Risk Management in

Islamic Financial Instruments

140

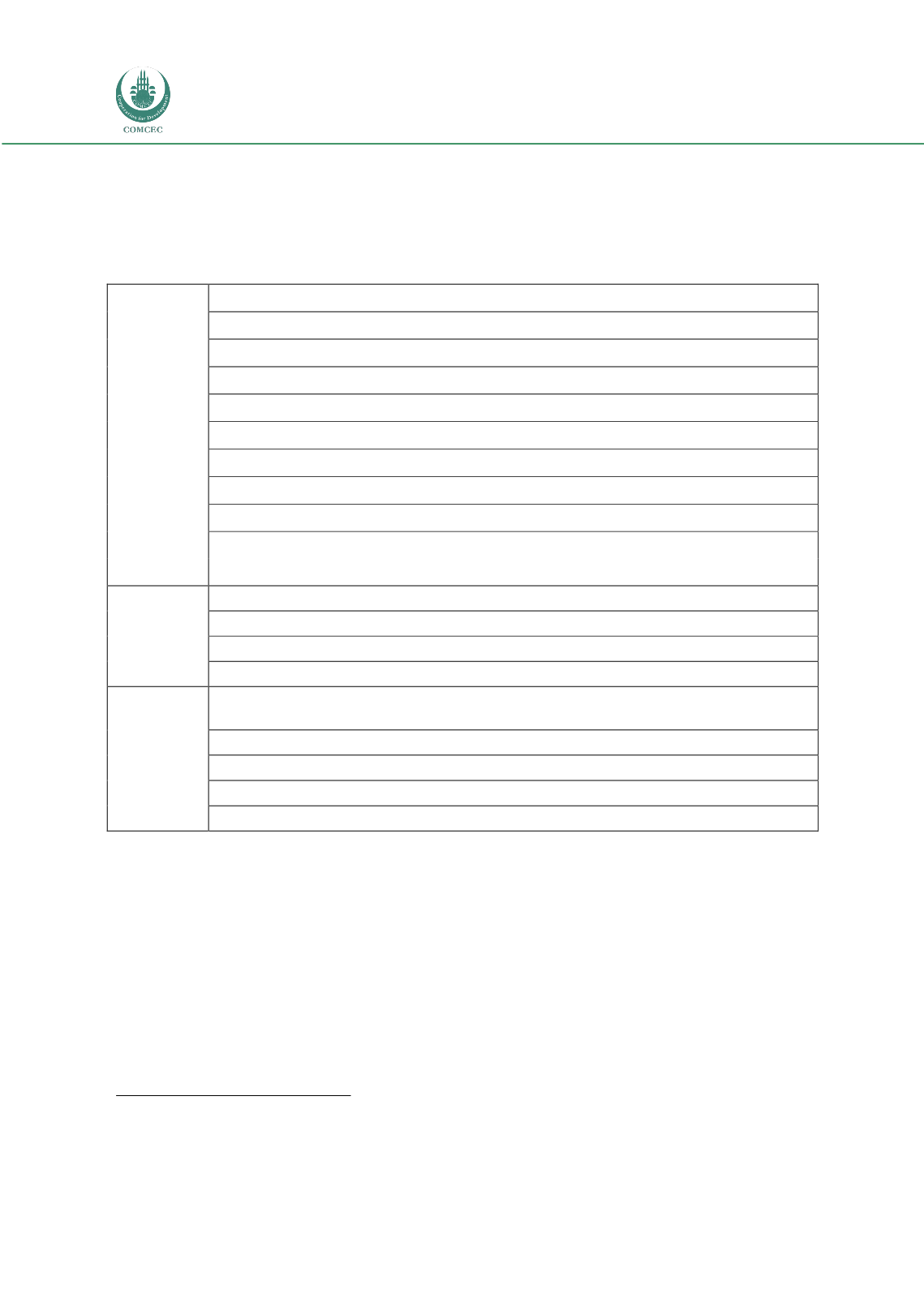

6.9.2 Key Initiatives for Implementation of the Goals

Table 6.4 provides the key initiatives that should be implemented in stages in order to make

progress in the Islamic financial industry and risk management capacity.

Table 6.4: Key Initiatives

Enablement

Integrate Islamic finance in national development plans

Introduce national Islamic financial services master plans

Enhance regulatory implementation and enforcement

Harmonize, where possible, regulation and regulatory frameworks across borders

Adopt and strengthen national Sharī`ah governance frameworks

Where mandates overlap, align the positions of industry bodies

Link Islamic financial markets across borders

Form a “Technical Assistance and Linkage Network”

Form regional working groups

Foster information-providing institutions that support the provision of Islamic finance

Incorporate Islamic finance data in statistical and official reporting

Performance

Institute centralized R&D for Islamic financial products in addition to the decentralized R&D

Establish diversified financial institutions

Demonstrate the industry’s distinctive value proposition

Fund public infrastructure projects to build Islamic capital markets

Reach

Revitalize Zakāh and Awqāffor greater financial inclusion and make them an integrated part of

Islamic financial system

Ensure that regulations allow for the use of new technology to provide affordable services

Engage with newly opened markets

Foster the financing of a wider set of economic sectors

Brand Islamic financial services for wider markets

Source: Islamic Research and Training Institute (2014): Islamic Financial Services Industry Development: Ten Year

Framework and Strategies, A Mid-Term Review

6.9.3 Support the Growth and Stability of the Islamic Finance Industry

27

A main goal of the international Islamic finance community is to encourage the continued

growth and stability of the Islamic finance industries across the globe. Initiatives aimed at

accomplishing this goal include, but are not limited to, strengthening Shari’ah governance

frameworks, encouraging more diversified institutions, promoting Islamic finance, and

improving financial data and reporting practices.

27

Islamic Research and Training Institute (2014): Islamic Financial Services Industry

Development: Ten Year Framework and Strategies, A Mid-Term Review