Risk Management in

Islamic Financial Instruments

136

11

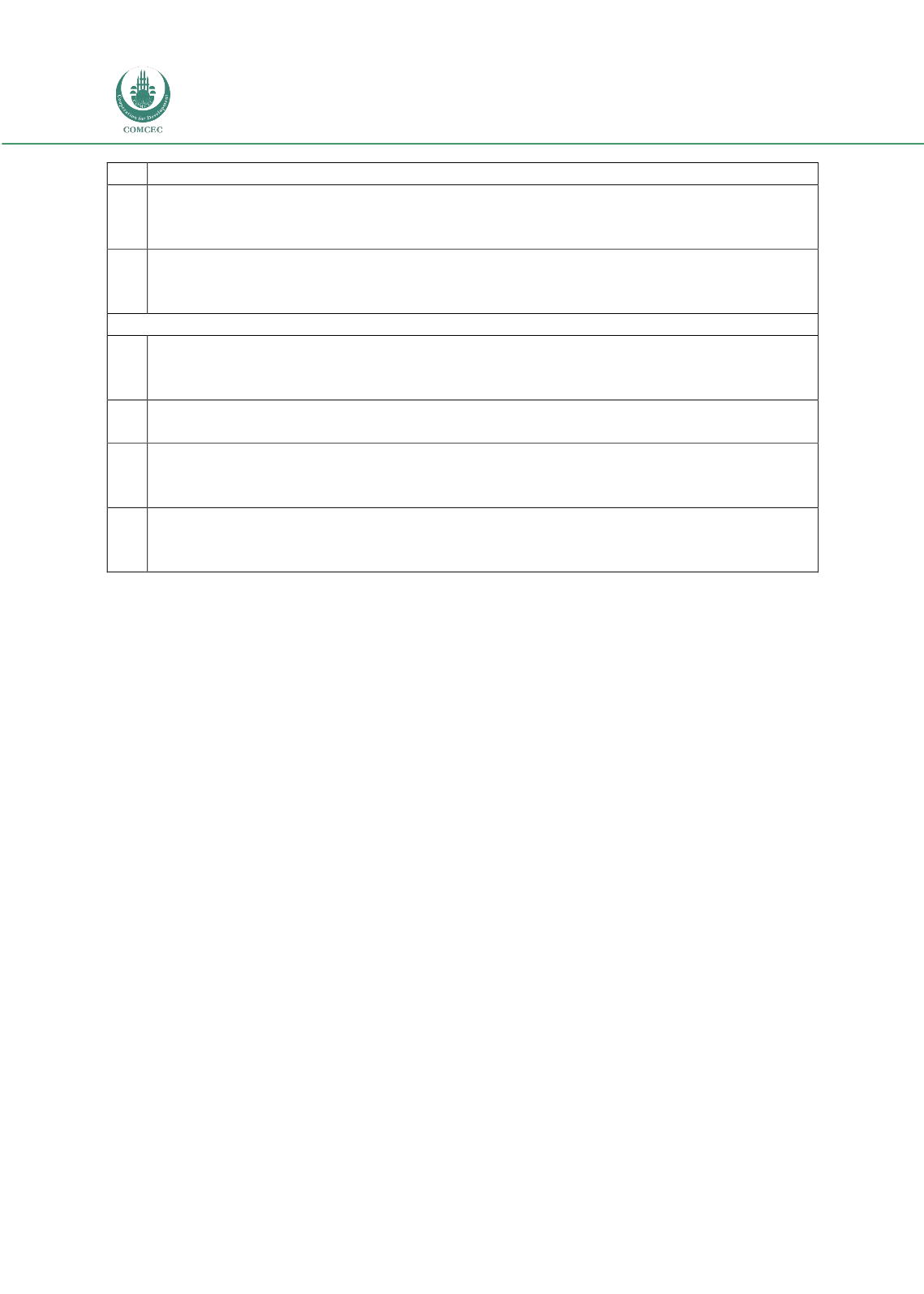

Strengthen and enhance collaboration among the international Islamic financial infrastructure

institutions

15* Foster and embrace innovative business models, including new technologies and delivery channels, in

offering Islamic financial services

Reach

3

Enhance access by the large majority of the population to financial services and enhance access to

funding for SMEs and entrepreneurs

10

Promote public awareness of the range of Islamic financial services

13

Conduct initiatives and enhance financial linkages to integrate domestic IFSI with regional and

international financial markets

16* Strengthen contributions to the global dialogue on financial services, offering principles and

perspectives to enhance the global financial system

Source: Islamic Research and Training Institute (2014): Islamic Financial Services Industry Development: Ten Year

Framework and Strategies, A Mid-Term Review

The mid-term review of the

Ten-Year Framework

by the IFSB, IRTI, and IDB Group revealed

that there was still a great deal of work to be done at the halfway point to achieve the goals set

out in the recommendations of the

Framework.

The IRTI, et al. concluded that, while “concrete

progress” has been made towards all of the recommendations, none have been entirely

achieved, and more focus is required by member countries in order to implement the 16

recommendations (

A Mid-Term Review

7-16). While there has been much discussion

surrounding the

Framework,

implementation has been a challenge. In grouping the 13

recommendations and the additional three recommendations into three categories of

enablement, performance and reach, the IFSB, IRTI, and IDB Group proposed over 70

initiatives to aid in the better implementation of the recommendations. The 70 initiatives were

narrowed to 20 key initiatives using key performance indicators (KPIs).