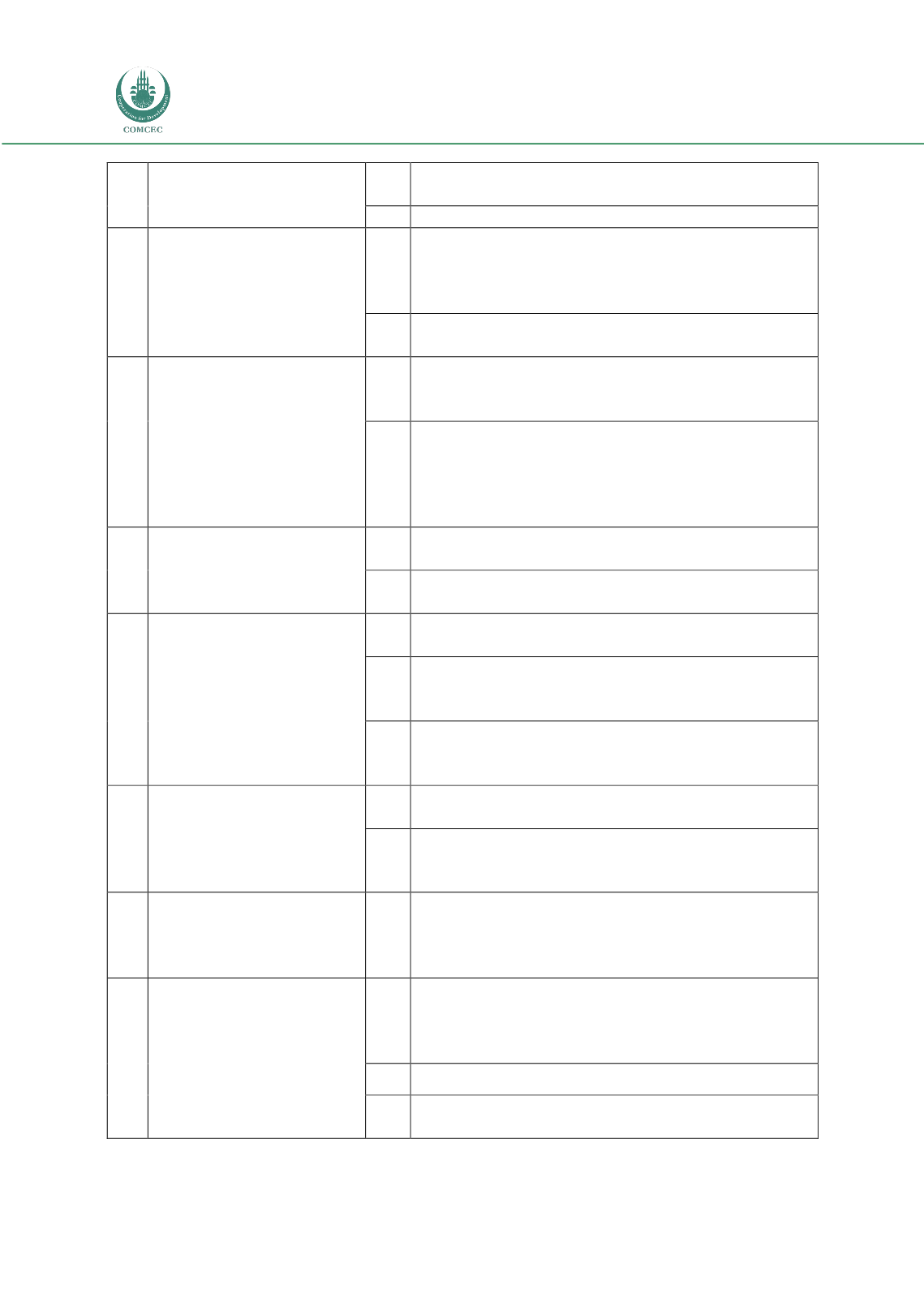

Risk Management in

Islamic Financial Instruments

138

innovation

6.2

Volume of published research on product innovation and

standardization

6.3

Number and usage of innovative products

7

Enhance the implementation

of the international

prudential, accounting

and auditing standards

applicable to the IFSI

7.1

Percentage of members requiring compliance with applicable,

Islamic finance industry-specific prudential, accounting and

auditing standards as generated by industry standard-setting

bodies

7.2

Collaboration with international standard-setting bodies such

as Basel Committee, IAIS, IOSCO and IASB

8

Develop an appropriate

legal, regulatory and

supervisory framework, as

well as an IT infrastructure

that would effectively

cater for the special

characteristics of the IFSI

and ensure tax neutrality

8.1

Percentage of member countries with tax neutrality, legal

enablement and other basic enablers of Islamic banking as

enumerated in ten recommendations from the 2007

8.2

Framework and reviewed in this document

Level of new and social media adoption by IIFS

9

Develop comprehensive and

sophisticated interbank,

capital and hedging

infrastructures for the IFSI

9.1

Percentage of member countries with domestic Islamic

interbank markets

9.2

Number of member countries with developed regulatory

and market infrastructure for Islamic capital markets

10

Promote public awareness

of the range of Islamic

financial services

10.1 Percentage of member countries with market share of Islamic

finance of 10% or greater

10.2 Percentage of Islamic banking, Takāful, Islamic capital

markets and Islamic microfinance activities as a proportion of

the total for the respective sector in member countries

10.3 Number of member countries with awareness-raising

programmes on Islamic finance (as standalone programmes

or part of broader financial literacy)

11

Strengthen and enhance

collaboration among

the international Islamic

financial infrastructure

institutions

11.1 Number of collaborative projects between infrastructure

Institutions

11.2 Impact assessment analysis of collaborative projects between

infrastructure institution

12

Foster collaboration among

countries that offer Islamic

financial services

12.1 Number of collaborative projects (multilateral and bilateral)

between countries that offer Islamic financial Services (e.g.

technical assistance on regulation, public awareness

campaigns, etc.)

13

Conduct initiatives and

enhance financial linkages

to integrate domestic

IFSIs with regional and

international financial

markets

13.1 Number of initiatives under way in member countries to link

domestic IFSIs with regional and international financial

markets (e.g. the facilitation of introductions between IFSIs

and overseas capital market participants)

13.2 Issuances of cross-border Islamic financial instruments

13.3 Observer or delegate status for Islamic finance services

infrastructure bodies on international regulatory bodies