Risk Management in

Islamic Financial Instruments

135

mid-term review of the

Ten-Year Framework

was conducted in 2013. The mid-term review

analyzed the impact of recent events on the IFSI. The mid-term review also examined the

progress made on the recommended initiatives, examined gaps in implementation, and

analyzed other issues with the listed priorities and initiatives in the

Ten-Year Framework

.

Through the mid-term review, it was determined that the IFSI has shown great resilience in

the face of recent tribulations in the global financial industry, especially in comparison to the

conventional financial industry. However, the IFSI has not been entirely immune to the recent

global financial crisis. While economies around the world have weakened, including countries

using Islamic finance, the financial crisis has impacted the IFSI’s asset values, investments, and

approach to financial regulation. The resilience of the IFSI has served as an indicator to

Western countries of the pertinence and potential of Islamic Finance (

A Mid-Term Review

2-5).

Table 6.3 lists the

Ten- Year Framework’s

13 original recommendations and three new

additions from the mid-term review. The

Mid-Term Review

categorized the recommendations

into three categories: enablement, performance, and reach (

A Mid-Term Review

6).

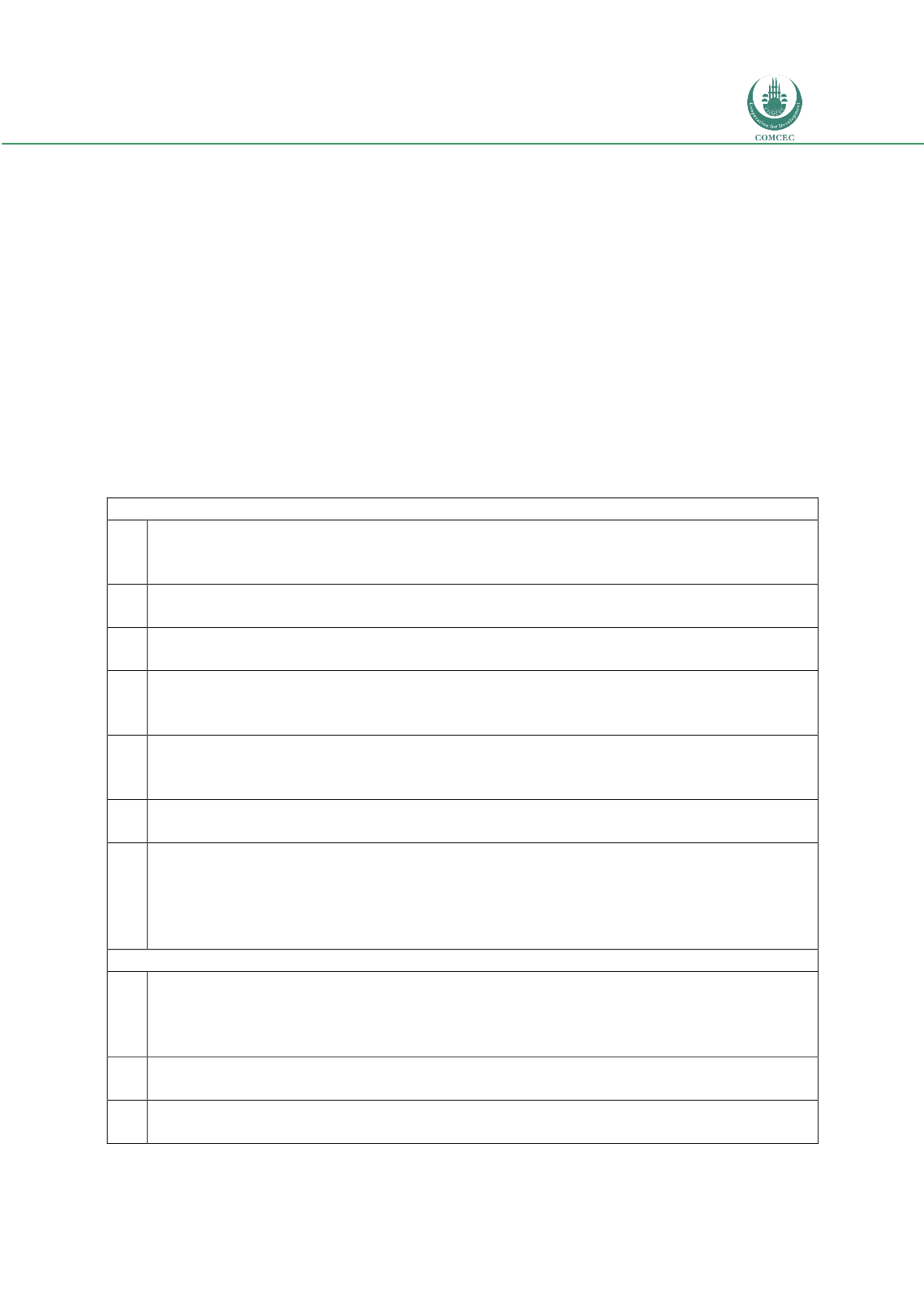

Table 6.2: Ten-Year Framework Recommendations

Enablement

1

Facilitate and encourage the operation of free, fair and transparent markets in the

Islamic financial services sector

5

Develop the required pool of specialized, competent and high-caliber human capital

6

Promote the development of standardized products through research and innovation

8

Develop an appropriate legal, regulatory and supervisory framework, as well as an IT infrastructure that

would effectively cater for the special characteristics of the IFSI and ensure tax neutrality

9

Develop comprehensive and sophisticated interbank, capital and hedging market

infrastructures for the IFSI

12

Foster collaboration among countries that offer Islamic financial services

14* Develop an understanding of the linkages and dependencies between different

components of Islamic financial services to enable more informed strategic planning to be undertaken

Performance

2

Enhance the capitalization and efficiency of institutions offering Islamic financial services (IIFS) to

ensure that they are adequately capitalized, well-performing and resilient, and on par with international

standards and best practices

4

Enhance Sharī`ah compliance, effectiveness of corporate governance and transparency

7

Enhance the implementation of the international prudential, accounting and auditing standards

applicable to the IFSI