Risk Management in

Islamic Financial Instruments

137

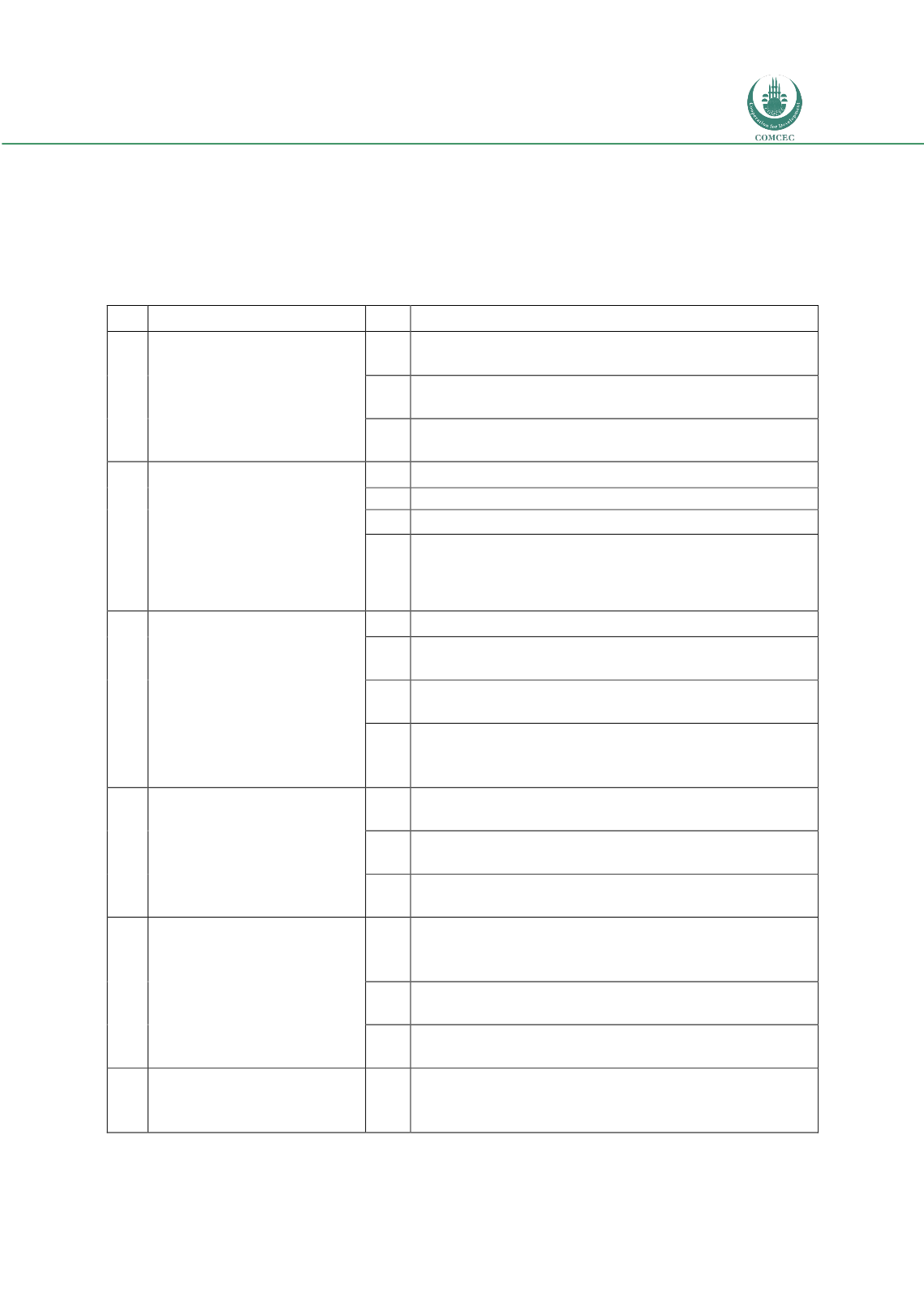

6.9.1. Key Performance Indicators for Measuring Progress

The Midterm Review of Ten-Year Framework also provided a number of KPIs against which

the progress of Islamic financial industry development can be measured. Table 6.3 shows

those KPIs.

Table 6.3: Key Performance Indicators for Measuring Progress

No. Recommendation

Key Performance Indicators

1

Facilitate and encourage

the operation of free, fair

and transparent markets

in the Islamic financial

services sector

1.1

Progress made by member countries on World Bank

governance metrics

1.2

Percentage of member countries operating free market

financial systems

1.3

Level of transparency of Islamic banks compared with

conventional counterparts

2

Enhance the capitalization to

ensure that they are

Adequately capitalized, well-

performing and

resilient, and on par with

international standards and

best practices

2.1

Average capital adequacy of Islamic banks

2.2

Average ROE of Islamic banks

2.3

Average ROE of Takāful companies

2.4

Market capitalization of member country capital markets

3

Enhance access by the large

majority of the population

to financial services, and

enhance access to funding

for SMEs and entrepreneurs

3.1

Percentage of population with access to financial service

3.2

Number of Islamic microfinance institutions in member

countries

3.3

Percentage of Islamic banks offering SME and entrepreneurial

finance

3.4

Number of member countries with SME and entrepreneurial

finance programs (public sector or NGOs) that are Sharī`ah

compliant

4

Enhance Sharī`ah compliance,

effectiveness of corporate

governance and transparency

4.1

Number of member countries with national Sharī`ah

standards or national Sharī`ah boards

4.2

Number of countries adopting international Sharī`ah

standards in their supervision framework

4.3

Corporate governance standards and disclosure standards of

Islamic financial institutions

5

Develop the required pool

of competent, skilled and

high-calibre human capital

and ensure utilization of

state-of-the-art technology

5.1

Percentage of countries with Islamic finance education

available (within general educational institutions or

specialized Islamic finance institutes)

5.2

Access to specialized Islamic finance training through

internet-based platforms

5.3

Number

of

professionals

receiving

industry-specific

qualifications

6

Enhance the development

of standardized products

through research and

6.1

Number and usage of standardized products with

published structures and contracts