National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

223

coordinate to establish an Islamic Monetary Fund (IsMF) that can perform the function. The

role of IsFM will be to either provide Shariah compliant liquidity or coordinate arranging

liquidity from other central banks by using swap arrangements.

As the Islamic financial sector is evolving, application of the standards and guidelines to

strengthen the financial architecture would require improving the knowledge and skills of the

personnel working in different infrastructural institutions at the national levels. The case

studies indicate that there is lack of understanding of Islamic finance related issues among the

infrastructure related institutions such as regulatory bodies. SBIF in coordination with IDB

have created technical assistance programs to provide education and training to relevant staff

and employees of different infrastructural institutions.

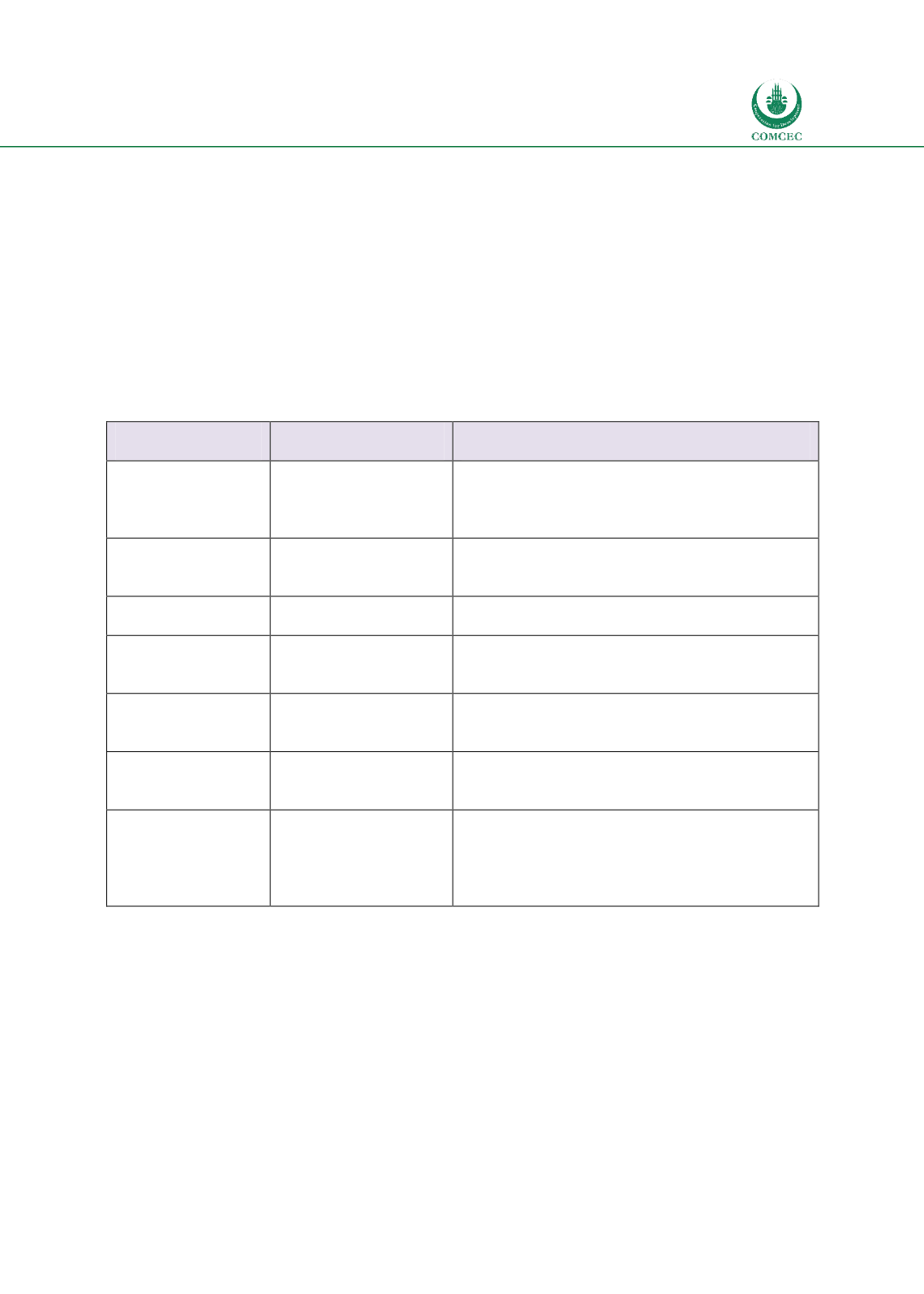

Table

7.15: Suggested New International Infrastructure Institutions and Initiatives

Infrastructure

Institutions

Institutions for

Conventional Finance

Suggested Institutions and Initiatives for

Islamic Finance

Legal Infrastructure

UNCITRAL,

World

Bank, ADB (Law &

Policy

Reform

Program)

Create a new body/entity Stability Board for

Islamic Finance SBIF (either by OIC/COMCEC or

D-8)

IDB can initiate Islamic Law & Policy Program

Regulation &

Supervision

Framework

BSBC, IOSCO, IAIS

Strengthen IFSB (have three Assistant Secretary

Generals for Banking, Takaful and Capital

Markets)

Shariah Governance

Regimes

N.A.

SBIF coordinate the Shariah issues with AAOIFI,

IsFA, IFSB and IIFM

Liquidity

Infrastructure

IMF

Establish IsMF to develop liquidity management

framework in coordination with IDB IFSB, IIFM,

IILM and LMC

Information

Infrastructure &

Transparency

IFSR,

World

Bank

(FSAP), FSB

SBIF coordinate accounting and auditing issues

with AAOIFI, IFSB and IIRA

Consumer

Protection

Architecture

IADI, OECD, World

Bank

SBIF coordinate accounting and auditing issues

with IFSB, CIBAFI, IADI

Human Capital &

Knowledge

Development

N.A.

SBIF and IDB can coordinate with AAOIFI, CIBAFI,

GIFDC, IDB, IFSB SBIF and IsMF and develop

technical assistance programs to enhance

knowledge and skills related to Islamic financial

architecture