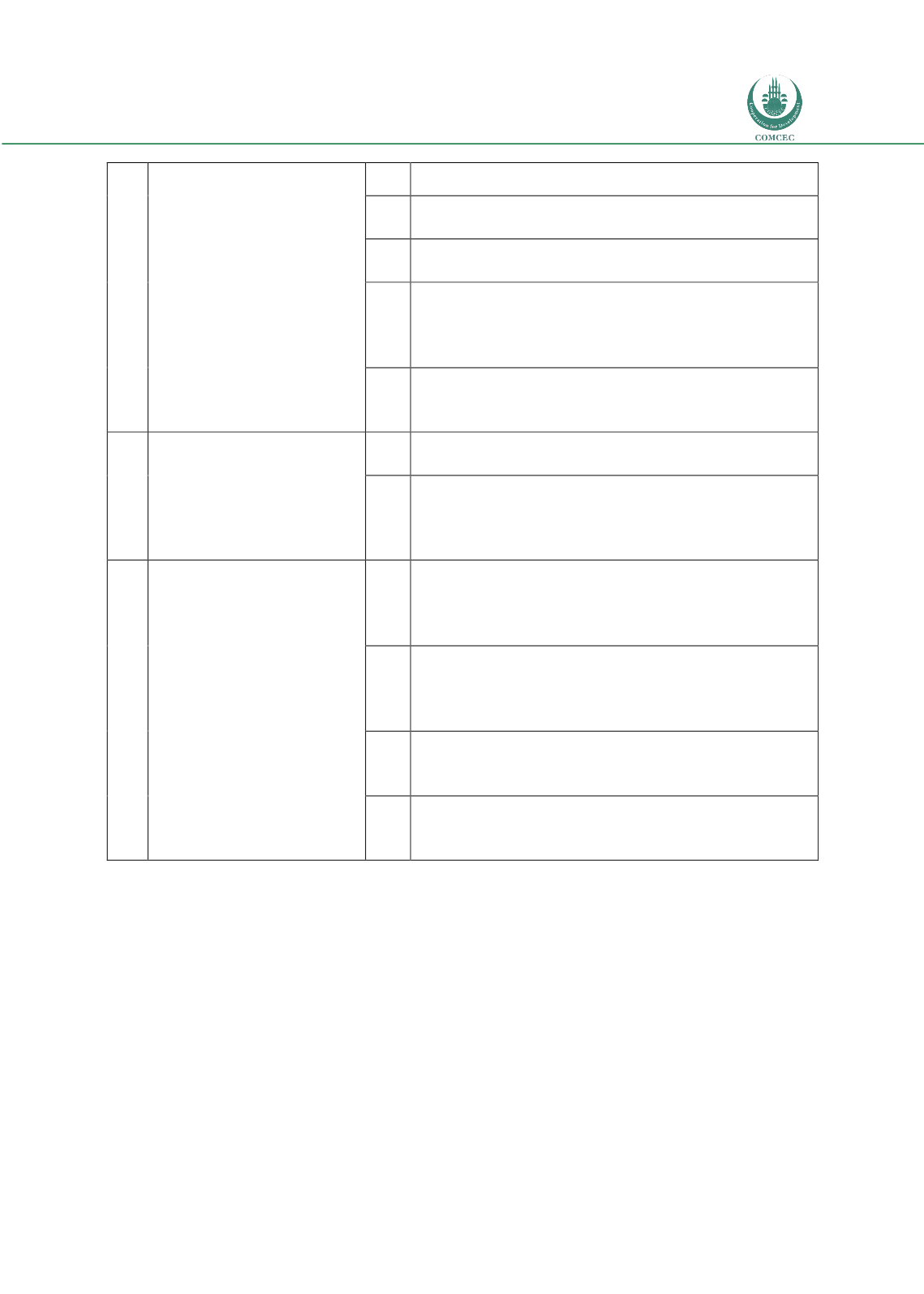

Risk Management in

Islamic Financial Instruments

139

14

Develop an understanding

of the linkages and

dependencies between

different components of

Islamic financial services

to enable more informed

strategic planning to be

undertaken

14.1 Regular tracking of the industry-level KPIs

14.2 Re-visiting the framework strategies at the end of the Ten-

Year period

14.3 Inclusion of Islamic finance statistics in the national and

regional statistics of member countries

14.4 Participation in the Islamic Financial Sector Assessment

Programme

(iFSAP),

an

initiative

that

provides

supplementary templates on Islamic finance for the World

Bank–IMF Financial Sector Assessment Program

14.5 Participation in self-assessment, peer review and/or IMFWB

FSAP on the basis of Core Principles for Islamic Finance

Regulation

15

Foster and embrace

innovative business models,

including new technologies

and delivery channels, in

delivering Islamic financial

service

15.1 Percentage of IIFS utilizing internet, mobile banking and other

forms of alternative channels

15.2 Introduction of innovative business models such as peerto-

peer financing, crowdfunding, digital payments, etc.

16

Strengthen contributions

to the global dialogue on

financial services, offering

principles and perspectives

to enhance the global

financial system

16.1 Participation by Islamic infrastructure institutions and

regulators in reviews of the overall financial system at

international forums (e.g. the G20, Basel Committee, IMF/

World Bank, etc.)

16.2 Explicit reference and consideration of Islamic finance

principles in communiqués and proceedings of key

international forums (e.g. the G20, Basel Committee,

IMF/World Bank, etc.)

16.3 Number of dialogues held between OIC central banks, stock

exchanges and regulatory authorities on various issues of

Islamic finance

16.4 Number of papers prepared or events organized providing

Islamic perspective on the current and long-term strategic

issues pertaining to the global financial system

Source: Islamic Research and Training Institute (2014): Islamic Financial Services Industry Development: Ten Year

Framework and Strategies, A Mid-Term Review