesh

Asia

Common Law

17

1.34

2.

Egypt

Arab

Civil Law

4

b

1.17

3.

Indonesia

Asia

Civil Law

4.6

c

1.39

4.

Malaysia

Asia

Common Law

21.9

9.56

5.

Nigeria

Africa

Common Law

N.A.

N.A.

6.

Oman

Arab

Civil Law

4.4

d

N.A.

7.

Pakistan

Asia

Common Law

9.8

0.75

8.

Saudi Arabia

Arab

Islamic law

51.3

18.57

9.

Senegal

Africa

Civil Law

N.A.

N.A.

10.

Sudan

Arab

Islamic Law

100

1.00

11.

Turkey

Asia

Civil Law

5.7

3.2

12.

UAE

Arab

Civil Law

17.4

7.36

a-All data for 2014H1 (source IFSB 2015) except otherwise indicated; b-Data for 2012 (source SESRIC 2012);

c-Data for 2015 (Source Tampubolon 2015); d- TR, IRTI and CIBAFI (2015). e-World Bank (2004). Note that

the countries are classified according to legal origins such as English, French, German, etc. While the English is

considered common law, the continental European legal systems belong to civil law regimes. The World Bank

does not include Islamic law as a category. This category is added for Saudi Arabia and Sudan as these

countries have Islamic legal systems.