Risk Management in

Islamic Financial Instruments

79

Average Shareholder's Equity (%). Generally, ROEs for conventional banks are higher than

those of Islamic banks. The Total Interest (Profit Share) Income / Interest (Profit) Bearing

Assets Average (%) Ratio exhibits a decreasing trend for both the conventional banks (from

6.14% in 2005 to 3.32% in 2014) and the Islamic banks (from 5.49% in 2005 to 3.12% in

2014), and the ratios are consistently higher for the conventional banks.

The Net Interest (Profit) Revenues (Expenses) / Average Total Assets (%) Ratio also shows a

similar decreasing pattern for both conventional banks (from 2.45% in 2005 to 1.38% in

2014) and Islamic banks (from 2.20% in 2005 to 1.29% in 2014). The Fees, Commission and

Banking Services Revenues / Average Total Assets (%) Ratio represents the contribution of

non-interest earning revenues and also shows a consistent downward over the sample period

for both the conventional and Islamic banks; however, the ratios are generally higher for the

Islamic banks.

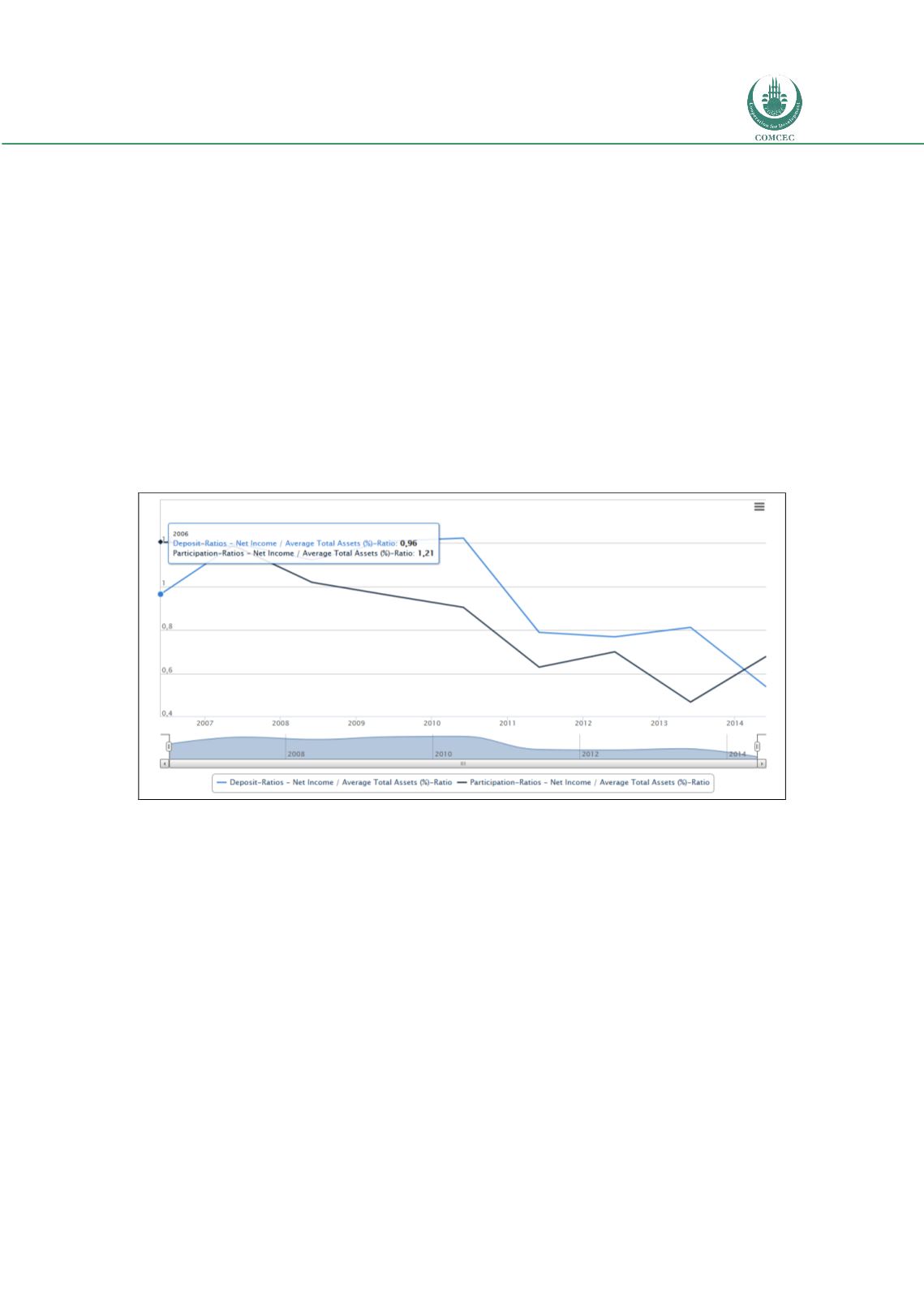

Chart 4.21: Net Income / Average Total Assets (%)-Ratio

Source: Turkish Banking Sector Interactive Bulletin 2014